Should You Pick a Roth 401(k) or Traditional 401(k)

Post on: 16 Март, 2015 No Comment

It doesnt take a financially savvy person to know that taking advantage of an employer 401(k) plan is a must for building a future retirement portfolio. However, some would say it is difficult to choose between a Roth 401(k) plan and a traditional 401(k) plan.

In general, both accounts are similar to each other:

- They both have participant contribution caps issued by the IRS annually

- They both are a way to plan for retirement

- Borrowing against the assets and accessing the assets have about the same stipulations

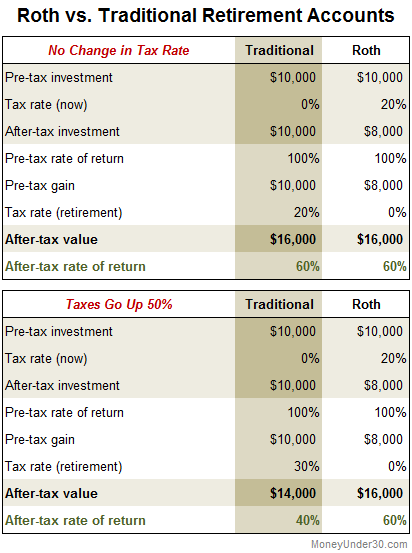

The main and most important difference is that by choosing a Roth 401(k), you are contributing to the plan after taxes, and upon accessing the money in your retirement at the legal time limit, no more taxes will need to be paid on the distributions.

Traditionally, 401(k) earnings contributed are made pre-tax, meaning the money is deducted directly from your paycheck and put aside into your retirement account. This deferral of your money can lower your tax bracket for the participating year, however taxes will need to be paid upon withdrawal of the fundswhich may be a disadvantage since the more income you gain over your life time, the higher your tax bracket is. In the end, you may have to pay more tax on your savings.

Factors to Consider When Choosing a 401(k)

A few things you should consider, include:

- What stage of life and earning potential are you in?

- What you really need to gauge to formulate your choice is the expectation of your future tax rate?

As mentioned earlier, if you are fairly new in the career game and expect your earnings and tax bracket to increase over time, it may be better for you to opt into a Roth 401(k) so you are not levied with a higher tax penalty in the future.

However, if you are at your peak earning potential and actually expect your tax bracket to be lower in the future for whatever reason, you may opt into a traditional 401k to keep more of your money in your pocket.

Like any investment strategy, it is up to you to weigh the pros and cons and crunch the numbers. Use a retirement calculator to help you. If you are not sure what is your best strategy, contact your tax preparer for some professional advice and counseling.