Should Home Equity Be Part Of Your Portfolio Asset Allocation

Post on: 23 Апрель, 2015 No Comment

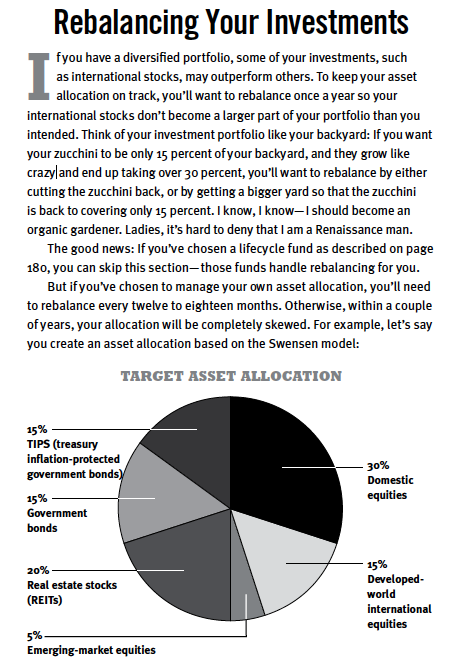

When people talk about asset allocation. they usually refer to the relative amount of stocks or bonds in their portfolio (like the model portfolios shown here ). But I am occasionally asked whether to include personal home equity in asset allocation. If you have a significant amount of home equity, does this mean you are overexposed to the Real Estate sector? Should you change your other investments to compensate?

Conspiracy Theory Argument

Professional portfolio managers are usually paid based on a percentage of assets under management, or when you make trades. Since they dont usually control your home equity, they cant charge you for it, which is why some say the industry secretly decided it shouldnt be included in asset allocations.

Im not so sure about this one. Most people dont have professional money managers. And if they do, for example Im betting that most advisors would include a huge 401(k) in their planning even they didnt control it.

Pricing and Liquidity Argument

It is very hard to determine the true market value of an individual house. You cant sell only a portion of it, which means you cant rebalance relative to other asset classes. Because of these issues, some people say personal home equity shouldnt be included.

Still, this is also true of investment/rental properties, which I think should be included in asset allocations just as much as owning any company with physical assets.

My Answer: It Depends?

I plan on staying in the same geographical area indefinitely. Once Ive committed to buying a place, Im mainly trying to pay off all future rent at once. If I never move, then obviously it wont much to me what happens to housing prices. If housing prices in my area go up, then my house value will go up, and an alternative house I want to buy will go up. The opposite will be true if housing prices go down. Over the long term, prices should pretty much match inflation. So I dont consider my house as part of my portfolio.

However, if I planned to sell my house upon retirement, and then use the money to move to a significantly cheaper home and use the difference to cover other expenses, then I would care about my house value because I would have to cash out at some point. Some people end up relying on a reverse mortgage to pay for things, which would be a similar scenario.