Super 10 stocks (5 Safe 3 New Government 2 Dividend Bets) to BUY at current Prices! HBJ Capital

Post on: 21 Июль, 2015 No Comment

- This is a Special Investment Write-Up that is available only to our Premium Fortuna & Bulls Eye customers..

We are releasing a Special Investment write-up highlighting the 10 Best stocks to buy at current prices. We have divided the stocks into 3 main categories to provide diversity to the stock picks.

* 5 Safe Compounders :

We have identified 5 Ideas that are safe bets and that can consistently deliver strong returns for the next 10 years. These businesses have scalable business models, good managements, strong moats, large opportunity size etc. We believe that the high quality nature of these businesses essentially makes them safe bets that can compound to deliver 10X returns over the next 10 years .

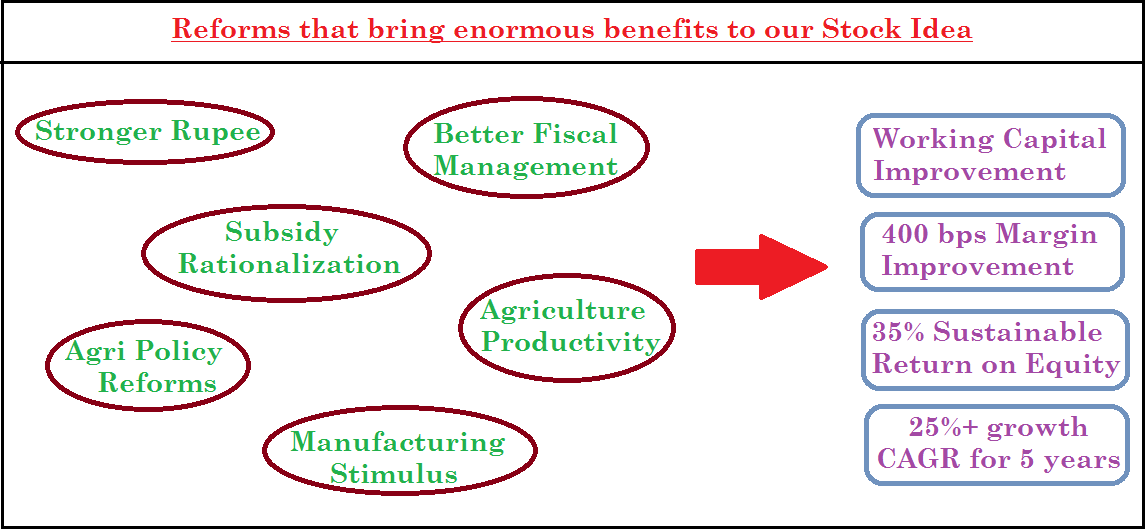

* 3 BJP Manifesto Bets :

We have also identified 3 Quality cyclical stocks that can deliver exceptionally strong returns in case of a strong Government at the centre. These stocks are extremely undervalued and are good bottom-up stories. These 3 Ideas can deliver multiple time returns during a good economic cycle backed by earnings growth as well as valuation re-rating.

* 2 Super Dividend Ideas :

The 2 high yield stocks that we have mentioned in this write-up have a dividend yield of over 7%. We believe that the current level of dividends in these 2 companies will not only sustain but also grow over the next 5 years. These stocks not only provide variety to your portfolio but also provide the necessary cash flows to re-invest.

- We have detailed 40-slide Research reports on each of the 10 stock Ideas mentioned in this special write-up.

1.) Best Real Estate stock : This stock is an extremely ultra-long term bet that can deliver exceptional returns. With a great management at helm and a value additive business model, the stock is well poised to compound at high rates going forward.

2.) Quality Education Stock : This is a stock that has great scalability. The companys business is high cash generating with superior return ratios. With a competent Management at the helm, execution should not be an issue.

3.) A Niche Market Leader : This is a stock which is one of the few good businesses that is still available at attractive valuations. The company has strong competitive advantages and is a Market leader with an increasing Market share.

4.) Fast Growing Consumer Stock : This is a mis-interpreted consumer stock that is showing great signs for improved performance going forward. The companys core business is of high quality with ROCEs in excess of 70%.

5.) Well managed Mid-Cap IT Stock : It is one of the few niche Mid-Cap stocks that has a clear differentiation in a crowded space. The company has a management which understands capital allocation well. We are bullish on the business growing at a rapid level going forward.

6.) Best Turnaround Bet : This stock is a monopoly in a sub-segment of the broad infrastructure gamut. It is a stock that has tremendous potential to deliver Multibagger returns over the next 5 years. The stock in fact gave 100X returns in the previous cycle.

7.) Quality Logistics Stock : This is a stock that is in the radar of several high profile investor. The passage of GST could provide a huge Fillip to the stock. The stock would get re-rated going forward. The improving delta in the stock is its biggest positive.

8.) Strong Parent Financial : It is one of the few secular plays that can benefit enormously from a stable government at the centre. This is a high quality cyclical stock that can deliver high risk adjusted returns for investors.

9.) Asset Light Cash Cow : This is an asset light business that generates strong cash flows. The stock has been beaten down badly as the company had no growth triggers. The current environment induces growth into the company and thereby providing a strong trigger for re-rating.

10.) Mis-priced high return Bet : This mis-priced high return bet can provide strong returns for any rational investor who can see through the facts. The company has a high dividend yield of over 8%. This dividend is growing and we expect the company to deliver strong profitability growth going forward.

You can get in touch with our associates or just fill the form below to know more about these stocks and download these Research reports.