Social Enterprise and Impact Investing

Post on: 16 Март, 2015 No Comment

Social enterprises, by definition, proactively intend to create positive societal impact as well as generate profits. In the quest for innovative ways to engage the private sector to bolster global sustainability further, social enterprises represent a new frontier for companies to create greater positive impact. The Global Compact facilitates business partnerships between social enterprises, corporations, investors and other stakeholders to advance innovative business models in emerging and frontier markets.

Companies can benefit from viewing partnerships with a social enterprise not only as a way to strengthen the societies where they operate, but as a financially and strategically valuable investment. These partnerships have the potential to generate economic benefit for both parties involved, via:

- Insights for innovation. Operating in low-income markets challenges companies to innovate in order to create low-cost products, new business models and efficient supply chains. Drawing on these experiences, companies can apply novel business approaches toward other similar markets.

- Access to new markets. Many companies recognize that low-income populations in emerging markets will constitute a significant consumer and supplier base in the long-run. Often corporate-social enterprise partnerships allow for both parties to make investments that will serve that high-potential market segment in the future.

- Opportunities for risk management. Corporate-social enterprise partnerships allow for both parties to diversify economically, through entering different markets, as well as operationally, through interactions with new customers, suppliers and products.

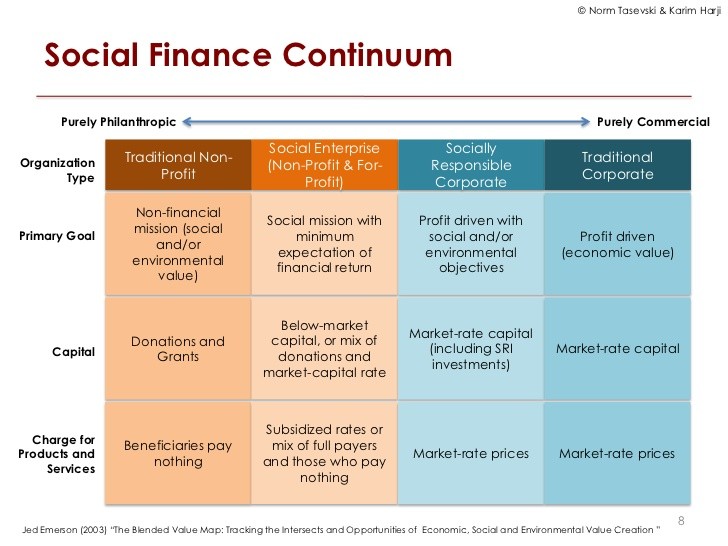

Definitions

- Social enterprise development is defined as creating and nurturing micro-, small-and medium-sized businesses that aim for positive social or environmental outcomes while generating financial returns;

- Impact investing is defined as the placement of capital (into social enterprises and other structures) with the intent to create benefits beyond financial return.

Social enterprise and impact investing overlap significantly, although they are not synonymous. Social enterprises, for example, need more than just investment capital to be successful, while impact investments can be made into non-enterprise structures like loan or equity funds or infrastructure projects.