S Corp FAQ How are S corporation dividends taxed

Post on: 19 Май, 2015 No Comment

This question is a really good one.

But to understand how S corporation dividends are taxed you first need to understand both what S corporation dividends are and what S corporation distributions are.

Dividends versus Distributions

Let us start by pointing out that, in general, the money that an S corporation pays to its shareholders isn’t called a dividend.

Regular corporations, also known as C corporations, pay dividends. And those dividends are taxed.

But S corporations, in general, pay distributions.

The Usual Rule: Distributions Don’t Get Taxed

In general the distributions paid by an S corporation to the S corporation shareholders are not taxable to the shareholders.

In other words, if you’re an S corporation shareholder and you receive a $100,000 distribution check from an S corporation in which you own shares, you generally are not taxed on the $100,000.

Upon hearing this, some people become confused and say, Well, that’s crazy. does that mean that I don’t pay taxes on S corporation profits?

The answer to this related question is no.

As a shareholder, you pay taxes on your proportionate share of the S corporation’s profits. For example, if you and a buddy equally own an S corporation and the S corporation makes $250,000, you will each need to pay the income taxes on your $125,000 shares of the S corporation’s profits.

Note that it won’t matter whether or not this money is retained by the corporation. Even if the corporation keeps the profits, you will still be taxed on the profits.

The Exceptions to the Rule

Okay, so what we’ve described in the preceding paragraphs is the general rule. But note that two common exceptions exist to the general rule:

Exception #1: If an S corporation used to be a regular C corporation and the corporation retained some of its profits from the C corporation years and the corporation while an S corporation pays some of those old C corporation profits out to shareholders, that payment is a dividend. And that dividend (because it’s paid out of the C corporation’s old profits) is taxed to the shareholders. Under current tax law, the dividend is taxed at a preferential qualified dividends rate, which is 15% or less.

Exception #2: If an S corporation shareholder receives a distribution that exceeds his or her basis in the S corporation, the in-excess-of-basis distribution gets treated as a long-term capital gain and, therefore, may be taxed. This business about a distribution in excess of basis gets tricky. But as a generalization, S corporations and their shareholders get into this situation when they retain very little of their profits inside the corporation and instead borrow money for items like fixtures and equipment. In effect, in this situation, and often without realizing it, the S corporation borrows money from someone like the bank and then directly or indirectly uses this borrowed money to pay distributions to shareholders.

Additional Information You May Find Useful

If you want additional information about how to maximize the tax savings related to running a business or investment venture, you may also be interested in one of our downloadable e-books (see descriptions below). Each book covers a category of tax planning topics that easily save a business owner significant amounts of income or self-employment taxes (potentially thousands of dollars a year) and is instantly downloadable.

One of the most powerful tactics for saving small business taxes is maximizing your deductions. You can literally save thousands in taxes each year.

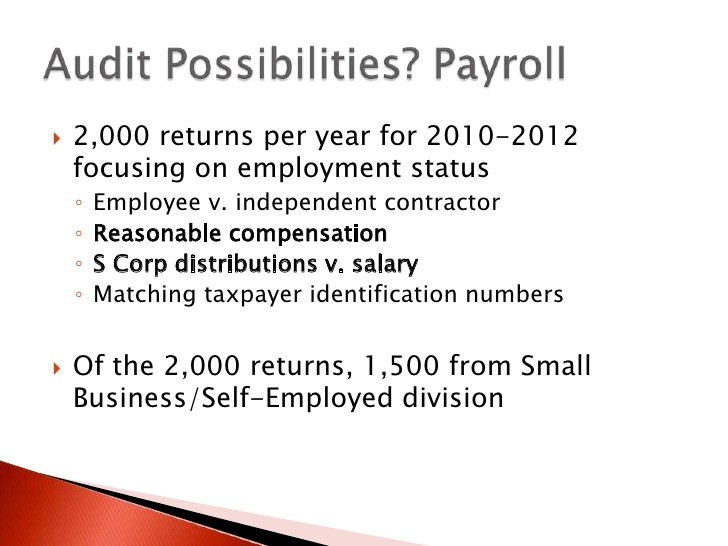

Using an S corporation for your business? To maximize savings, you need to minimize the salary paid to shareholders. But this decision is tricky.

Tax laws provide active real estate investors with giant tax planning loopholes. A little upfront planning on your part could save you thousands a year.