Short Sale Timeline How Long Does A Short Sale Take To Complete

Post on: 28 Июнь, 2015 No Comment

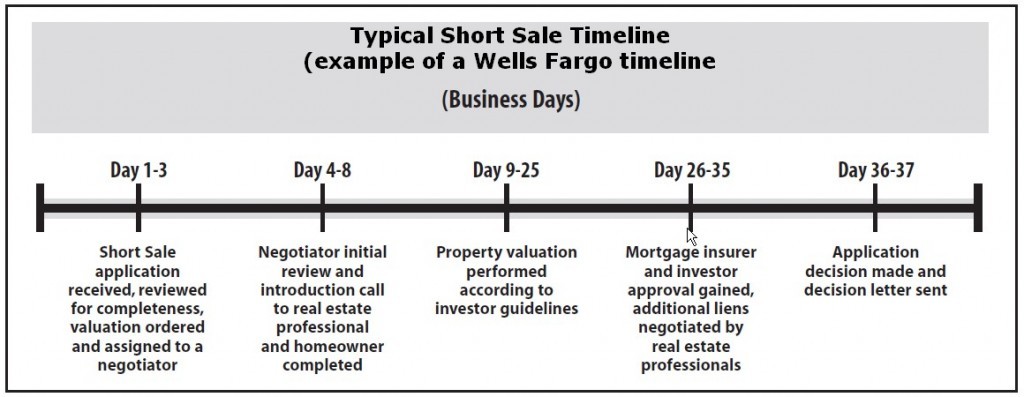

Recently, I have had numerous questions about the life of a short sale, or, more specifically, requests for a short sale timeline. The underlying question is How long does a short sale take? The answer is complicated but, on average, the process usually takes 4-5 months.

sdshortsaleattorney.com/how-do-i-find-a-realtor-for-a-short-sale/.

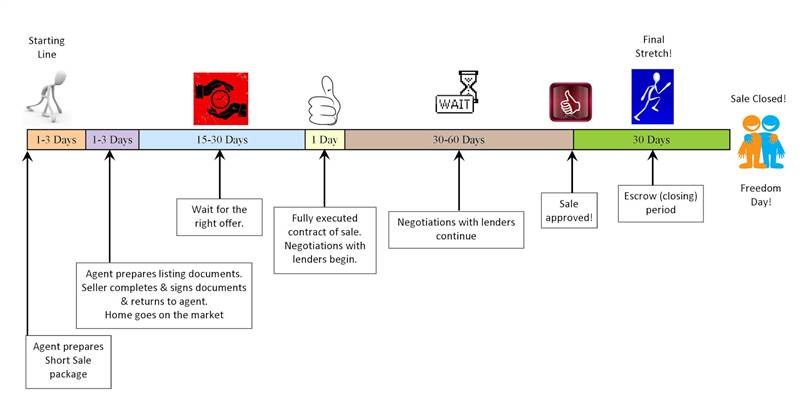

The short sale timeline has 4 stages. The first stage is Marketing Stage. During this stage a homeowner will secure the services of real estate professional to market their property and obtain an offer from a qualified buyer. The length of time needed for the Marketing Stage depends on the market. There is no doubt that a homeowner will receive offers from investors attempting to get the homeowner to accept a low ball offer significantly below the fair market value of the property. These offers should be avoided unless absolutely necessary as the lender is surely going to question whether the low ball offer is representative of the fair market value of the property. A prudent real estate agent will hold off advising his client to accept such an offer and, instead, continue marketing the property in an effort to obtain a closer to market value offer. However, that could take a little bit of time because finding qualified buyers in a depressed market can be difficult. Plus, many of the buyers in todays market are FHA and VA buyers. FHA and VA Buyers can present a challenge to homes that are not in acceptable condition. When a FHA or VA buyer attempts to buy a home an appraisal has to be done and the appraiser needs to make sure that the house meets the FHA and VA criteria. If not, then repairs must be done in order for the lender to grant the loan. Most of the time Sellers attempting a short sale either do not have the funds available to repair their property so that the property meets FHA and VA standards or the homeowner does not have the desire to throw any more money into something when they are getting nothing out of it. VA loans also have an issue related to NON-ALLOWABLE VA expenses that the buyer is prohibited from paying. This prohibition against fees that are allowable to FHA and conventional loans means that the net recovery to the lender with a VA buyer will be less than the same buyer obtaining a FHA loan. I am not advocating that sellers steer away from VA loans but a real estate agent needs to be aware of this nuance when helping a homeowner decide which offer to accept. With that being said, I have been successful numerous times with short sales and VA buyers. All of this is relevant because it demonstrates that the marketing phase is complex and could take some time. I would say that the normal marketing time for a short sale from signing of the listing agreement until an offer is accepted by the homeowner to be around 30-60 days. Of course a homeowner might receive an acceptable offer 2 days after listing the property but, in general, 30-60 days is a good estimate. For the sake of overall time expectations I am going to use 30 days as a representation of the time period for the Marketing Stage.