Seller Disclosures to Buyers Required in California

Post on: 2 Июль, 2015 No Comment

Seller Disclosures to Buyers Required in California

Sellers must disclose to buyers in California all material facts about the property that might impact the buyer whether or not to make the purchase.

See the seller disclosure obligations as presented by the California Department of Real Estate.

It’s the sellers obligation to disclose all material facts and issues to buyers, including possible water leaks and roof problems.

Its the buyer’s responsibility to become completely aware of possible issues and problems before completing the purchase.

What is a disclosure?

Disclosure statements come in a variety of forms and are the buyer’s opportunity to learn as much as they can about the property and the seller’s experience with that.

Potential seller disclosures would include such things as leaky windows, noisy neighbors, major major construction, possible noise from motor vehicles and airplanes, or building development projects nearby.

Disclosure documents serve to inform buyers and can protect the sellers from future legal action. It is the seller’s chance to lay out all material facts, anything that can negatively impact the property value, usefulness or enjoyment of the property.

How does a seller make such disclosures to the buyer?

California has some of the most strict seller disclosure requirements. Home sellers must complete or sign off on lots of documents, including a Natural Hazards Disclosure Statement, Lead Based Paint Disclosure, Advisories about Market Conditions and Megan’s Law Disclosures.

Seller must disclose each material fact about the property and not try and diagnose the problems. If you are a seller and know information about the property, disclose it.

Disclosure usually comes in the form of boilerplate documents (put together by the California Association of Realtors ), where the seller is responsible for answering a series of yes/no questions detailing their home and their experience there.

In addition to the standard documents a seller is required to complete, if there is any written or verbal communication regarding something negative about the property, that must also be disclosed to the buyerWhat do sellers typically disclose to potential buyers?

The work and upgrades sellers have done to their property are a common disclosure, whether the work was done with or without permits. If done with permits, buyers are advised to cross check the seller’s disclosure with the city building permit report. Doing work without the city signing off with a permit is a key disclosure. If the work was not approved by the city, it may not have been performed to code and may cause a fire or health hazard. Buyers should independently investigate any non-permit work that was done.

Other common disclosures include the existence of pets, termite problems, neighborhood nuisances, any history of property line disputes, and defects or malfunctions with major systems or appliances. Disclosures could include whether seller is involved in bankruptcy proceedings and whether there any liens on the property.

Failure to disclose can result in a messy conflict with the buyer after the sale.

Seller Disclosure is not the same as Buyer Inspection

Disclosure is something given to the buyer by the seller documenting their knowledge of the property and is not the same thing as an inspection.

Buyer property inspection should always be done by the buyer while in escrow. The inspector will check the property out from top to bottom, many times verifying what the seller has disclosed but sometimes bringing to light new issues.

When does the buyer receive a seller’s disclosure statements?

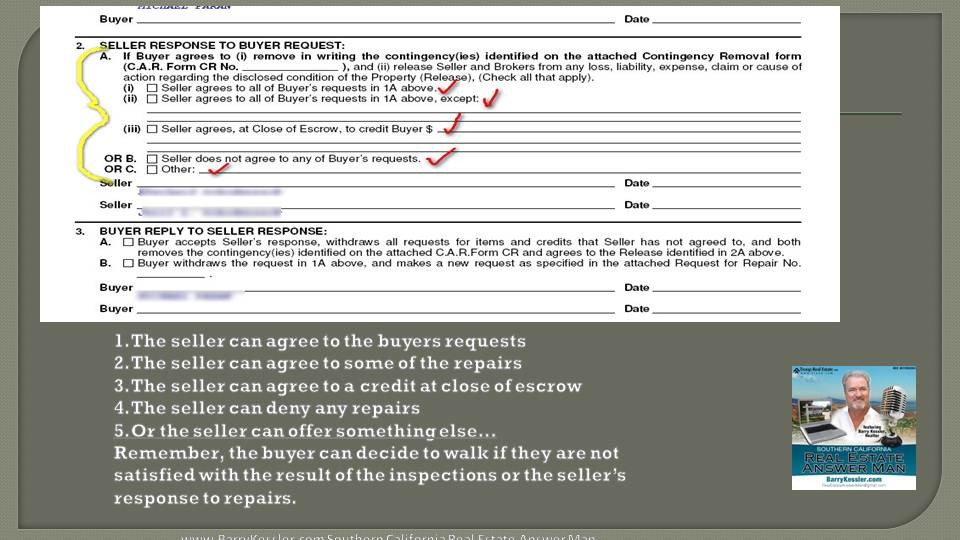

Disclosure documents are provided to buyers once the seller has accepted their offer. In addition to their inspections or loan contingency, the buyer has an opportunity to review the seller’s disclosures. If the buyer discovers something negative about the property through disclosure, he can usually back out of the offer without losing his escrow deposit.

In some markets, sellers provide these disclosures to the buyers even before they receive an offer. Some sellers prefer to have buyers know everything they need to know up front. This is also smart because it saves everyone time, hassle and expense by preventing deals from falling apart once they’re in escrow.

Buyers are required to sign off on disclosure documents and reports. So it’s important to review them carefully and ask questions if you need to.

Full Disclosure of all material facts is the Only Way to Go for Sellers

Providing full disclosure can help a seller. Realtors like to see a comprehensive set of disclosure documents, which shows that the seller is thorough and upfront. This will probably help the buyers have all essential information and peace of mind about the purchase.

_________________________________

This is for information only and is not the providing of legal or tax services. If you are a property seller, you should work with your Realtor agent and disclose all material facts about the property that might impact its value to the buyer.