Securitized Mortgages and Loan Fraud

Post on: 10 Июнь, 2015 No Comment

Reinhart’s Securitized Mortgage and Loan Fraud Team assembles lawyers to address the needs of clients who participate in the origination, transfer, insurance, securitization, funding and collection of mortgage loans. This industry has seen a recent upsurge in litigation in connection with the recent subprime credit crisis. Reinhart lawyers working on this team have the requisite experience to gain successful results for the firm’s clients in this area.

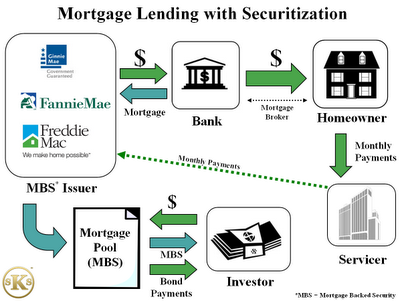

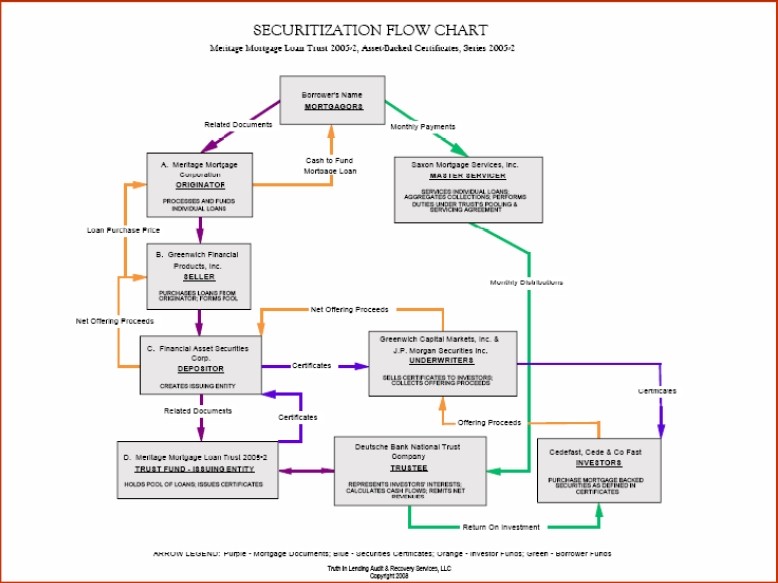

This team includes lawyers with backgrounds in complex financial litigation, banking, mortgage fraud, real estate lending, class actions, securities law, white collar crime, and bankruptcy. The team is prepared to assist clients in disputes concerning loan pools sold on the secondary market, especially those securitized as bond offerings. The team also represents clients in civil and criminal cases involving allegations of loan fraud, both on individual loans and pools of loans. The team members are experienced in representing the professional advisors, including auditors and bond issuers involved in securitized loan pool offerings. Team members have considerable experience in borrower claims of TILA and RESPA violations. Finally, team members are experienced in disputes concerning warehouse lines of credit and the issuance of good funds to the settlement agent.

Some examples of relevant matters we have handled:

Representing bank in bringing series of claims against mortgage brokers making subprime loans for fraud and misrepresentation in loan origination process

Representing investment advisory firm sued along with investment manager by trustees alleging that investment manager and advisory firm had violated investment guidelines of trust by investing in collateralized mortgage obligations

Represented major institutional investor which purchased interest in pool of mortgage-backed loans to convenience stores in evaluating claims against loan originator and investment banks

Representing lenders in defending against borrower allegations of TILA and RESPA violations and advising lenders on TILA and RESPA compliance

Representing lenders in resolving numerous collateral disputes caused by loan fraud, including phony appraisals, silent second mortgages, stolen identities, alleged equity skimming and related fraudulent activities

Defending lender liability actions

Representing international financial institution in consumer class action relating to mortgage electronic registration system fees

Represented bank in class action seeking recovery for failure to pay interest on money escrowed under mortgage agreements

Representing financial institution which asserts that originator of credit card portfolio made misrepresentations about credit quality in sale of the portfolio

Represented regional bank in action brought by consumer alleging breach of fiduciary duty and conversion in extensions of credit backed by residential mortgage

Represented parties in mortgage loan funding disputes and issues concerning warehouse lines of credit to mortgage bankers, and disputes concerning good funds and wet funding (a team member drafted Wisconsin’s good funds law)