Stocks v Estate Lazy Man and Money

Post on: 4 Июль, 2015 No Comment

Comments

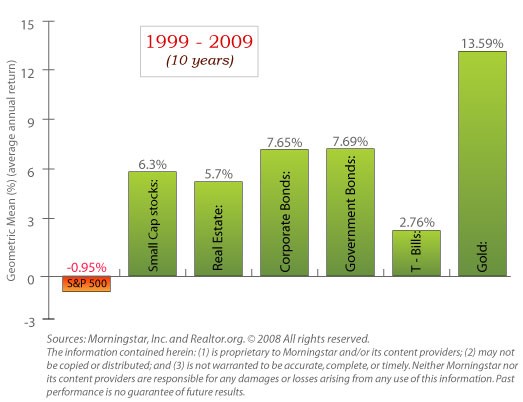

May’s Money Magazine tries to answer the Stocks vs. Real Estate question (see page 94). I had thought that real estate was going to come out the big winner. I know that real estate has been really popular of late, but I had it as the favorite due to the value of leverage.

Money Magazine declared stocks the winner, but I think they glossed over the leverage factor. For one they took a 2 year time-line for the real estate and then deducted a lot of one-time costs. That didn’t seem to be a particularly fair shake to me. So to the left you’ll see my attempt at the running the numbers in Excel. In the example, I assume the investor has $40K to put to work. For stock picks. I assume a 10% (for better or worse) gain. I also took a cue from my early physics classes and ignored friction — in this case it’s the cost of buying stocks. The Real Estate column assumes the investor puts 20% down allowing them to buy a $200K home and pays 10K in closing costs (closing costs from the article). The Real Estate AC (after costs) factors in a 6% sales commission (though I believe this can be less), paying off of the mortgage, $3,600 in preparing the house for the sale (gleaned from Money Magazine), plus the original 40K investment.

I’m not 100% that my chart is accurate. I’ve edited it a few different times realizing a couple of errors. However, each of the charts showed the same trend. Real estate seems to out perform in the short term, but at some point in the 25-30 year mark the 10% return of stocks takes over the leverage of real estate. However, if one were to lock in the gains of real estate at year 8 (around $125K), the person could use the gains to buy three more $200K homes getting more an more leverage. Leverage can be a dangerous thing as a loss can spiral just as much in the negative direction. It still makes me think that there are a lot of gains to be had in real estate in general.

If you are planning to execute on this plan, remember that it’s not a get rich quick scheme. In today’s real estate market, I believe you should be prepared to hold onto a home for a minimum of 6 years (while being prepared to hold for 10 years). Trying to fix up and flip a home within a year opens you up to short term price pressures and fixed costs. You should also be aware of other factors mentioned in the Money Magazine article apply. One such important one to remember is that a home is not a very diverse investment. Another one is that real estate investing takes a lot of work, while investing in stocks is relatively quick and easy.