Selling Rental Real Estate at a Loss TurboTax Tax Tips & Videos

Post on: 7 Сентябрь, 2016 No Comment

Updated for Tax Year 2014

OVERVIEW

You may own rental real estate that you need to sell at a loss. To help ease the pain, losses from selling rental properties generally receive favorable tax treatment.

For only $79.99 $54.99 *

First make sure you actually have a tax loss

The recent housing slump has reduced the value of most every form of real estate. You might be looking at loss if you have to sell a rental home any time soon. To determine if you have a tax gain or loss, you will need to compare the propertys sale price to its tax basis. The tax basis is generally your original purchase price, plus the cost of improvements (not counting expenses youve deducted as repairs and maintenance), minus any depreciation deductions you claimed while you owned it.

Be careful if you acquired the property in a tax-deferred Section 1031 like-kind exchange where you swapped another property for the one youre thinking about selling. With a 1031 exchange, you defer paying the tax on a gain from selling one property by exchanging it for another property. The gain that you defer reduces the original tax basis in the new property. This can result in a small amount of tax basis in the property that you are trying to sell. The propertys basis may be lower than you think.

Bottom Line: Make sure you know your propertys tax basis before you sell. That way you wont be expecting a loss and instead wind up with a gain that increases your tax bill.

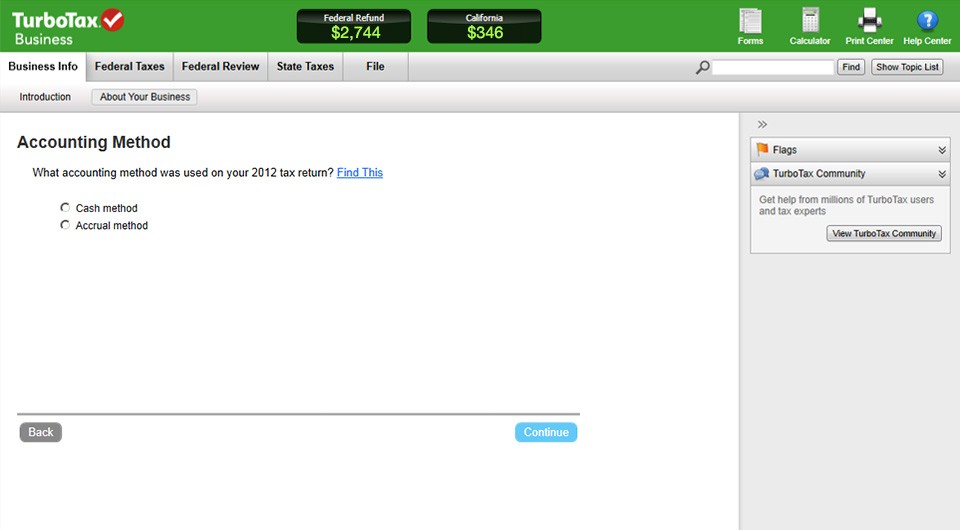

TurboTax can help you track your tax basis for your properties.

If you do have a tax loss, more favorable rules may apply

Lets assume you do expect a tax loss from selling a rental property youve owned for more than a year. That loss will be a Section 1231 losswhich can be a good kind of loss to have. Heres why.

First, Section 1231 losses can be used to reduce any type of income you may have — salary, bonus, self-employment income, capital gains, you name it.

Second, you may have a net operating loss (NOL) if the Section 1231 loss is large enough to reduce your other income below zero. If so, you can carry back the NOL for at least two years and use it to offset taxable income in those years. In doing so, you can recover some or all of the taxes you paid in those previous years by amending those returns.

If any of the NOL is left over after going back two years, you can carry the rest forward into future tax years to offset future income (for up to 20 years). Alternatively, you can choose to not to carry it back and just carry it forward for 20 years.

Deducting passive activity losses

If your rental property has generated losses in past years, you might have suspended passive activity losses (PALs). You can generally deduct these losses only against passive income, which can be from other activities such as rentals or other passive business activities.

Fortunately, you can also deduct suspended PALs when you sell the property that generated them. If you sell a rental property with suspended PALs, you may be able to deduct them on top of deducting any Section 1231 loss from the sale. Like Section 1231 losses, deductible PALs can also create or increase an NOL that you can carry backward or forward.

Converting a personal residence into rental property

Losses from selling a personal residence are not deductible. You can only claim tax losses for sales of property used for business or investment purposes.

However, if you convert a personal residence into a rental property and then sell it for less than the original cost, will you then have a deductible loss? Maybe. The tax basis of the rental property is the lesser of the cost or the value when it is placed in service, plus any improvements, less any depreciation taken. So, if the house declined in value before converting it into a rental property you might not have a tax loss. However, a loss from a decline in value after conversion to a rental, is generally deductible.

As an example, you convert your residence into a rental when the propertys cost basis is $350,000, and its FMV is $250,000. Later, you sell it for $210,000 after claiming $15,000 in depreciation write-offs. For tax loss purposes, your tax basis is $235,000 ($250,000 FMV on conversion date minus $15,000 depreciation = $235,000).

That means you do have a deductible loss, but its limited to $25,000 ($210,000 sale price — $235,000 basis = $25,000 loss).

TurboTax calculates depreciation and helps keep track of your propertys tax basis so that you will know exactly where you stand when you sell your property.