Scalping and Patience The Psychology of Scalping

Post on: 16 Март, 2015 No Comment

You can opt-out at any time.

Please refer to our privacy policy for contact information.

Scalping is one of the trading styles (i.e. scalping, day, swing, and position trading) and is specifically the shortest tem trading style (i.e. scalping makes the trades that are active for the least amount of time), but in all other respects scalping is no different from the other trading styles.

One of the perceived differences between scalping and the longer term trading styles is the amount of time between trades. Scalping is often (and incorrectly) assumed to make many trades very quickly, but the reality is that scalping often requires waiting just as long as day trading, sometimes as long as swing trading, and theoretically even as long as position trading.

Scalping Myth

One of the reasons that new traders are often attracted to scalping is the popular belief that scalping makes many small trades in rapid succession, with very little time spent without an active trade. As a result, many new traders approach scalping with an expectation of making a lot of trades very quickly (not to mention the expectation of making a lot of profit very quickly), and consequently they perform their scalping incorrectly.

Scalping is the shortest term trading style, and therefore does tend to make smaller trades (i.e. trades with smaller targets and stop losses), but the frequency of the trades does not necessarily increase accordingly.

Scalping Requires Patience

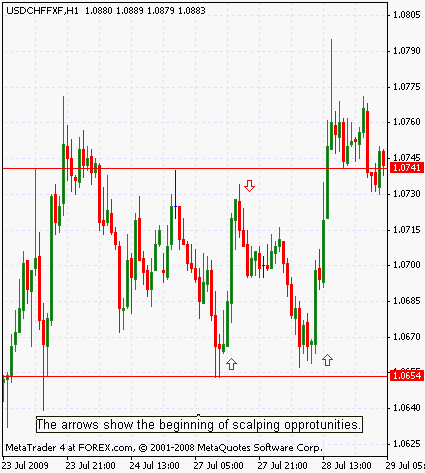

Scalping therefore requires a lot more patience than many new traders expect or are prepared for. Scalping definitely requires as much patience as day trading, sometimes requires as much patience as swing trading, and in theory could require as much patience as position trading (i.e. waiting weeks for the next trade). Professional scalpers will wait as long as necessary for their next trade, even if that means waiting several days for a trade that then lasts only five minutes.

Any lack of trading when scalping can theoretically be offset by trading additional markets (e.g. where a day trader might trade a couple of markets, a scalper might trade several markets), as the additional markets could provide additional trades (assuming that the markets are different enough), but trading many markets is not a requirement of scalping, and there are some very successful (and very patient) professional scalpers who only trade a few markets.