S REIT found a safe harbor in mortgagebacked securities

Post on: 7 Июнь, 2015 No Comment

St. Anthony: REIT found a safe harbor in mortgage-backed securities

Two Harbors Investment Corp. continues to offer a safe harbor for investors rebounding from the 2008-10 tsunami known as the mortgage-backed securities market.

Two Harbors is a publicly traded REIT, or real estate investment trust, that started buying government-backed and riskier private mortgage pools when those securities were trading at huge discounts after the housing bust.

So far Two Harbors seems to have successfully managed timing, growth and profitability in this treacherous market since 2010.

CEO Tom Siering said the other day: We want to be recognized as the industry-leading hybrid-mortgage real estate investment trust.

During the Bush administration, the mortgage peddlers and Wall Street financiers and government-backed, secondary-market players such as Fannie Mae and Freddie Mac had all-but-abandoned solid underwriting and eventually flooded the pipeline with so much bad paper that it choked the global financial system.

That prompted the controversial 2008-09 federal bailout of the too-big-to-fail banks.

In the past two years, Two Harbors, created by the veteran mortgage investment team at Minnetonka -based Pine River Capital, has raised nearly $2 billion in public capital that has enabled it build a nearly $10 billion portfolio of government- and non-government-backed mortgages valued at about $2.2 billion recently.

The shares, which traded last week at around $10.75, are up a couple of bucks over the past six months.

Net income has gone from a small loss in the start-up year of 2009 to about $125 million in 2011. The company is required as a REIT to pay out most of its profit to shareholders.

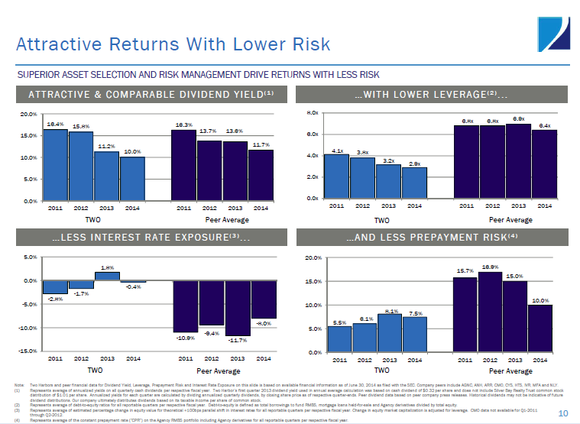

The company pays a dividend that yields about 15 percent. And Siering, who got his start at Cargill Financial more than 30 years ago, said initial shareholders had earned a total return of 33 percent since operations commenced in October 2009.

Thirty months does not amount to a long track record. But these guys are off to a great start. And their success underscores how cool operators were able to make money as strapped sellers had to sacrifice their winners as well as their losers in their panicked exit from the market.

Siering, in a recent interview and according to company disclosures released last week, contends there should be money to be made in the mortgage-backed securities market for a while. That’s because:

Fannie Mae and Freddie Mac are shrinking their $1 trillion-plus portfolios by about 10 percent annually, lessening competition.

Low interest rates promised by the Federal Reserve for the next couple of years mean bond pickers don’t have to worry too much about rate hikes devaluing their holdings.

Two Harbors, which has proved an adept strategist so far, plans to start buying single-family homes in depressed markets, rent them and hold on to the properties until they can sell as prices rebound.

Two Harbors actually has no employees. Its operations are run by Pine River, which employs 208 in Minnetonka and New York City.

Pine River is paid a management fee of 1.5 percent of stockholders’ equity annually. That has risen from $2.9 million in 2010 to $14.2 million in 2011.

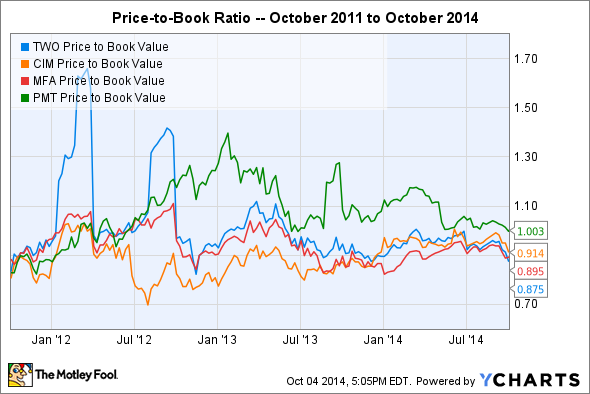

Two Harbors’ co-chief investment officers are Steve Kuhn, a former Goldman Sachs portfolio manager who also once worked at Cargill Financial, and Bill Roth, a 30-year Wall Street bond-fund manager. The firm, thanks to market timing, investment prowess and what it calls first-rate technology and analytical tools, has been a top-tier rated REIT since it launched.

As confidence in the sector returns, there will be more such funds. And, as they say in the investment world, past performance is no guarantee of future returns.

Neal St. Anthony 612-673-7144 nstanthony@startribune.com