Subprime Mortgage Crisis

Post on: 16 Март, 2015 No Comment

Subprime Mortgage Crisis

The subprime mortgage crisis is a financial and real estate crisis that has been going on in the United States between the years 2007 and 2010. It began because of a drastic increase in mortgage delinquencies, foreclosures, failures in credit default swaps, saturation of the debt and real estate markets and reverse trading. All these parameters had an adverse effect on the financial markets and banks all over the world.

In recent times, The United States witnessed a rise in the number of adjustable-rate mortgages. Roughly, 80% of the mortgages that were issued to numerous subprime borrowers were of this kind. After the peak of the United States’ real estate market in the year 2006, real estate prices began to crash and their refinancing became more and more complex. The rate of mortgage delinquencies grew drastically because adjustable-rate mortgages were resetting at higher rates. Subprime mortgages and securities, which were mainly owned by companies, began losing their value and as a result, numerous U.S. Government sponsored firms and banks witnessed a decline in capital.

What is Subprime Lending?

According to the United States Federal Deposit Insurance Corporation, the term subprime talks about individual borrowers’ credit characteristics. Subprime borrowers are those borrowers that have weakened their credit histories, which comprise of important issues such as bankruptcies, charge-offs, judgments and payment delinquencies. They might also portray reduced capacity of loan repayment and debt-to-income ratios or any such parameters that may cover borrowers with incomplete histories of credit. Subprime loans are nothing but loans given to borrowers who portray one or more of the above mentioned characteristics at the point of purchase. If the borrower displays any delinquency while making mortgage payments, the lender can take complete possession of the property via foreclosure.

Events Leading to the Subprime Mortgage Crisis:

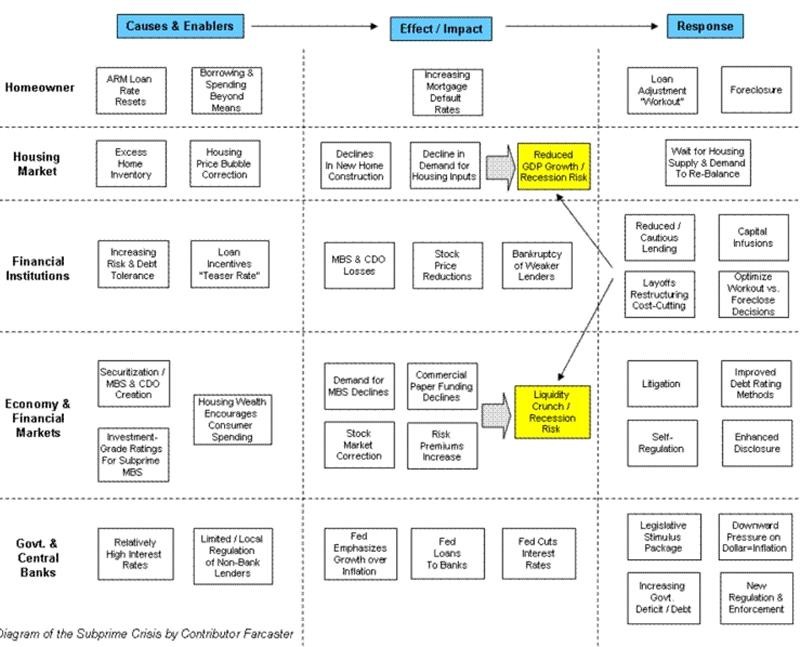

Apparently, the chief cause of the subprime mortgage crisis is the United States housing bubble which burst after reaching its peak in the year 2006. The rate of defaults on adjustable-rate mortgages increased dramatically. Borrowers were encouraged because of the increase in loan incentives such as simple initial terms. Other significant factors such as the old trend of always-rising house prices also played an important part in drawing them forward. However, once the interest rates began to rise, refinancing the loans became difficult as a result of which, foreclosures and defaults began to increase as well. Real estate prices didn’t rise, as was expected, and the adjustable-rate mortgages were reset on a higher level. The prices of houses fell so drastically that, at one point of time, they were lower than the loan amount. This forced people to opt for foreclosures and that is when the huge foreclosure epidemic began. This epidemic continues to play a huge role in the global economic crisis as it tends to drain the money customers possess and weaken the financial strength of banks. (Refer fig 1.1)

In the times that later led to the crisis, there was a lot of money that came into The United States from rapidly developing economies in Asia and oil exporting countries in the Middle East. This money along with the extremely low interest rates in The United States fueled the growth and popularity of the real estate market and created the credit and housing bubbles. Numerous types of loans were given away easily to customers who went on to accumulate loads of debts for themselves. Mortgage-backed securities grew rapidly because of the credit and real estate bubbles. Later, when the housing market in the U.S. collapsed, many companies and individuals who had invested heavily in real estate, reported heavy losses, some of them filing bankruptcies. The total amount of loss around the world was estimated to be few trillion U.S. dollars.

Meanwhile, when the credit and housing bubbles were expanding, number of factors came into consideration, which made the economy increasingly vulnerable. Policymakers didn’t realize the true importance of financial institutions such as hedge funds and investment banks. These banks played a huge role in providing the American government with credits. While doing so, they took huge loan recovery burdens upon themselves and did not possess the financial cushion required to take the impact of loan defaults and mortgage-backed security losses. This resulted in an economic slowdown as the banks lost their potential to lend.

The American Mortgage Market (2006-2010):

As of 2007, subprime mortgages in The United States were estimated to be valued at $1.3 trillion comprising of at least $7.5 million subprime mortgages that were outstanding. Between the years 2004 and 2006, the share of subprime mortgages in the total amount of originations ranged from 18% to 21% as compared to 10% between the years 2001-2003. In the third financial quarter of the year 2007, subprime adjustable-rate mortgages made up only 6.8% of outstanding mortgages in The United States. It also accounted for 43% of all foreclosures in that particular quarter. By October 2007, the rate of delinquency was 16% which was approximately thrice that of the year 2005. In January 2008, the rate of delinquencies had risen to 21% and by May later that year, it was 25%.

The chart (Refer fig 1.2) above provides the number of foreclosures that has taken place in The United States in the last three years.

Home Owners’ Speculation:

According to numerous surveys and studies, the speculative borrowing in the real estate sector is one of the chief causes of the subprime mortgage crisis. In the year 2006, 22% of the total number of houses purchased (1.65 million houses) were solely for investment purposes. An additional 14% were purchased as holiday homes. This implies that 36% of the houses that were purchased in the year 2006 weren’t purchased as a primary residence. The comparative figures in the year 2005 were 28% and 12% respectively. The then chief economist of National Association of Realtors, David Lereah said that in 2006, investors in real estate were fewer because many speculators left the market immediately. Real estate rates managed to double themselves between the years 2000 and 2006. This was a shade different from the earlier trend in which the rates appreciated approximately with the rate of inflation. Because of the housing bubble, houses were suddenly being viewed as objects of investment based on speculation. Numerous cases of people buying properties while they were under construction and then selling them when their rate appreciated without ever having lived in them were witnessed. Warren Buffet openly declared that this was the biggest hype that he had ever witnessed in the market. He rightly judged that people were under a false sense of security that house rates will never fall drastically.

Government Policies and their Contribution to the Crisis:

Government implemented regulation and deregulation were both equally responsible for the subprime mortgage crisis. Alan Greenspan and the Securities and Exchange Commission conceded in a testimony before the Congress that they had failed in permitting self-regulation of investment banks. Numerous past presidents of The United States like Franklin .D. Roosevelt, Bill Clinton, Ronald Reagan and George Walter Bush have stressed upon the importance of house ownership. In the year 1982, the Congress passed the Alternative Mortgage Transactions Parity Act, which permitted non-federally chartered housing creditors to write adjustable-rate mortgages. Numerous types of mortgage loans such as adjustable-rate, optional adjustable-rate, interest-only mortgages and balloon-payment, were created as a result of this. The biggest criticism that the banking industry received was that the government failed to enact necessary regulations that would have played a role in preventing misuse of these new types of mortgages. Subsequently, numerous cases of abuse of predatory lending were observed in the upcoming years. In the year 1995, numerous GSE’s such as Freddie Mac and Fannie Mae received tax incentives from the government for purchasing mortgage backed securities which also included the issue of loans to borrowers with low income. It was in this way that the firms like Fannie Mae and Freddie Mac became heavily involved with the subprime mortgage market. Between the years 2002 and 2006, the subprime mortgage market grew at an astonishing rate of almost 292%. The combined purchase of subprime securities made by Freddie Mac and Fannie Mae grew from $38 billion to $175 billion which also comprised of $350 billion Alt-A securities. By the year 2008, Freddie Mac and Fannie Mae owned $5.1 trillion in residential mortgages, either via sponsored mortgage pools or directly, which was approximately half the total of the entire United States mortgage market.

The graph (Refer fig 1.3) represents the mortgage-backed securities downgrades between the 3rd quarter of 2007 and the 2nd quarter of 2008.

Between June 2007 and November 2008, all Americans, on an average, lost more than a quarter of their net worth. Real estate prices had fallen 20% from their high in the year 2006 while the future market predictions were indicating an approximate of a 35% fall. The total real estate equity in The United States was valued at $13 trillion during the 2006 peak, had fallen to $8.8 trillion by mid 2008. Total retirement assets, the average American’s second-biggest household asset, fell by 22% to $8 trillion in the year 2008. While this was going on, pension assets fell by $1.3 trillion and savings and investment assets fell by $1.2 trillion. The total loss amounted to a substantial $8.3 trillion. The members of minority groups in The United States started receiving an abnormal number of subprime mortgages and therefore, went on to face an unfair number of foreclosures.

Since the subprime mortgage crisis became apparent in the year 2007, numerous necessary actions have been taken by agencies, policymakers and the government. In the year 2008, when the financial markets all over the world began to decline, special attention was given to the crisis. Numerous agencies and policymakers began innovating new methods to handle the subprime mortgage crisis.