Stock Selection and Portfolio Management Guide for Value Investing

Post on: 5 Июль, 2015 No Comment

Stock Selection Matters

For value investors, active portfolio management remains much more an art then science. There is sufficient value investing literature available that describes the methods and processes fundamental analysis to find appropriate value stocks. Not much is said about how you might go about creating an optimum portfolio structure that includes appropriate stock selection and maintenance over time.

Part 1 in this series of articles introduced the concept of business lifecycle (or product lifecycle ). Part 2 takes the same concept and presents it in the form of a BCG Matrix that can be used to make strategic decisions about managing your portfolio of investments (products, services, stocks, real estate, etc). In this article, we will take these concepts and adapt them to present an empirical process a value investor can use to structure his or her portfolio and manage it over time taking into account his or her various capital allocation constraints and investment risk.

Going Beyond the Monolithic Definition of Value Investing

Reduced to its simplest form, value investing is about finding stocks that can be purchased at a significant discount to the intrinsic value of the company. However, as any practicing value investor knows, value stocks come in different shades of value. Part of it is the degree of undervaluation and the rest lies in the manner in which value may be realized, estimated holding period, and existence of catalysts. Add to this the need for keeping a optimally diversified portfolio. and the active management of the portfolio becomes complex.

It is hoped that the process I am laying out in this article will give a certain structure to the portfolio construction process without taking anything away from the art of value investing.

We will again use the BCG Matrix framework introduced in the Part 2 of this series. However, we will adapt the matrix so it is relevant to a value investors portfolio.

Adapting the BCG Matrix

Lets start by recalling that the 4 quadrants of the matrix looked like this:

The idea for an investor is to use the Cash Cows to fund the Question Marks until they either turn into Stars or become Dogs. Dogs are harvested.

In our case, I will redefine these terms to reflect the kind of value stocks an investor might hold in their portfolios. To start with, the horizontal axis Relative competitive position changes to Profit Potential and the vertical axis Market growth changes to Quality of Undervaluation. The revised matrix now looks like this:

Question Marks: These are the stocks that are highly undervalued according to one or many of the valuation metrics. They may not have anything else going for them other than undervaluation. If you buy these stocks, you might end up waiting a long time to see the valuation gap close with a profit or it may come tomorrow. Quite often, some of these companies may bob along in the undervalued bucket and if they are not generating profits, the risk is that the value in the stock might erode over time.

There are 2 distinct outcomes for these stocks. There may be a change in the environment that allows the company to generate value for the shareholders. For example, a sale of the company, liquidation of assets, change in management, new product that is well received, FDA approvals, etc. In this case, the stock will quickly move to the Star quadrant. Absent these events, the stock may stay undervalued for a long time and eventually become a Dog.

The idea is to buy these stocks and wait for something to happen. Most value stocks belong to this category.

Stars: These are Question Marks that have a high likelihood of value realization. This could be because of existence of catalysts that when they occur will propel the stock price up, closing the valuation gap. Finding these catalysts takes deep critical review of the business and working out various scenarios and their probabilities. It also helps if the stock is under followed by the investment community. The reward for the intense research is

a) finding stocks where the odds are strongly in your favor, and,

b) quicker returns

As a result, the risk of capital loss is drastically reduced (this does not mean the volatility of the stock will decrease. Volatility is what the market does and you cant control. Risk is the possibility of capital loss that you can control to a large degree with diligence).

Eventually all Stars fade. Done right, most will yield outstanding profits, but fade they will, nevertheless. Some Stars may end up with excellent competitive advantage in their industry and may become Cash Cows. Others will end up as Dogs and will need to be liquidated.

Cash Cows: Cash Cows are a curious bunch of value stocks. To be frank, they may not be considered strict value by traditional practitioners of the value investing philosophy since the value in these stocks is not derived from tangible assets. Indeed, most of the value lies in their earnings power. As long as the company is able to maintain an above average margins and dominate its market, the company can continue to generate above average returns for investors who had the foresight to buy the stock at a reasonable discount. These companies are said to possess a durable competitive advantage, also known as moat.

There is a certain lure to investing in Cash Cows. They are generally considered safer although in reality this is not always true. I would rather invest in a company that is valued at $100 million but has net assets conservatively worth $150 million then invest in a company where value lies in the business being able to maintain or grow its above average profitability. If there is any constant in the business world, it is the fact that competitive advantage erodes over time. New competition comes in, technologies change, consumer behavior changes, product is no longer relevant, etc. No one, not even Coca Cola (KO ) is immune from competitive pressures. Besides, future earnings cannot be predicted with any useful degree of certainty. There is company risk as well as macro economic risk (note: precision is not the same as accuracy).

My use of the term Cash Cow here does not imply that the stock pays a good dividend. It may or may not. However, dividend payout rate is immaterial. If the business generates excess cash which is not paid out, the stock price will reflect the accumulation/re-investment.  In absence of a dividend, you could generate cash in this quadrant by harvesting parts of your cash cow holdings.

Dogs: Dogs are the stocks where the valuation gap has either closed (fairly valued) or has inverted (over valued). Ideally the gap closed as the stock price rose to meet the intrinsic value, in which case you realized a profit. In some cases, the investment thesis may not work out and the intrinsic value actually declines leaving you with a loss. Regardless of the reason or the returns generated, Dogs need to be sold.

You may also want to push a stock to the Dog quadrant if it fails to return value within a time frame you are comfortable waiting for. This stock may not be a dog and could have excellent investment merits, however your investment process may require you to sell a stock in 2 years (for example) and chalk it off to an unknown mistake in your stock selection process. It may or may not be a right move, but sometimes you just need to make a decision, kick it out, and move on.

Selecting Stocks and Structuring Your Portfolio

Using this BCG Matrix like framework gives you a good basis for giving a structure to your portfolio. Most value investors tend to rely on their gut and intuition which may not work well at all times.

Lets peel back another layer and talk about how you can use this for stock selection and active portfolio management. Follow the following 3 step process:

1. Review cash use and cash generation in your portfolio

Cash Cow stocks and Dogs generate cash. Stars and Question Marks consume cash. Additionally, another source of cash for your portfolio may be your periodic contribution to your investment account. If you are running a closed portfolio, for example in a tax deferred account that may not see a cash infusion for some time, you may want to maintain a higher portion of cash cow stocks. Over time though, with a focused yet reasonably diversified portfolio (10-20 stocks), you will have frequent exits (harvesting Dogs) to provide liquidity to fund Question Marks and Stars.

2. Decide what percent of your portfolio you want in fresh ideas

Fresh ideas are basically your Question Marks and Stars. For a young investor, focused primarily on maximizing rewards, a large part of the portfolio will be in these 2 quadrants. Perhaps as high as 75%. Some will be in the Dogs quadrant while Cash Cows will be minimal. For a Large portfolio though, you will end up with over allocating to the Cash Cow quadrant and your portfolio performance will suffer (similar to Warren Buffetts portfolio). This is primarily because you have a better chance of finding Question Marks and Stars among smaller stocks and with a large enough portfolio, you are constrained for investing in these stocks unless you turn your portfolio into an index fund clone.

3. Focus on value, not price, except AFTER you harvest

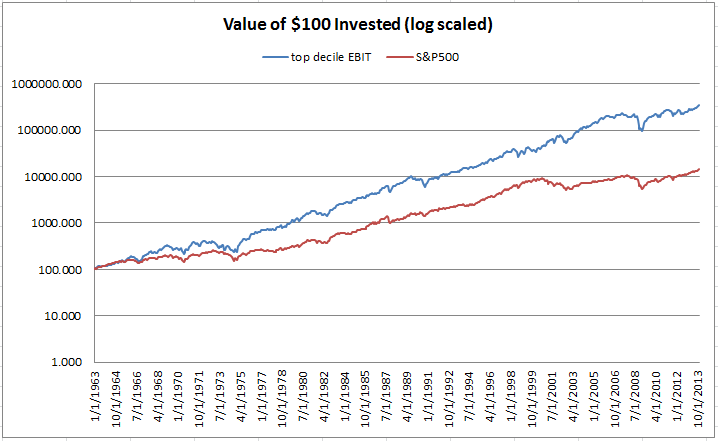

Value investing is a process that you have to trust to a large extent. Fortunately, there is overwhelming history to support your trust in the process. You will have occasional stocks that do not work out, but if you focus on finding value, over time your portfolio will work out better than average. To make sure you do not get sidetracked with market sentiment or other irrelevant hype, you should focus on value and not price through this process. After you have harvested a stock, you should review your original investment thesis and the actual outcome and if necessary refine your stock selection process.

How to Account for Value Traps

A value trap is a dog from the start, isnt it? The problem is that a value trap is an after the fact definition. There is no way to determine a value trap before you buy the stock.

The best way to limit your risk of ending up with a value trap is to insist on a business catalyst that you estimate has a high probability of occurring. The other way is to limit your holding of an unprofitable position to a finite time, such as 2 years. It is not profitable to agonize over whether you made a mistake. If it turns out you did, realize it and move on.

That being said, what may be a value trap today may actually be a terrific investment tomorrow. Things change, including the business and the management. It is not wise to pigeon hole an investment in the value trap category and ignore it forever.

It is interesting to see that many of the concepts I present here are easily intuited, but are often wrongly applied. For example, the saying let your winners run works for cash cow stocks but only when there is sufficient value in its moat. In most cases though, when winners become dogs (over valued), they should be liquidated. Additionally, value investing does not have to mean a long wait for the Mr. Market to come to its senses. You can short cut the value realization process by looking for potential catalysts.

P.S. This article builds upon some of the earlier concepts and presents an original way of looking at active portfolio management for value investors. I use this in my own practice. I plan to expand this to build a rigorous framework that we can all benefit from. Your questions, critiques, feedback, ideas, etc posted in the comments below will bring in a wider variety of views and insights and will be much appreciated. I want this to be a real world methodology as opposed to a purely academic one that any investor can use.