Short Sale vs Foreclosure

Post on: 11 Июль, 2015 No Comment

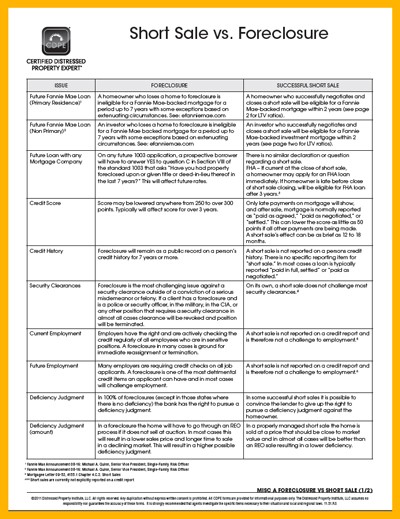

Many people often want to know what the difference is between a short sale vs foreclosure. They also want to know what has a better impact on them down the road, a short sale or a foreclosure?

Ultimately this will come down to a personal decision but here are the facts for each as well the top 3 mistakes you don’t want to make when choosing between a short sale or foreclosure.

Mistake #1- “I’ll just walk away and let the bank have the house”

Many people feel that it is better to let the bank foreclose and take the house back so they will be free from the burden of the mortgage. The truth is, most state laws allow the bank to still come after you for any remaining balance owed after they sell the home at the courthouse steps. You could end up with a foreclosure on your record and still owe the bank if they are not able to get all of their money back from the sale of your home.

In a short sale however, it is possible that the bank can try and collect more money from you at closing or even after the short sale if they chose. It is important to negotiate a waiver of deficiency if you are doing a short sale, otherwise the bank may try and collect funds from you down the road even after having done a short sale.

Mistake #2- “I’ll just let the bank foreclose, my credit is ruined anyway”

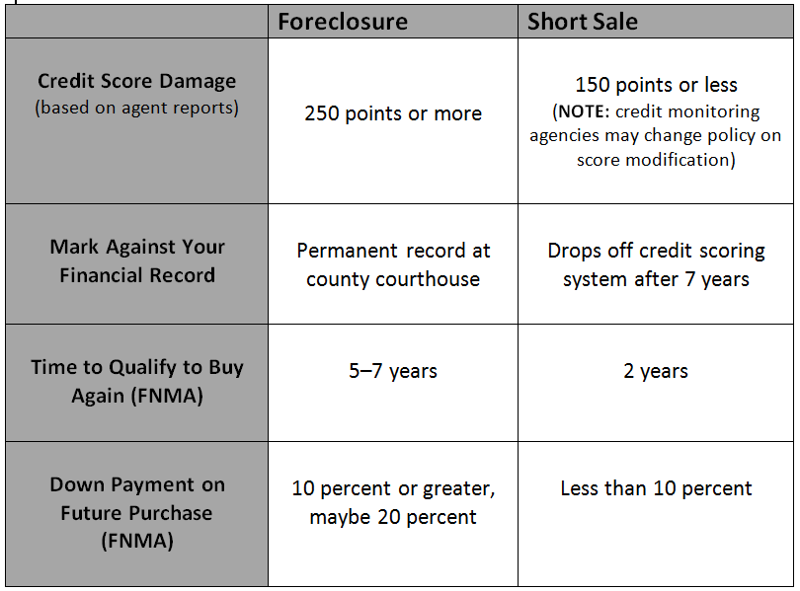

A short sale is better on your credit rating than a foreclosure because of the fact that there are several loan programs, including FHA, that allow you to re-purchase a home much more quickly if you have had a short sale vs foreclosure. While the impact to your credit score may be severe with either option, having a short sale will only restrict you from buying a home for 2 years as opposed to several more years with a foreclosure. It is important to note that there are several other factors that affect your ability to get a new loan, mainly your credit score. It is important that you take steps to re-establish good credit after a short sale in order to have the best chance at getting financing in the shortest period of time.

There are currently short sale programs like HAFA that now report your loan as “paid in full” on your credit report. This means that it is possible to do a short sale with NO NEGATIVE IMPACT to your credit.

Mistake #3- “I am already in default, I can’t do a short sale.”

It is important to know the different methods that the lender can take when foreclosing. Each state will have laws that dictate whether or not a lender can do a judicial or non-judicial foreclosure. In a non-judicial foreclosure state, the bank can appoint a trustee and foreclosure on your property in as little as 120 days after they have filed a notice of default against you. A judicial foreclosure can take much longer depending on the state you live in and the availability of judges to hear the bank case against you. The bank, at its own discretion, can postpone or put on hold a non-judicial foreclosure at any time in order to pursue other alternatives. Many banks will put the foreclosure on hold while they let your real estate agent try and find a buyer for a short sale. Even if your foreclosure date is close, there is a good chance that the bank will stop the sale in order to consider an offer to purchase the home with a short sale.

The Truth About Short Sales

Many people prefer to do a short sale because of the minimal impact it has on their credit and the fact that lenders are now offering incentives to complete a short sale. Chase bank, for example, is offering up to $30,000 in some cases for homeowners to sell their home in a short sale. It is clear that banks are encouraging short sales because of the legal challenges they are faced with because of the MERS, robo-signing and other practices that are being scrutinized. It is much easier for them to complete a short sale than risk a foreclosure that could have its legality challenged. They are also receiving pressure from the US treasury to offer as many foreclosure alternatives as possible.

Some homeowners are allowing the bank to foreclose and then demanding “cash for keys”. This is where the homeowner agrees to leave peacefully after a foreclosure if the bank can give them some cash to move on peacefully and help them with the relocation expenses. It is in the bank best interest to make sure that the their asset (the home) is not destroyed by an angry owner so they will offer some form of payment to assist them in relocating in hopes that they will turn over the property in good condition so the bank can re-sell it.

In summary, It is generally believed that if done properly, A short sale is a better solution to a distressed homeowner than a foreclosure. In a short sale, the homeowner can receive relocation help and have minimal impact on their credit. They can also get the lender to waive their deficiency balance so that the short sale is a clean break and a fresh start for the homeowner. It is still possible for a homeowner to receive a relocation expense with a foreclosure but the waiver of the deficiency is based on state laws. It is also a much longer process to get their credit repaired to the point that they can purchase a home again with a foreclosure on their record.