Source 4 Donor Advised Funds

Post on: 24 Апрель, 2015 No Comment

SHARE:

Like other area agencies on aging (AAAs), the Atlanta Regional Commission (ARC) was confronted with shrinking public dollars at a time of growing demand for services. To help solve its financial squeeze, this AAA looked to generate more private funds.

It chose to establish a donor advised fund (DAF) called Thank You Mom and Dad Fund housed at the Community Foundation for Greater Atlanta. By contributing to this special fund, donors could honor loved ones on important occasions such as birthdays, holidays, Mothers Day, Fathers Day, and Grandparents Day. They also could memorialize special relatives, friends, or mentors who had died.

The DAF was a quick and convenient way for donors to make tax-deductible contributionsand have some influence on the funds use. The DAF proved to be a useful short-term financial vehicle that took relatively little time, money, and legal assistance to set up and maintain.

What is a Donor Advised Fund?

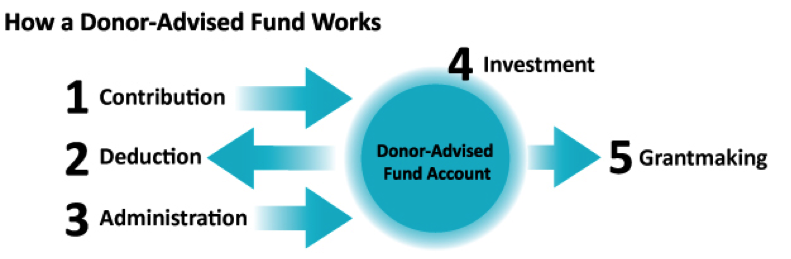

A DAF is a private fund administered by a third-party organization and created for the purpose of managing charitable donations on behalf of an organization, family, or individual. Its an easy-to-establish, low-cost, flexible vehicle for charitable giving. Donors who use a DAF enjoy administrative convenience, cost savings, and tax advantages.

Community foundations pioneered donor advised funds, and many commercial sponsors, educational institutions, and independent charities now offer them. DAFs were once considered the fastest-growing charitable giving vehicle in the U.S. although the recession put a significant damper on their growth. There are estimates that more than 125,000 people have established DAFs holding over $23 billion in assets and donating more than $3.5 billion to charities each year.

A DAF is an agreement between a donor and an administrating organization that gives the donor the right to advise the organization on how a portion of his or her contributions will be distributed to 501(c)3 organizations. However, the donor cannot dictate how the funds will be used.

DAFs can accept the widest range of assetsincluding cash, appreciated securities, restricted and closely held stock, limited partnerships, real estate, and other tangible assets. The contributed assets are tax-deductible.

Where to Find Donor Advised Funds

- Community foundations

- Nonprofit organizations (e.g. where a donor wants to establish an endowment-type fund)

- Commercial sponsors (e.g. Fidelity, Vanguard, Schwab)

- Independent sponsors (e.g. American Endowment Foundation, National Philanthropic Trust, U.S. Charitable Gift Trust)

DAF Advantages for Nonprofits

- Low administrative costs mean more money for nonprofits.

Ninety-nine percent of all DAF-contributed dollars go to nonprofits. Organizations that administer these funds provide services that help donors obtain easy access to research about various nonprofits social impact. As a result, they tend to give their support more confidently and generously.

You dont have to be a Rockefeller or a Gates to participate in meaningful philanthropy. Minimum contributions to DAFs are usually $5,000. A Bank of America study found that households with incomes in excess of $200,000 or assets in excess of $1 million cited these barriers to increasing their charitable contributionsred tape, the time it takes to give, lack of access to research on prospective nonprofits, and lack of knowledge about needy organizations. DAFs can reduce all these barriers.

Even when theres a downturn in the stock market and contributions to the funds may decrease, a portion of DAF assets are distributed to nonprofits. DAFs gives nonprofits more fundraising leverage. Nonprofits that didnt have the ability to accept donations of non-publicly traded assets, like ownership in a private company, real estate and other tangible assets, can now receive income from these investments.

Many are volunteers and/or serve on nonprofit boards.

Drawbacks of DAFs

- Lack of knowledge.

Most financial advisors and investors are not familiar with DAFs, so they dont explore this option with clients.

There are a few exceptions. For example, the Renaissance Charitable Gift Fund is a self-directed fund and The Calvert Giving Fund focuses on socially responsible investments that can magnify a donors philanthropy.

Unlike DAFs, charitable remainder trusts allow you to create an income stream for the donor.

How to Get Started with DAFs

- Develop solicitation materials.

Create materials to educate DAF account holders about your organizations work and mission. You wont know who has a DAF account unless you ask. You can provide an additional check-off box on any of your solicitations that says, I will recommend this amount from my donor advised fund. This gesture makes it easy for donors to support your organization in a way thats also easier for the DAF administrator.

Keep your website up-to-date and information about your nonprofit on commonly used nonprofit research sites, such as Charity Guide, Charity Navigator, GuideStar, and BBB Wise Giving Alliance. Also make sure your tax code number is easily accessible on your website.

The Future of DAFs

Tom Harding, executive officer of Tactical Wealth Advisors. says DAFs are viable but have never really reached their full potential, despite hype in the early and mid 2000s. Not surprisingly, the recession led to a slump in new DAF accounts and decreased funds in existing ones, according to 2009 figures in a recent Giving USA report.

Post-recovery, DAFs will likely play a more significant role in private philanthropy, but only if a large educational campaign is launched to increase awareness of this promising vehicle. There is a solid potential fit for community foundations, financial advisors and their clients, and other mid-range donors for what some call the poor mans foundation.