Signs of Portfolio OverDiversification

Post on: 19 Сентябрь, 2015 No Comment

Signs of Portfolio Over-Diversification

If you’re new here, you may want to subscribe to my RSS feed. Thanks for visiting!

A well diversified investment portfolio is a key requirement for long-term investing success.

Diversification is important. But sometimes too much diversification can negatively impact portfolio performance. It can be a fine line in getting it right.

Today, a look at indications your portfolio is overly diversified.

Portfolio Diversification

We have looked at the benefits of portfolio diversification in previous posts. Should you wish to refresh yourself on this important concept, please take a read of:

Pretty creative titles. What else to expect from an accountant/finance guy? At least I am not an actuary. As the saying goes, an actuary is simply an accountant without a sense of humour.

Bottom line, proper diversification is extremely important for investing success.

But too much diversification can hurt performance.

Indications You May Be Over-Diversified

1. Owning too many mutual funds within any single investment style category

Investing in more than one mutual fund within any style category adds investment costs, increases required investment due diligence, and generally reduces the rate of diversification achieved by holding multiple positions.

For each investment category, find a single mutual or exchange traded fund that meets your investment criteria for that class. This should be fairly straightforward for passive investing. If you are investing with active fund managers, you may want to look at two or three funds to hedge the managers performance.

Also, watch for too little diversification when buying multiple funds in the same investment style category. The pool of available investments within an investment class may be small, so you may end up with very similar holdings in two or more funds. Or, some investments span multiple investment style categories. You may just end up with Apple in every fund you own regardless of style category.

Watch the underlying holdings in any funds you research. Do not spread yourself too thin or pay for the same fund twice. And be careful with costs. Let your capital accumulate on your behalf. Not on making the fund company rich.

2. Excessive use of multi-manager investments

When considering multi-manager investment products, you should weigh their diversification benefits against their lack of customization, high costs and layers of diluted due diligence. Is it really to your benefit to have a financial advisor monitoring an investment manager that is in turn monitoring other investment managers?

I am not a fan of fund of funds and/or multi-manager investment products. There are some investing aspects where it may be cost-effective to hire professional expertise (financial planner, active managers in specialized markets, etc.). But any individual investor should be able to put together a portfolio of funds on their own. Why pay someone to amalgamate a variety of readily available funds?

3. Owning an excessive number of individual stock positions

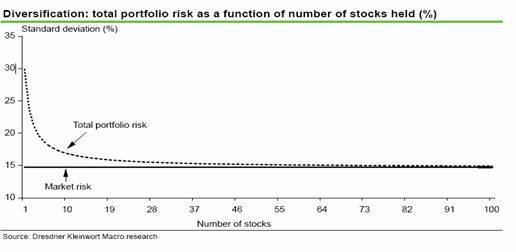

Too many individual stock positions can lead to enormous amounts of required due diligence, a complicated tax situation and performance that simply mimics a stock index, albeit at a higher cost.

The greater the complexity of a fund, the greater the costs you will usually pay.

A problem with this is that outside of certain index funds (e.g. the SPDR Dow Jones Industrial Average (DIA) reflects the Dows 30 components), most funds will have significantly more holdings than the 20 to 30 normally cited for adequate diversification. Is holding 184 investments in the fund materially more cost effective than 227 holdings?

Or what about a fund that only has 60 investments but is constantly churning the portfolio? Is that better or worse than a fund with 300 investments that has very little turnover?

Me, I tend to focus more on two things. One, I look at the percentage of total fund assets in the top 20 or 30 holdings. That tells me something on the real concentration of assets. Two, I focus on the annual expense ratio for the fund. That tells me about management fees, transaction costs, administration expenses, etc. for the fund.

4. Owning privately held “non-traded” investments that are not fundamentally different from the publicly traded ones you already own

Non-publicly traded investment products are often promoted for their price stability and diversification benefits relative to their publicly traded peers. While these “alternative investments” can provide you with diversification, their investment risks may be understated by the complex and irregular methods used to value them. The value of many alternative investments, like private equity and non-publicly traded real estate, are based on estimates and appraisal values instead of daily public market transactions. This “mark-to-model” approach to valuation can artificially smooth an investment’s return over time, a phenomenon known as “return smoothing.”

Most investors should be able to go through their lives without investing in these types of alternative investments.

I have owned some of these investments but tend not to recommend them to non-professional investors. Valuations can be problematic. Proper management is important. Cost structures tend to be relatively high. Also, liquidity can be an issue for investors wishing to divest. I suggest using caution when considering non-publicly traded investments.

Too much diversification may negatively impact your portfolio performance. Not necessarily from having too many investments. But in the increased costs associated with those additional funds and holdings.