Short Sale Basics

Post on: 20 Июль, 2015 No Comment

Posted about 3 years ago. 1 helpful vote

Buying a home is one of the most significant purchases a person will make. The enjoyments of owning a home go a long way. However, it can also be a hardship if making the monthly mortgage payment becomes a burden. Making monthly payments can cause great stress, and before a person realizes it, the home may have to be sold.

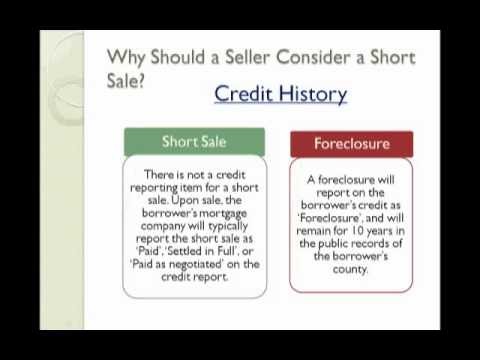

In situations where a home must be relinquished, a short sale may actually be a positive option. In a short sale, the mortgage on the home exceeds the selling price. Although this is not the most desirable outcome, it is preferable over foreclosure or other potential outcomes. The bank determines whether or not a short sale will take place. If the bank will benefit from the procedure, it is likely that a short sale will commence. For that reason, it is entirely up to the bank whether or not a particular home will go into foreclosure or be sold in a short sale. When a homeowner can no longer make the house payments, it may be wise to secure a real estate agent who is experienced in working short sales. It is important for the agent to price the home appropriately. If the amount is too high, the bank will refuse to buy the home.

A bank or lending institution may agree to a short sale for various reasons. Banks do not want to acquire a poor reputation for faulty loans, which is perhaps the primary reason for why they agree to short sales. They may determine that losing money in the process is more desirable than losing a reputation. Another reason a bank or lending institution may agree to a short sale is to avoid an auction. Auctions have other hidden costs which add up and end up costing the bank more in the long run. The bank must take these and other factors into consideration when being faced with a potential short sale. Short sales are more common for houses that require an extensive amount of restoration. A house that is in good condition will usually be more appealing to a potential buyer than one that is broken-down.

The short sale process generally follows a basic outline. The property must be valued to determine how much it is worth. After that, the homeowner and lending institution or bank must communicate so that the lending institution receives the short sale request. The homeowner must then write a hardship letter—a letter which convinces the lender that the home must either be sold on a short sale or go into foreclosure. This letter is followed by a short sale package, which must be approved by the lender.

Additional Resources

www.foreclosurelawyersarasotafl.com/Contact-Us.aspx>contact a Sarasota short sale attorney from their firm today for more information.