Should bullish fund managers be making you nervous Page 3

Post on: 15 Апрель, 2015 No Comment

This site uses cookies. Some of the cookies are essential for parts of the site to operate and have already been set. You may delete and block all cookies from this site, but if you do, parts of the site may not work. To find out more about cookies on the website and how to delete cookies, see our Privacy and Cookie Policy.

Should bullish fund managers be making you nervous?

Most fund managers seem extraordinarily bullish at the moment, which should make contrarian investors nervous.

In this month alone, we have had FE Alpha Managers Robin Geffen and Nick Train declare that there has never been a better time to invest in equities. with fellow investors John McClure and Dylan Ball insisting that they can double and quadruple clients’ over the coming years, respectively.

Most recently star manager Richard Buxton (pictured) declared that he expected the FTSE 100 to break through the psychological barrier of 7,000 next year. and push on from there.

There are good reasons for the managers to hold such opinions, no doubt – equities could well go higher from here.

What is concerning, however, is why more fund managers weren’t so positive two years ago when equity markets were trading around 35 per cent lower than they are now.

Performance of indices over 2yrs

202013_Article_charts_%20&_graphics/20131217_should_1.png /%

Buxton may be right that looking at performance over five years is unreasonable, given that the starting point was at a time when the FTSE 100 was trading at a historic low of six times earnings.

However, two years is a far more reasonable time frame to consider, and back in late 2011 bullish investors were in the minority.

There is good reason for Warren Buffett’s “be fearful when others are greedy and greedy when others are fearful”, saying to be one of the most famous in the investment world.

It has been during times of panic that the very best opportunities for investors have arisen, 2008 being the most recent example.

In contrast, at the height of the dotcom bubble in 2000 when even your average Joe was piling into tech stocks, very few people saw a crash on the horizon. Similarly anyone snapping up real estate during the debt-fuelled rally of the mid-2000s never foresaw the biggest financial crisis since the 1920s.

Performance of index over 20yrs

202013_Article_charts_%20&_graphics/20131217_should_2.png /%

On both occasions, equities were seen as something that could only go up.

When investors read headlines such as “My fund could double again in three years” and “We can quadruple clients’ money in the cycle”, it is reasonable to wonder: is it too good to be true? Will that line in the top right-hand corner in the graph above keep on rising, or follow in the footsteps of past cycles?

What’s perhaps most concerning is the scarcity of bearish managers out there. FE Alpha Managers Martin Gray at Miton and Steve Russell at Ruffer are showing no signs of upping their risk exposure, while Alastair Mundy and Sebastian Lyon continue to emphasise capital preservation above all else, but their numbers are few and far between.

Tellingly, all of these managers are highly established individuals, operating more often than not at boutique firms that are far more patient than say a pension provider or a multinational asset manager.

Although anything is possible in this industry, as shown by the number of high-profile exits this year, the stellar long-term records of the likes of Gray and Lyon should ensure their futures are safe, even if they do continue to lag behind their peers.

Would a manager at a multi-billion pound firm be afforded so much support? Are they under pressure to capture the upside?

Tim Cockerill (pictured). investment director at Rowan Dartington, thinks the pronouncements of bullish fund managers need to be taken with a pinch of salt, especially after a strong period for markets.

He says some groups use a strong period of performance as an opportunity to bring in business, but urges investors to be more wary.

“People have a tendency to up their risk exposure after the market has done well,” he said. “They may have been in a medium-risk fund and then want to go to the next step and get the kind of returns that higher risk funds have achieved. Fund groups know this.”

“It could also be that a group has had a bad time and uses a time like this as an opportunity to say ‘we’re very bullish, buy our fund’. You have to be careful.”

Felix Wintle. manager of the 404m Neptune US Opportunities fund, is very much in the bullish camp, insisting that this time around “things are different”.

He says the fact that there is no obvious bubble in one area of the market is very encouraging, and is in stark contrast to previous rallies.

“In 2001 we had tech and in 2008 we had global resources and credit; this time around, there is no one sector leading things,” he explained. “We’re seeing broad sector leadership, which is very encouraging.”

Wintle adds that the fact pensions remain skewed towards bonds adds further fuel to his bullish outlook.

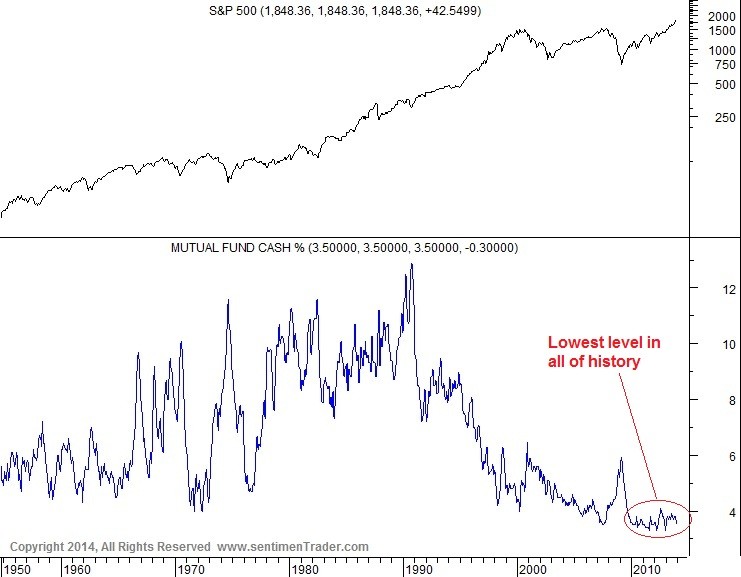

“Sentiment is not backing this bull market yet. It’s not being backed and yet we’re at all-time highs,” he added.

Cockerill is more wary, however, and thinks valuations will essentially drive stock market performance in the coming years.

“In terms of the economic outlook, we don’t know what’s coming,” he explained. “Everyone would agree that the economic numbers are getting better but it depends on how you interpret them.”

“On one hand, GDP growth is improving, but if you look at the US, wage growth is pretty flat and inflation is falling, which could imply that growth is not as strong as many suggest.”

“Similarly we don’t know how much of the eurozone recovery has come from the fact that the US has done better.”

“At the end of the day, you have to come back to valuations, which are far more predictable. I don’t think there’s anyone out there who would say markets were cheap in a broad sense.”

“If nothing bad happens next year then I think we could be in for a moderate year in 2014, but I don’t think you can expect one like we’ve just had, given that we’ve just had a re-rating.”

Thankfully my pension portfolio has a long time horizon, and given the lack of value in alternative asset classes such as bonds and cash, I am happy investing in equities, hopeful that the compounding effect of income will see me through no matter the outlook for risk assets.

On a three- to five-year view, however, I’m a little more wary, and I’m beginning to wonder whether my ISA – which I’m using to help fund my house deposit – needs to be rebalanced.

With the help of industry professionals, I’ll talk readers through my thought process and the funds on my radar in an upcoming FE Trustnet article.