Sucker Yield Reits Does Annaly Capital Management Qualify 2015

Post on: 18 Май, 2015 No Comment

3A%2F%2Fseekingalpha.com%2F?w=250 /% This is my second article in a series called The Sucker Yield REITs and I’ll cut to the chase on this one: Annaly Capital Management (NYSE:NLY) is, in my opinion, a

3A%2F%2Fwww.nasdaq.com%2F?w=250 /% Company Description (as filed with the SEC) Annaly, we, us, or our refers Refer to the section titled Glossary to Annaly Capital Management, Inc. and of

3A%2F%2Fseekingalpha.com%2F?w=250 /% Interest rates are going to rise, that much is certain. Rising interest rates are a danger to traditional mortgage REITs that earn their bread by investing

3A%2F%2Fwww.reit.com%2F?w=250 /% NAREIT ®, the National Association of Real Estate Investment Trusts®, is the worldwide representative voice for REITs and publicly traded real estate companies with

3A%2F%2Fwww.investopedia.com%2F?w=250 /% DEFINITION of ‘Buydown’ A mortgage-financing technique with which the buyer attempts to obtain a lower interest rate for at least the first few years of the mortgage

3A%2F%2Fen.wikipedia.org%2F?w=250 /% This is a list of notable public company real estate investment trusts (REITs) in the United States.

3A%2F%2Fwww.nasdaq.com%2F?w=250 /% Company Description (as filed with the SEC) Western Asset Mortgage Capital Corporation (the Company unless otherwise indicated or except where the context otherwise

3A%2F%2Fwww.investopedia.com%2F?w=250 /% You get rewards for buying at any store in the Gap chain. Does that make one of the Banana Republic store cards worth adding

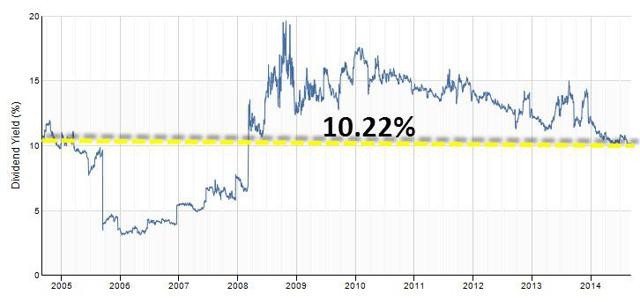

3A%2F%2Fseekingalpha.com%2F?w=250 /% This is my second article in a series called The Sucker Yield REITs and I’ll cut to the chase on this one: Annaly Capital Management (NYSE:NLY) is, in my opinion, a sucker-yield REIT. As I explained in a previous article, Josh Peters, author of The

3A%2F%2Fwww.fool.com%2F?w=250 /% So, we could say that a double-digit dividend yield that was actually safe could be considered For instance, two very popular mREITs, Annaly Capital Management (NYSE: NLY ) and American Capital Agency (NASDAQ: AGNC ) have leverage rates of 5-to-one

3A%2F%2Fwww.businessrecord.com%2F?w=250 /% I don’t know what to do. J.M. Jonesboro urging investors to buy high-yield mortgage real estate investment trusts (REITs) – e.g. Annaly Capital Management, Hatteras Financial, CYS Investments, Chimera Investment Corp. and Invesco Mortgage

3A%2F%2Fwww.investingdaily.com%2F?w=250 /% For the past couple years, investors continually pushed mortgage REITs’ unit prices higher. But that upward momentum finally reversed toward the end of 2012, as even industry standard Annaly Capital Management does qualify as a value. Annaly’s

3A%2F%2Fwww.marketwatch.com%2F?w=250 /% All references to we, us, or our mean Annaly Capital Management be taxed as a real estate investment trust (or REIT) under the Internal Revenue Code of 1986, as amended (or the Code). If we qualify for taxation as a REIT, we generally will

3A%2F%2Ffinance.yahoo.com%2F?w=250 /% In order to qualify Mortgage REITs Index Fund (NYSEArca: REM — News), a fund that focuses on U.S.-listed REITs with a focus on mortgage-related securities. Annaly Capital Management makes up nearly a quarter of REM, which had a 30-day SEC yield of

3A%2F%2Fwww.wealthdaily.com%2F?w=250 /% To qualify REIT cannot pass any tax losses through to its investors. This means REITs pay high dividends to you every year. Some REITs, such as Annaly Capital Management (NLY), pay as much as 14.13%. One Liberty Properties (OLP) has a 7.20% dividend yield.

3A%2F%2Fwww.moneyshow.com%2F?w=250 /% We think our old friend Annaly Capital Management (NLY) knows how to do this properly. Annaly, which is rejoining our High-Yield Income portfolio, has long experience as the largest publicly traded US mortgage REIT of leverage can qualify as

3A%2F%2Fwww.dailyfinance.com%2F?w=250 /% To qualify as a REIT yield. At the end of 2013, Annaly Capital Management and American Capital Agency — which are two of the largest mREITs — both held approximately $64 billion in agency MBSes, with an average yield on assets of 2.8%. How do

3A%2F%2Fwww.gurufocus.com%2F?w=250 /% Introduction: There is a growing trend towards do-it-yourself (DIY more important when growth is low and yield is high. Very High Yield Low Growth Annaly Capital Management (NLY) is a high-yielding mortgage REIT that has shown decline in Funds from