Sharp Ratio

Post on: 16 Март, 2015 No Comment

‘P ast investment performance is not an indicator of future investment results’ is a required, responsible, and absolutely true investing footnote; an investing fact that anyone who has spent more than a nanosecond in the financial markets would or should know; an investing law designed to protect the investing naive, innocent, and unsuspecting.

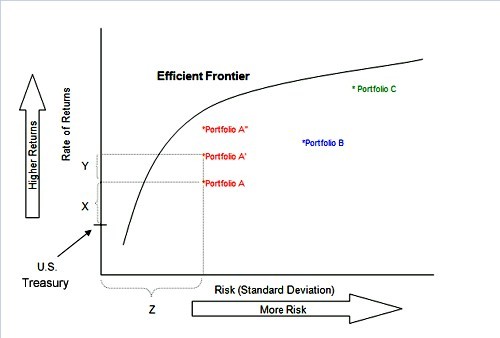

T hen why would one blindly place his/her trust in the present and his/her hope for the future in a mythical investing science — Modern Portfolio Theory and all of its illegitimate relatives such as Monte Carlo Analysis, Efficient Frontier Analysis, Beta, Brinson’s Asset Allocation, Pie Charts, and a distant relative, Technical Analysis (worth a glance) — that relies solely on past performance investment data to feed hypothetical and contrived investing algorithms in a misguided effort to predict future investment results?

A ll are just other ways to record and to illustrate investment history without valid analytical, interpretive, deductive, predictive, or directional investment value.

Y et knowing that past performance is not an indicator of future investment results, most investment advisors, money managers, and individual investors build their investment advising and investing performance cases by defiantly applying flawed past performance investing concepts — such as Modern Portfolio Theory, Monte Carlo Analysis, Efficient Frontier Analysis, Alpha, Beta, Standard Deviation, VaR, Sharpe Ratio, and Investing Technical Analysis:

Because little or no investing judgment or skill is required; just scan, sort, pick, retrieve, view, print, present, and hope that the investing past will somehow become the investing future.

By stubbornly using investing software tools that base all calculations, conclusions, and projections on past investment performance data; performance more by chance than by design.

I f this investing nonsense were valid, there would be no need for investing analytics, forecasting, or guidance of any kind — research, analysis, opinion, advisors — and one would simply select investments based on past performance without regard to suitability, quality, structure, or risk.

E xplained another way, a thermometer measures temperature in degrees as the weather changes.

A thermometer is a recording device not a forecasting one and, therefore, it cannot be used to predict future temperature levels.

S tandard Deviation, Efficient Frontier, Beta, VaR, and Sharpe Ratio are much like a thermometer; merely means to measure past (contrived) relative investment performances between investment variables and neither the cause of nor the predictor of either.

F urthermore, if a thermometer also happened to store prior temperature readings on a daily basis, you certainly would not retrieve that information and use it to predict tomorrow’s or next week’s temperature readings.

A s one would have to analyze the weather-changing causal variables that affect weather, such as humidity and barometric pressure, to predict future temperature levels.

T he same holds true for historical Standard Deviation, Efficient Frontier, Beta, VaR, and Sharpe Ratio readings as a basis for predicting the investing future.

F uture investment values and associated investment/investing risks can only be meaningfully understood and predicted based on one’s correct understanding and interpretation of the fundamental performance changing, causal investment performance variables that actually affect an equity’s behavior.

K eep in mind, there is no theory — modern or otherwise — that can be ordained, no computer that can be programmed, no software that can be designed, no investing tool that can be ‘imagineered,’ no technical analysis voodoo methodology that can be contrived, and no equation that can be divined to quantify, evaluate, and predict the primary forces that drive the sublime chaos of the financial markets and investment prices; human consensus, mood, and behavior; intelligent and not, knowledgeable and not, reasoned and not, rational and not, and logical and not.