Security market line Wikipedia the free encyclopedia

Post on: 5 Апрель, 2015 No Comment

Contents

Formula [ edit ]

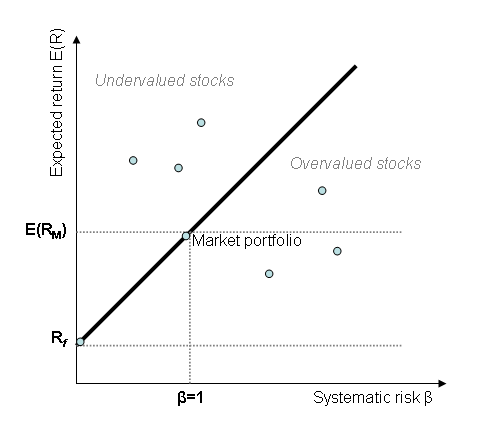

The Y-intercept of the SML is equal to the risk-free interest rate. The slope of the SML is equal to the market risk premium and reflects the risk return trade off at a given time:

where:

E(R i ) is an expected return on security E(R M ) is an expected return on market portfolio M β is a nondiversifiable or systematic risk RM is a market risk Rf is a risk-free rate

When used in portfolio management. the SML represents the investment’s opportunity cost (investing in a combination of the market portfolio and the risk-free asset). All the correctly priced securities are plotted on the SML. The assets above the line are undervalued because for a given amount of risk (beta), they yield a higher return. The assets below the line are overvalued because for a given amount of risk, they yield a lower return. [ 2 ]

There is a question about what the SML looks like when beta is negative. A rational investor will accept these assets even though they yield sub-risk-free returns, because they will provide recession insurance as part of a well-diversified portfolio. Therefore, the SML continues in a straight line whether beta is positive or negative. [ 3 ] A different way of thinking about this is that the absolute value of beta represents the amount of risk associated with the asset, while the sign explains when the risk occurs. [ 4 ]

Security Market Line, Treynor ratio and Alpha [ edit ]

All of the portfolios on the SML have the same Treynor ratio as does the market portfolio, i.e.

In fact, the slope of the SML is the Treynor ratio of the market portfolio since .

A stock picking rule of thumb for assets with positive beta is to buy if the Treynor ratio will be above the SML and sell if it will be below (see figure above). Indeed, from the efficient market hypothesis. it follows that we cannot beat the market. Therefore, all assets should have a Treynor ratio less than or equal to that of the market. In consequence, if there is an asset whose Treynor ratio will be bigger than the market’s then this asset gives more return for unity of systematic risk (i.e. beta), which contradicts the efficient market hypothesis .

This abnormal extra return above the market’s return at a given level of risk is what is called the alpha .

See also [ edit ]

References [ edit ]

- ^ Security Market Line ^ Investopedia explains Security Market Line — SML ^ Berk, DeMarzo, Stangeland (2012). Corporate Finance, Second Canadian Edition. Pearson Canada. p. 390. ISBN  978-0-321-70872-4.   ^ Geurts and Pavlov, Calculating the Cost of Capital for REITs: A Classroom Explanation. Real Estate Review 34 (Fall 2006).