RRSP and TFSA Strategies You Can Take to the Bank

Post on: 16 Март, 2015 No Comment

It’s that time of the year again RRSP Season. Canadians will be lining up at the bank to either contribute to their RRSP (Registered Retirement Savings Plan), or borrowing for an RRSP loan. For most Canadians, that net benefit will be a tax-refund. What many Canadians don’t realize however, is the refund from contributing to their RRSP is not a gift. It has to be paid back later with taxes. That’s because any money withdrawn from your RRSP is considered income and is fully taxable. This makes the RRSP nothing more than a tax-deferral plan.

Any money withdrawn from your RRSP (or RRIF) is considered income and is fully taxable. This makes the RRSP nothing more than a tax-deferral plan.

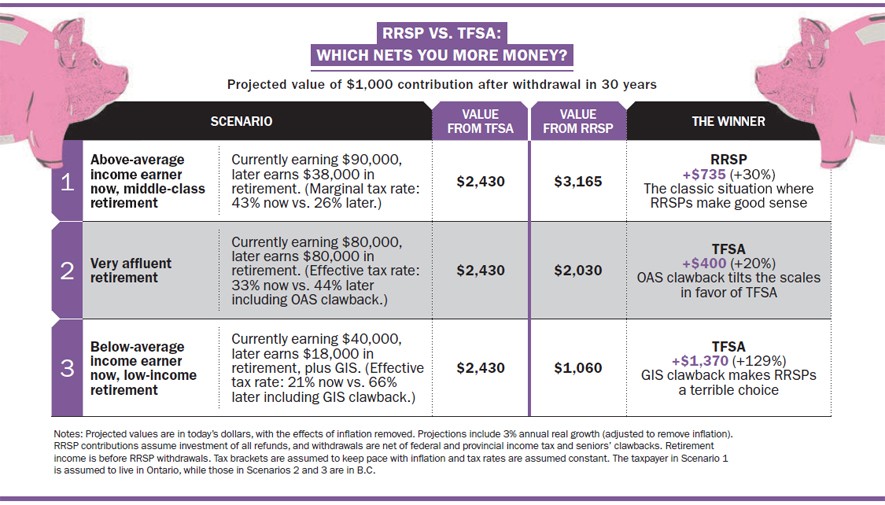

Many high-income Canadians can get a net-benefit from contributing to their RRSP, especially if it places them in a lower tax bracket. However for most Canadians, maximizing their TFSA (Tax Free Savings Account) makes more sense. The key is to avoid looking at the short-term refund, and treat your TFSA and RRSP as an overall financial plan. If you can’t contribute to both, then which one makes the most sense for you? In most cases the TFSA will be the clear winner.

RRSP Income in Retirement

Before January 1st 2009, the TFSA wasn’t even a consideration. The RRSP was the only game in town for Canadians to shelter investment income and reduce taxes. For those with modest incomes, the RRSP was a chance to be able to save for retirement, and get the benefit of a tax refund. For high income earners, the RRSP presented an opportunity to lower their tax rate through contributions. Most Canadians, regardless of income, viewed withdrawing from their RRSP (or RRIF) as something they could worry about later in retirement.

There was also an adage in the financial planning industry, that it was OK to maximize your RRSP, because in retirement you would be in a lower tax bracket. To a degree that is true. However, many Canadians who earn a high income also tend to have a pension plan through their employer. As with RRSP withdrawals, these Registered Pension Plan (RPP) withdrawals are also considered income, and are fully taxable when withdrawn. Including government benefits, private or public pensions, as well as investment income could provide for a significant income.

Contributing to your RRSP now, might in fact be an extra tax burden in retirement. Remember, you will be taxed on all those future years of income and compound growth of that RRSP contribution, not just the initial amount.

Here are three RRSP and TFSA strategies you can take to the bank, which will help you pay less tax in retirement:

Optimize Your RRSP

Optimizing your RRSP is a strategy I first came across at myownadvisor.ca, although the strategy has been around for a long time. Mark discussed the idea of only contributing enough to your RRSP to offset any additional taxes payable. His post was titled, Why we optimize, do not maximize our RRSPs .

The first thing to do is determine if you actually have any tax payable. Downloading software such as TurboTax, allows you to quickly asses all your tax receipts, and check if you have any tax owing. You can then test various contributions with the software, to see how much you actually need to contribute if any. Optimizing your RRSP means only contributing what you need in order to offset taxes payable.

Maximize Your Refund

Another strategy is to maximize your refund with a small RRSP Loan. The Passive Income Earner recently discussed this strategy in, Weekly blog round: RRSP Planning (although he called it optimizing). Again you’ll want to download some tax software so you can play around with the numbers.

The idea is to basically borrow the amount of your refund for an RRSP loan, thereby increasing your RRSP contribution. Then most importantly, use the entire refund to pay down your short-term RRSP loan. For example, if you have a $1000 refund and you are in a 40% tax bracket, then borrowing an extra $1500 will result in an additional $600 towards your tax refund. Your total refund now comes to around $1600 and will pay off the short-term RRSP loan. Youve also managed to contribute an additional $1500 towards your retirement although youll also pay tax on it later.

This is a much better route than taking out an RRSP loan for an extended period of time, and paying additional loan interest. The idea is to make a short-term RRSP loan, boost the tax refund, and pay back the loan as quickly as possible.

Maximize Your TFSA

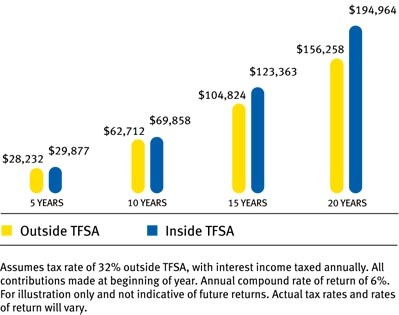

The TFSA is the ideal retirement vehicle, because there are no taxes payable when money is withdrawn. Your investments and income also benefit from tax-free growth.

One strategy is simply not to contribute to your RRSP at all and maximize your TFSA. This allows you to build up a small retirement nest-egg, without having to pay tax on future withdrawals. If you are not expecting much of a refund in the first place and don’t need to optimize your RRSP, then this might be the better route to go.

I have a pretty simplistic view of the TFSA, and I think everyone should contribute, regardless of income. As I wrote two years ago in January 2011, Max Out Your TFSA, and Forget the RRSP! The concept is pretty simple. Although you don’t get a refund for contributing to the TFSA, you don’t have to pay any taxes when you later make withdrawals. As well, all the income and gains in your TFSA compound tax-free.

For 2013, you are allowed to contribute a maximum of $25,500 to your TFSA. That’s $5,000 per year from 2009 to 2012, and $5,500 for 2013. I think everyone should contribute and max out their TFSA regardless of their income. For most Canadians maximizing 5K per year will be a struggle, and for some Canadians the 25K will be a nominal investment. However each year, the allowable room is increasing by $5,500. Sadly, according to Garth Turner in his recent post, the gift . only 4 in 10 Canadians even have a TFSA. Garth writes,

Despite being able to shelter all this money from any kind of tax, most don’t. Only four in ten people have a TFSA, even five years after it was created. Of those only half actually contribute to them.

Readers what’s your take? Are you investing in the TFSA, RRSP, or both? What’s Your RRSP strategy for 2013?

Disclaimer. Tax and investment planning is beyond the scope of this blog, nor am I a certified financial planner. I suggest everyone at some point should sit down with a certified financial planner, their accountant, or estate and tax expert, and make a long term financial plan. The TFSA and RRSP are only part of the plan.