Roth IRA Starter Guide

Post on: 16 Март, 2015 No Comment

Share

Introduction

If you’ve come to this guide because you’re ready to begin investing for retirement, take a moment to appreciate how far you’ve come. If you’re following Dave’s seven Baby Steps, you’re now on Baby Step 4. You’ve eliminated your debt and built an emergency fund that will provide for your family for up to six months. That alone makes you unique in a nation where most families live paycheck to paycheck.

You’re ready to enter an exciting new phase of wealth building. The path you’ll take going forward will look familiar. You’ll still need a good plan and lots of discipline. But you’re no longer concerned with the mistakes of the past. You’re building for the future!

While this is a big step for you, fortunately it’s an easy one to take. Retirement investing has a reputation for being incredibly complicated and intimidating. But the good news is the process is actually simple and the tools are readily available.

The Roth IRA (Individual Retirement Account) is a key player in any retirement plan thanks to built-in tax benefits that actually increase the value of your savings compared to traditional investment accounts. And opening a Roth IRA is as simple as opening a checking account.

But first, let’s talk about why you need a Roth IRA as part of your retirement plan. No complicated investor-speak, we promise!

How a Roth IRA

Turbocharges Your Retirement

A Roth IRA is a type of account that allows the money you invest for retirement to grow tax-free. When you retire, the withdrawals you make from your Roth IRA are also tax free.

You probably already know that the Roth IRA is not the only type of retirement plan that offers special tax treatment. The 401(k), for example, allows your savings to grow tax deferred. That means you don’t pay taxes on the money in your 401(k) until you withdraw it.

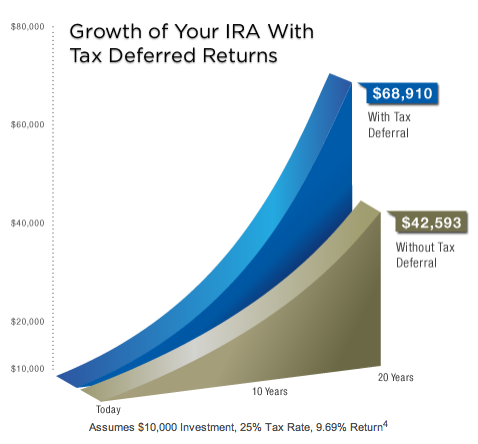

But the 401(k)’s tax deferral is not as powerful as the Roth’s tax-free feature. The benefits of tax-free withdrawals are clear in a side-by-side comparison.

Even though the same amount of money went into each of these accounts, and each one grew at the same rate, the tax-free account is worth far more than the taxable or tax-deferred accounts when it comes time to actually use the money.

An important note

The 401(k) is still a valuable retirement savings tool if your employer matches your contributions. When you’re ready to start investing for retirement, you should actually start with your 401(k) and invest up to the employer match. Then max out your Roth IRA contribution until you are investing 15% of your income between the two accounts.