Should I Short Sale Accept Foreclosure or File Bankruptcy

Post on: 16 Март, 2015 No Comment

Facing Foreclosure Should I Short Sale or File Bankruptcy?

June 13th, 2011 by chirnese

NOTE: This article was originally posted on Chirneses blog and republished here with her permission.

Due to the state of the economy – individuals are being faced with this question everyday. Should they just let their home be foreclosed? Should they short sale? should they file for bankruptcy? Not everyone’s situation is a clean cut “you should foreclose, or you should file bankruptcy”. So, although this article may help you to understand, which road you think you should take, you should always talk to a professional to discuss your specific situation.

The economy has exposed lots of people to the elements of being unable to maintain their mortgage payments. The immediate consequence of defaulting on mortgage payments is losing a home. Crushing as this may be, people who have suffered this fate also have to contend with the long term realities of a devastated credit score.

There are some options to consider when the inability to make mortgage payments becomes a reality and these come in the form of a foreclosure, short sale, or bankruptcy. Each of these options has its advantages and disadvantages and are therefore beneficial to different people facing different financial situations. It is prudent to be forearmed with the inherent details about what each of these options entail in terms of their appropriateness, their costs into the long run, and also what impact they have on one’s credit. Occurrences like serious accidents, illnesses, job loss, and even divorce can afflict anyone unexpectedly and consequently make a negative impact on mortgage payments. Before the worst happens it is certainly best to be knowledgeable about your options.

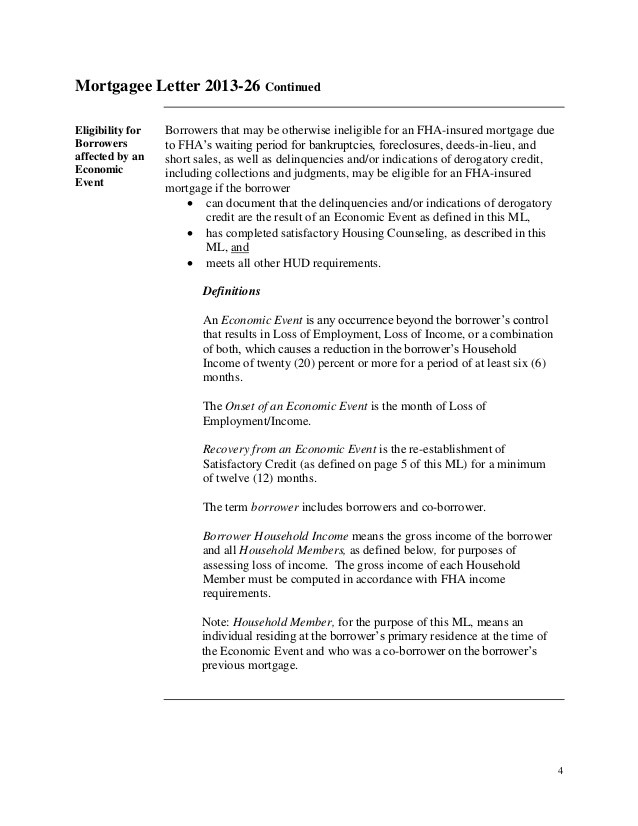

1) The Short Sale Option

A short sale ideally involves a lender receiving an amount that is lower than what’s actually owed. This happens when a property is sold off and the lender gets a pay-off from the sale monies.

Lenders have the right to take over the ownership of a property if a borrower falls back in terms of mortgage payments. They will normally sell off the property to recoup their owed monies but getting the exact amounts may not be possible given the current state of the real estate market. As the borrower in question you can convince the lender to receive a lesser amount compared to what you owe. Lenders will mostly agree to this if they are assured of getting more money than they would after a foreclosure procedure. They will definitely want to keep their losses at an utmost minimum.

The Implications of a Short Sale

The short term consequences of the short sale option are quite comforting for all participating parties. As a borrower you will have maintained your credit and will have managed to preempt a foreclosure from your records. The lender will be happy to minimize losses and resolve a bad loan.

In the long term things can sometimes take a nasty turn for the worst. As the borrower you should realize that you still owe the lender what remained from the original loan. You should also be aware that the lender only releases a property’s title deed to a buyer. Even if the property is fully sold later you still owe the lender money and you may be able to be sued for this. This debt impacts negatively on your credit score.

It gets worse when the lender decides to forgive your debt – this actually implies that a tax deduction has been taken from you, leaving you with grim tax implications. Failing to indicate this debt on your subsequent tax returns sets you up for an IRS tax audit which also comes at a cost. This cost’s penalties and interests may even see your tax debt double.

2) Allowing your home to be foreclosed

The foreclosure process is governed by both the mortgage deed’s terms and state law. This process sees a lender take hold of a defaulting borrower’s property title so as to recover a debt or unpaid loan. Borrowers agree to lenders foreclosure actions when they sign the deed of trust or promissory note – they consent to surrender their property in the event that they are unable to make mortgage payments as per the terms initially agreed to with the lenders.

The foreclosure process can be initiated even as soon as 35 days after you are late in making loan/mortgage payments. As a borrower you cannot delay or halt a foreclosure by either being present at the property sale. However, if your mortgage payments have been made on time in the past, you can convince the lender to make considerations. The lender is not obliged to agree to these requests though.

Borrowers can prevent foreclosure sales by filing for bankruptcy in a federal bankruptcy court. This court will issue an order to halt any property transfer and debt collection. The order is only effective until the lender convinces the same court to lift it (motion for relief from the automatic stay ) or until when the case closes – either by discharge or dismissal. There are also other ways to legally prolong the foreclosure period so that you can stay in your home longer. For more details on this, contact the Law offices of Chirnese L. Liverpool at (818) 714-2200.

The Implications of Foreclosure

Foreclosure does not give an affected borrower any sort of respite and it should be avoided by all means. Not only will the house be lost but it is possible for the lender to sue for the foreclosure action’s costs. More seriously, one’s credit score will be negatively dented for years to come and getting any sort of credit will largely be an impossible task.

3)The Intricacies of Bankruptcy

Chapter 7 is generally preferable for people who have had below or average incomes for the last six months. Chapter 13 is appropriate for people whose incomes are higher than average, enough to help them pay a certain amount on their debts. This latter option can help borrowers whose houses are in foreclosure and in so doing help them save considerable sums of money. Affected borrowers can file these cases themselves or with the help of an attorney; the latter is most advisable thanks to the inherent legal intricacies involved. For more information on bankruptcy, please contact theBankruptcy Law offices of Chirnese L. Liverpool at (818) 714-2200.