Should You Include Target Date Funds in Your IRA

Post on: 16 Март, 2015 No Comment

3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D64&r=G /%

26 March,2013

When looking for the best IRA rates and performance, many investors have been considering target date retirement funds. Before you decide that a target date fund is a good way to set it and forget it when it comes to your retirement, its a good idea to stop and consider the pros and cons of these types of funds.

What is a Target Date Retirement Fund?

One of the fundamentals of investing is the idea of asset allocation. As you age, and get closer to retirement, you are supposed to rebalance your portfolio so that your asset allocation stays on track.

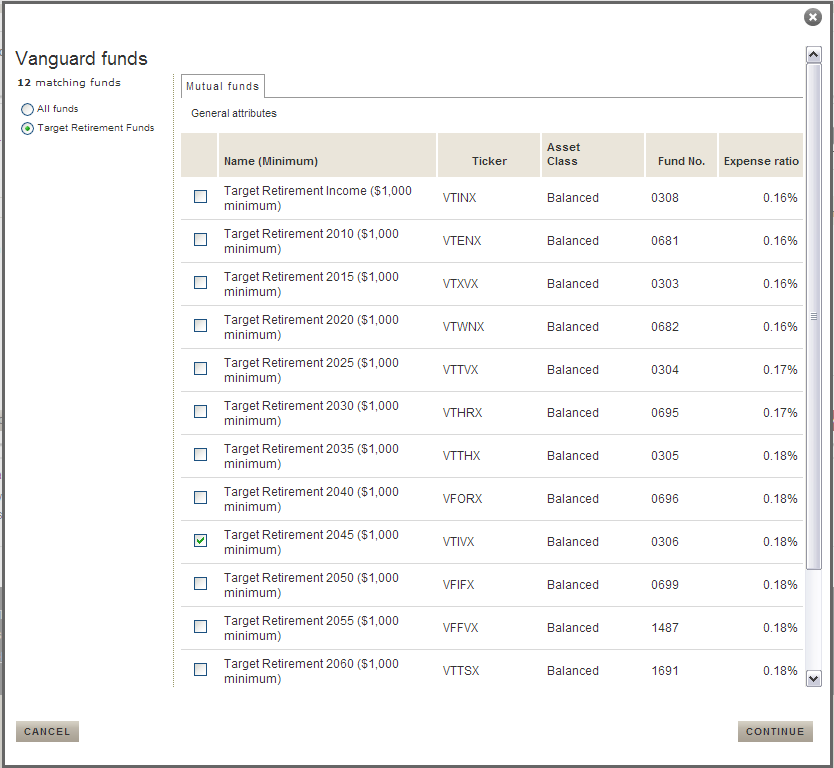

A target date retirement fund is supposed to take care of this for you. You invest, and then, as you reach age milestones in the approach to retirement, your asset allocation changes within the fund. You choose your target date fund based on when you plan to retire, and everything is just supposed to be taken care of on your behalf.

Will a Target Date Fund Really Work for You?

The real question, though, is whether or not a target date fund will really work for you. The biggest issue with a target date fund is that it makes the assumption that the market will always act consistently. While, over time, volatility does tend to even out, timing does matter to some extent. As you start investing. you will discover that when you exit a position, or sell your shares, does matter.

If you need to retire right at the time theres a crash, and your target date fund doesnt take that into account, you could be in trouble. Another issue is that your funds automatic rebalancing might come at a low point in the market, meaning that you might be selling low as part of the routine rebalancing.

There have been difficulties with target date funds in the past, and there are concerns that this situation might not benefit your IRA.

Choosing Investments for Your IRA

When deciding what to put into your IRA. it makes sense to think about your goals, and what investments you think are most likely to help you reach those goals. A target date fund might not be a horrible choice for a portion of your IRA, but its probably not the best choice for you to base your entire retirement on that single fund.

As with all investing, appropriate diversification is the key when investing in your IRA, whether its a Roth or a Traditional IRA. Consider a mix of assets that reflects your risk tolerance. And make an effort to be at least a little involved. While its tempting to take a set it and forget it approach, and rely on someone else to manage everything, thats not always the best option. While you dont want to be constantly trading, and adding up the fees, its important to pay attention and rebalance at least once or twice a year.

Dont let target investment funds be a crutch for you. Instead, really think about your retirement portfolio, and make decisions for your IRA based on your long-term needs.