Reverse Engineering Google’s Innovation Machine

Post on: 7 Июль, 2015 No Comment

Loading.

Reprint: R0804C

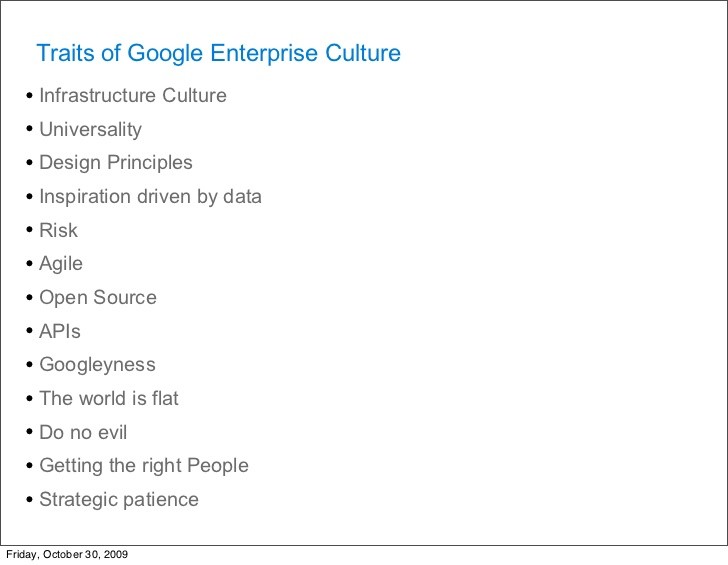

Even among internet companies, Google stands out as an enterprise designed with the explicit goal of succeeding at rapid, profuse innovation. Much of what the company does is rooted in its legendary IT infrastructure, but technology and strategy at Google are inseparable and mutually permeablemaking it hard to say whether technology is the DNA of its strategy or the other way around. Whichever it is, Iyer and Davenport, of Babson College, believe Google may well be the internet-era heir to such companies as General Electric and IBM as an exemplar of management practice.

Google has spent billions of dollars creating its internet-based operating platform and developing proprietary technology that allows the company to rapidly develop and roll out new services of its own or its partners devising. As owner and operator of its innovation ecosystem, Google can control the platforms evolution and claim a disproportionate percentage of the value created within it. Because every transaction is performed through the platform, the company has perfect, continuous awareness of, and access to, the by-product information and is the hub of all germinal revenue streams.

In addition to technology explicitly designed and built for innovation, Google has a well-considered organizational and cultural strategy that helps the company attract the most talented people in the landand keep them working hard. For instance, Google budgets innovation into job descriptions, eliminates friction from development processes, and cultivates a taste for failure and chaos.

While some elements of Googles success as an innovator would be very hard and very costly to emulate, others can be profitably adopted by almost any business.

In the pantheon of internet-based companies, Google stands out as both particularly successful and particularly innovative. Not since Microsoft has a company had so much success so quickly. Google excels at IT and business architecture, experimentation, improvisation, analytical decision making, participative product development, and other relatively unusual forms of innovation. It balances an admittedly chaotic ideation process with a set of rigorous, data-driven methods for evaluating ideas. The company culture attracts the brightest technical talent, and despite its rapid employee growth Google still gets 100 applicants for every open position. It has developed or acquired a wide variety of new offerings to augment the core search product. Its growth, profitability, and shareholder equity are at unparalleled levels. This highly desirable situation may not last forever, but Google has clearly done something right.

Indeed, Google has been the creator or a leading exponent of new approaches to business and management innovation. Much of what the company does is rooted in its legendary IT infrastructure, but technology and strategy at Google are inseparable and mutually permeable—making it hard to say whether technology is the DNA of its strategy or the other way around. Whichever it is, Google seems to embody the decades-old, rarely fulfilled vision of IT pundits that technology should do more than just support the business; it should engender strategic opportunity and be architected with that purpose in mind. As such, Google may well be the internet-era heir to such companies as General Electric and IBM as an exemplar of management practice.

We haven’t spent a lot of time in the Googleplex, and between us we’ve consumed only one of the company’s tasty and free cafeteria meals. One of us impulsively tried to question Sergey Brin in the Googleplex courtyard, but he beat a hasty retreat and came close to calling security. Fortunately, however, the company is quite open (there are scores of official and unofficial blogs accessible through the company’s website, for example), and non-insiders can find countless clues as to how the company approaches innovation. Many of those clues we unearthed, appropriately enough, through Google searches. Based on our years of observing how Google does what it does so well, we have identified a number of key innovation practices that others can profitably adopt. To be sure, some of Google’s attributes—two are its category-killing search engine and a massive, scalable IT infrastructure—would be very hard and very costly to emulate. But others—technology explicitly architected for innovation coupled with a well-considered organizational and cultural strategy—can be applied diligently and successfully by businesses across many industries.

Practice Strategic Patience

Google’s mission “to organize the world’s information and make it universally accessible and useful” is so broad as to be imperial, yet Google clearly takes it seriously. Beyond its core search and advertising capabilities, the company has embarked on ventures involving online productivity, blogging, radio and television advertising, online payments, social networks, mobile phone operating systems, and many more information domains.

What information management tools the company hasn’t developed it has acquired: Picasa for photo management; YouTube for online videos; DoubleClick for web ads; Keyhole for satellite photos (now Google Earth); Urchin for web analytics (now Google Analytics). Google seeks to master not only bits but also electrons: It recently announced an ambitious project to generate low-cost green electricity. While few of these ventures make money today, they are all bricks in the wall of its ambitious strategy, and few doubt Google’s resolve or its ability to make progress toward the ultimate goal. Almost every day the company announces a new product or feature that chips away at information disorganization.

With such a farsighted mission, the short-term profitability of a new offering doesn’t seem to matter as much to Google as it might to other businesses. The company’s managers are strategically patient. CEO Eric Schmidt has estimated that it will take 300 years to achieve the mission of organizing the world’s information. His 1,200-quarter forecast might invite smirking; still, it illustrates Google’s long-term approach to building value and capability. Google, unlike many companies, can afford its broad mission and collection of innovations simply because its search-based advertising is a fantastically profitable product that provides cover for many unprofitable ones. The company certainly cares about accumulating customers, but its executives believe that over time the business model and the money will take care of themselves. At a 2007 Bear Stearns conference, Schmidt put it this way: “Ubiquity first, revenues later….If you can build a sustainable eyeball business, you can always find clever ways to monetize them.”

In other words, not everything will take 300 years. If Google’s expressed mission is to organize the world’s information, it has a somewhat less exalted but equally important unexpressed commercial mission: to monetize consumers’ intentions as revealed by their searches and other online behavior. Search-based advertising is the first highly successful instantiation of this mission.

If the company’s expressed mission is to organize the world’s information, it has a somewhat less exalted but equally important unexpressed commercial mission: to monetize consumers’ intentions.

What makes strategic patience work for Google are the company’s clarity of purpose and attention to detail. Everything Google does extends its reach. It is informational kudzu, always putting down new roots based on the thoroughly internalized principle that information shall be organized by analyzing users’ intentions. Companies aiming to learn from Google must first understand that clear, simple directives underlie the vast infrastructure and ostensible chaos that we’ll describe here.

Exploit an Infrastructure “Built to Build”

Google has spent billions of dollars creating its internet-based operating platform and developing proprietary technology. The investment in infrastructure allows the company to guarantee specified service levels and sub-second response times. It also allows Google to rapidly develop and roll out new services of its own or its partners’ devising. The proprietary technology gives the company unprecedented control over the design and evolution of its infrastructure (and emergent strategy). The main attributes of Google’s infrastructure are these:

Scalability.

While the internet is of course available to every company, Google has made major investments to get more out of it and to construct a proprietary platform that supports new and growing online services. According to unofficial but widely reported statistics, Google owns a network infrastructure consisting of approximately one million computers; these run an operating system that allows new computer clusters to plug in and be globally recognized and instantly available for use. The operating software that performs this magic is a customized version of open source Linux (which itself is built to make it easy for third parties to add features of competitive value).

Another aspect of the infrastructure is that the internet platform is built to scale. For example, when Google needs more data centers, the proprietary operating system makes them easy to add. And the company can move data around the world seamlessly to meet changing user demand. Managing the petabytes of data Google accumulates requires special database-management tools. Because existing commercial systems couldn’t efficiently support such large volumes of data, Google developed a proprietary database called Bigtable, which is tuned to work with Google’s operating system to process growing volumes of data quickly and efficiently.

An accelerated product-development life cycle.

Google’s infrastructure is well suited to executing an entire product-development life cycle rapidly and efficiently. Google engineers prototype new applications on the platform; if any of these begin to get users’ attention, developers can launch beta versions to see whether the company’s vast captive customer base responds enthusiastically. If one of the applications becomes a hit, Google’s enormous “cloud” of computing capability can make room for it. In the process of moving products from the alpha to the beta phase, Google simultaneously tests and markets them to the user community. In fact, testing and marketing are virtually indistinguishable from one another. This creates a unique relationship with consumers, who become an essential part of the development team as new products take shape and grow. Google does more than just alpha and beta test applications—it can host them on its infrastructure. Google’s customers then transition seamlessly from testing to using products as they would any other commercial offering.

Support for third-party development and mashups.

Google created its proprietary infrastructure to be a more efficient and reliable alternative to the internet, ensuring a better user experience and higher quality of service. These purposeful investments in hardware, operating systems, and database management enable the company to exert control from end to end and to enhance such services as Gmail, Maps, AdWords, and the advertising placement system AdSense. When Google creates an application, it pays attention to the way it will fit into the infrastructure. Google Maps was therefore architected as a service so that either the company’s own engineers or those of third parties could use it as a module to enrich additional services.

Indeed, Google’s flexible infrastructure acts as an innovation hub where third parties can share access and create new applications that incorporate elements of Google functionality. These outsiders can easily test and launch applications and have them hosted in the Google world, where there is an enormous target audience—132 million customers globally—and a practically unlimited capacity for customer interactions. This benefits both parties: Google gets its product widely adopted, and its partners can devote their energies to developing product functionality important to their customers. For instance, a real estate company like Zillow.com can focus on getting high-quality data on properties that have been bought and sold, and leave the maps and display elements to Google or Microsoft.

In exactly this way, third parties browsing Google’s infrastructure began creating what are known as mashups—IT applications that combine data and program functionality from more than one external source into an integrated customer experience. For example, Housingmaps.com combines data from Craigslist with Google Maps to create an application that allows users to see apartments for rent or houses for sale plotted on a map of the local area. This notion of allowing useful services to be mixed and matched with relative ease across organizational boundaries has interesting implications for the competitive environment and for organizational efficiency, engendering a “just try it” class of lean innovation. (Technically, it is made possible by web protocols such as XML and industry standards such as RosettaNet; these allow for the level of interoperability among systems that IT users have long demanded.)

The dynamic interplay of Google, its third-party innovators, users, and advertisers creates a virtuous circle with benefits for all—and especially for Google.

This model is attractive on several counts: The interactions provide continuous feedback for iteratively improving or adding features to Google’s product offerings. Moreover, the operating platform furthers the goals of Google’s advertisers by getting their messages in front of relevant customers whose interests are revealed through their search terms. The dynamic interplay of Google, its third-party innovators, users, and advertisers creates a virtuous circle with benefits for all—and especially for Google (see the exhibit “Google’s Innovation Ecosystem”).

Google’s Innovation Ecosystem

While few organizations can match the magnitude of Google’s infrastructure investments, many can achieve the kind of purposeful design that allows the company to roll out innovations very rapidly. For example, the engineers in Bangalore, India, who launched Google Finance combined preexisting components scavenged from the Google infrastructure to create their new product. Following this model, a company could create reusable software components, bake them into its infrastructure, and make them accessible to the enterprise—or to members of the extended enterprise who might be inspired to use them in building and delivering their own applications.

Rule Your Own Ecosystem

In the ecosystem we’ve just described, Google plays the role of a keystone—the component that holds all others in place, as Marco Iansiti and Roy Levien describe in their book The Keystone Advantage. As owner and operator, Google can control the evolution of its ecosystem and claim a disproportionate percentage of the value created within it. Because every transaction is performed through the Google platform, the company has perfect, continuous awareness of, and access to, by-product information and is the hub of all germinal revenue streams. There’s no need for Google to do market surveys and statistical analyses to forecast trends in the ecosystem; the information is already in Google’s database.

While the sheer scale of Google’s platform and the dominance of its search technology are uniquely powerful assets, it’s still possible to emulate a model built expressly to foster innovation. Other companies can provide platforms that facilitate interactions with the partners within their value systems, becoming the hub of exchanges between and among them. Li & Fung, founded in Guangzhou, China, in 1906, has done just that within the apparel industry. Once it understood its hub position, Li & Fung ceased to be a trading company and became an orchestrator of highly customized end-to-end supply chains. It now participates in myriad decisions ranging from sourcing raw materials to manufacturing garments and managing supply chain logistics for the delivery of finished goods. Li & Fung’s global platform has created a standardized way for several thousand partners to instantaneously interact and coordinate activities.

Within the enterprise software market, Salesforce.com has used its AppExchange platform to build an ecosystem of individual developers, independent software vendors (ISVs), and end users. Its infrastructure hosts applications, integrates them, and supports users’ database and data-center requirements. Because of its position as the hub of all activities within its application domain, Salesforce.com can sell more subscriptions to its product. Developers benefit from the AppExchange infrastructure and access to customers.

Exercise Architectural Control

Under the right conditions, a company can create and exercise architectural control. As we’ve discussed, Google has demonstrated the feasibility of tracking the performance of mashups—a testament to the strength of its infrastructure. However, even companies lacking such infrastructure can maintain a firm hand in managing their ecosystems.

In executing an ecosystem strategy, it’s critical to negotiate relationships from a strong competitive position, particularly when using an internet-based operating platform. Consider Amazon, which allows third parties to bundle its capabilities into their branded services. Amazon benefits from the ease with which it can track web behavior and closely monitor the performance of those services. For example, it allows a third-party developer, Amazon Light 4.0, to affix a different user interface to Amazon’s database of books. In addition, AL4 combines news from Yahoo, blogging from Google, tagging from del.icio.us, and search from eBay into the same service. When a user decides to buy a book, the service directs the request to Amazon. AL4 initially included links to Netflix and iTunes; but since Amazon was providing an important service resulting in transactions and revenues for AL4, it was able to exercise its power to remove those competitors from the ecosystem.

The promise of revenues for everyone fuels these opportunistic alliances. However, during the early phases of innovation, revenues are speculative. Neither Google nor the third party building an application knows whether customers will find it useful. Given this uncertainty, third parties may prefer to innovate and test the application without first engaging in contract and revenue-sharing negotiations (delaying complicated and potentially entangling discussions until a critical mass of users embraces a product appreciably reduces the risk of failure). Customers benefit from faster access to more profuse innovations; Google benefits because it creates additional options for driving incremental traffic to its platform; the developer benefits if one of its applications creates enough value to warrant negotiations with Google to arrange a revenue-sharing deal. In the end, though, architectural control resides in Google’s ability to track the significance of any new service, its ability to choose to provide or not provide the service, and its role as a key contributor to the service’s functional value.

But control and ambition are not things you flaunt. Ecosystem-oriented innovators strive to avoid the appearance of competition by claiming to help everyone. For example, Google executives seldom miss an opportunity to remind the world that they don’t compete with media and content companies. Instead, they characterize media companies as their partners. Not everyone is so sure: Sir Martin Sorrell, chief executive of the advertising giant WPP Group, noted in the firm’s 2006 annual report that it’s not clear whether Google is friend or foe. The deals Google is doing suggest that its ambitions are far broader than just online advertising. Google hopes to use its platform, with applications relevant to ad buying, to help media companies track the effectiveness of campaigns and help advertisers allocate their marketing dollars effectively across print newspapers and magazines, radio, television, mobile devices, and the web. It is quite possible that what Google learns across various media as it solves problems for the ecosystem partners may position it to become the competitor that it now claims not to be.

This model has vulnerabilities, of course. As the infrastructure provider, Google has to prove itself constantly to keep its legions of users from being tempted by rivals. Otherwise, many might defect—and take Google’s coveted advertisers with them. Likewise, if Google were to violate customers’ trust by not properly securing their data or if its platform suffered significant downtime, those derelictions, too, could trigger a large-scale loss of customers. Innovation and continuous improvement are strategies to hedge against those prospects. And at Google, there’s more to innovation than technology and infrastructure. Google’s organizational culture plays a key role.

Build Innovation into Organizational Design

Companies wishing to emulate Google should also look to its organizational design. Many aspects are importable; let’s take a look at the key ones.

Who Should Use Google as a Role Model?

If your company aims to improve innovation capacity, consider emulating these key attributes that have contributed to Google’s success.

Strategic PatienceBenefitsChance to achieve dominance by assembling a market-spanning ecosystemWho Should EmulateCompanies that have a broad mission statement and a potentially huge marketThose whose products’ success requires an ecosystem of complementary goods or servicesThose in situations where contributions from a large community or user base make the product more valuablePitfallsCompanies could be penalized by the market for failing to perform in the short termA less-patient rival could be better/faster at monetizing certain strategic opportunitiesIt’s hard to retain young talent for the long-term— options vest, adrenaline wanes Infrastructure Built to Support InnovationBenefitsEconomies and efficiencies of scaleAbility to leverage third-party innovators in rapidly adding new products and functionsWho Should EmulateCompanies eager to involve third-party innovators or customers in iterative product developmentThose wishing to monitor innovation activity end to endThose whose ecosystems create opportunities to optimize and control information flowPitfallsEven at smaller-than-Google scale, IT infrastructure is complicated and expensive to build and maintainEcosystem That Enables Architectural ControlBenefitsFaster time to market, with better productsContinuous awareness of changing conditionsAbility to identify—and get rid of—partners who thrive at the owner’s expenseWho Should EmulateCompanies with a complex ecosystem of complementors whose many interdependencies need to be monitoredPitfallsSuccess relies on contributed innovations of others; if their products are of low quality or appeal, your reputation suffersEven good innovations may be difficult to integrate wellComplex ecosystems fail if trust among parties suffers—often when architectural control is wielded unfairlyInnovation Built into Job DescriptionsBenefitsRapid growth, powered by a knack for iterative product developmentSatisfied, motivated, productive employeesWho Should EmulateCompanies in long-tail industries (where customers have many unique needs)Companies that must innovate in many areas of operationCompanies whose product requirements are unclear or difficult to specify, necessitating rapid prototyping and iterative refinementPitfallsAs people spend more time experimenting, productivity in operational areas may sufferProject control can be lost in “skunkworks” that tend to proceed in fits and startsConstant flow of new products may confuse both the organization and its customersA Cultivated Taste for Failure and ChaosBenefitsFearless breakthrough innovation with broad participationWho Should EmulateCompanies seeking profuse innovationCompanies where user experience (not engineering) is the dominant value propositionPitfallsIf the organization lacks good learning skills and memory, people will repeat mistakesPoor coordination may lead to overlap among product groupsUsing Data to Vet InspirationBenefitsObjective analysis and rigorous decision making counter-balancing a highly improvisational innovation processWho Should EmulateCompanies seeking to mitigate their embrace of chaosCompanies in newer industries (with lower confidence in what works versus what doesn’t )PitfallsCompanies must have reliable sources of high-quality dataManagement must resist tendency to overanalyzeData-driven businesses can miss major contextual shifts in the competitive landscape

Budget innovation into job descriptions.

One clear reason for Google’s success at innovation is that the company does what many others do not: budgets for it in employee time. New ideas at Google are often generated by employees, from the bottom up, in a prescribed system of time allocation. Technical employees are required to spend 80% of their time on the core search and advertising businesses, and 20% on technical projects of their own choosing. As one new Google engineer put it in a blog: “This isn’t a matter of doing something in your spare time, but more of actively making time for it. Heck, I don’t have a good 20% project yet and I need one. If I don’t come up with something I’m sure it could negatively impact my review.”

Managers, too, are required to spend some of their time on innovation, dedicating 70% to the core business, 20% to related but different projects, and 10% to entirely new businesses and products. The company recently created a new position—“Director of Other”—to help manage the 10% time requirement. (Nontechnical, nonmanagerial employees have no discretionary time—a regrettable omission, we believe.) These percentages—particularly the 20% slice for engineers—are closely managed, although the allocation is not necessarily weekly or even monthly. For example, an engineer might spend six months on the core business, and work for a couple of months on a discretionary project. Even CEO Eric Schmidt and founders Sergey Brin and Larry Page try to adhere to the scheme. This explicit investment in innovation—supported by the management strategy—has produced streams of new products and features. During one six-month period, Marissa Mayer, Google’s head of search products and user experience, explained at a talk at Stanford, more than 50 new products resulted from Google engineers’ 20% time investments—accounting for half of all new products and features (including Gmail, AdSense, and Google News) developed during that period.

Eliminate friction at every turn.

Before becoming an authorized project, an idea must pass through a qualification process. It must be prototyped, piloted, and tested with actual users in a controlled experiment. Yet it would be a mistake to assume that Google’s process is slow and bureaucratic. As another engineer-blogger put it, change can still happen quickly and efficiently:

In my first month at Google, I complained to a friend on the Gmail team about a couple of small things that I disliked about Gmail. I expected him to point me to the bug database. But he told me to fix it myself, pointing me to a document on how to bring up the Gmail development environment on my workstation. The next day my code was reviewed by Gmail engineers, and then I submitted it. A week later, my change was live. I was amazed by the freedom to work across teams, the ability to check in code [submit workable programs] to another project, the trust [placed] in engineers to work on the right thing, and the excitement and speed of getting things done for our users….I didn’t have to ask for anyone’s permission to work on this.

Google’s approach to innovation is highly improvisational. Any engineer in the company has a chance to create a new product or feature. That individuals can have such influence has allowed Google not only to attract high-quality employees (including some of the world’s best computer scientists, statisticians, and economists) but also to create a large volume of new ideas and products. A recent New York Times article, which explored Google’s perceived assault on Microsoft’s hegemony in business software applications, quoted former Microsoft engineer Vic Gundotra on what drew him to defect to Google: “It became obvious that Google was the place where I could have the biggest impact. For guys like me, who have a love affair with software, being able to ship a product in weeks—that’s an irresistible draw.” Google appears to be adept at stripping away nonessential process while still preserving important checks and balances for value, quality, and usability.

Let the market choose.

There is no grand design for how new offerings fit together. Instead, Google executives assume that users will determine the success of innovations and that the company’s strategy will emerge as particular offerings prosper and build on each other—or else wither. In effect, Google has “crowdsourced” its product strategy.

The emphasis in this process is not on identifying the perfect offering, but rather on creating multiple potentially useful offerings and letting the market decide which are best. Even a modest fraction of Google’s more than 132 million users constitutes a massive test bed and focus group for evaluating the potential of new products. Among the company’s design principles are “ubiquity first, revenues later,” and “usefulness first, usability later.” When Google can’t build ubiquity, it buys it—as seen in its enormous investments in YouTube and DoubleClick to acquire those already pervasive web franchises.

Cultivate a taste for failure and chaos.

Google is on the lookout for its third major commercial hit, after search and advertising. Its approach is to release many products and hope that some of them will become blockbusters. It’s not entirely clear how many products Google currently supports (a Wikipedia entry lists 123 as of February 2008). Schmidt admitted in an interview that even he didn’t know how many offerings Google had on the market; at another point, he conceded that the number of new products is “confusing to almost everyone.” While more than 100 products might not impress executives at Procter & Gamble, it is a breakneck pace of technology innovation for an organization that’s less than a decade old. (Indeed, Brin hopes to have Google launch fewer products with more features, lest customers have to use Google’s own search engine to hunt down the company’s offerings.)

Given the strategy to let a thousand flowers bloom, many products are bound to fail. However, Google executives appear to be undeterred by failure. In fact, Schmidt encourages it: “Please fail very quickly—so that you can try again” is how he described his outlook to the Economist. Similarly, Page told Fortune that he had praised an executive who made a several-million-dollar blunder: “‘I’m so glad you made this mistake. Because I want to run a company where we are moving too quickly and doing too much, not being too cautious and doing too little. If we don’t have any of these mistakes, we’re just not taking enough risk.’” Needless to say, that level of risk tolerance is rare in corporations, despite the widespread belief that error and innovation go hand in hand.

The word “chaos” comes to mind when reflecting on innovation at Google. Shona Brown, before she became Google’s senior vice president of business operations, coauthored a book that was subtitled “Strategy as Structured Chaos.” Laszlo Bock, who reports to Brown as head of personnel, told the Economist. “We kind of like the chaos. Creativity comes out of people bumping into each other and not knowing where to go.” This means that a revolutionary new product emerging from the Google soil might not get noticed for a while—but recall that Google is in no hurry.

It is too early to say whether this approach to innovation will be a demonstrably superior way of creating numerous highly successful products. It’s not too early, however, to conclude that the strategy yields an impressive number of new products and product features. Google’s commitment to budgeted innovation and a frenzied, low-friction product-development process is already worthy of emulation by firms that simply need more new products and services to offer the marketplace.

Support Inspiration with Data

Innovation need not be entirely chaotic, and it isn’t at Google. A key ingredient of innovation at the company is the extensive, aggressive use of data and testing to support ideas. In a talk given at Stanford in 2006, Marissa Mayer stated that presentations about new products made to the executive team had better contain plenty of supporting data. This is not surprising in a company founded by two highly analytical Stanford computer-science graduate students. Google’s focus on analytics and data goes far beyond that of most companies. Still, it’s within the reach of most organizations to adopt an analytics-driven approach to evaluating innovation.

A key ingredient of innovation is the extensive, aggressive use of data and testing to support ideas.

Google has a massive amount of data available. For example, insight gleaned from the vast clickstreams of its own and its partners’ websites can be used to test and support any new idea or product offering (unless it relates to such offline ventures as the green-energy initiative). Google takes an analytical, fact-based approach not only to its core business of page-rank algorithms but also to making any change in its web pages and deciding what new services to offer. It’s relatively easy to perform randomized experiments on the internet: Simply offer multiple versions of a page design, an ad, or a word choice. Every day Google does thousands of experiments for its own benefit. It also offers customers the ability to do them. For example, to help customers understand the value of their advertising with Google, the company bought a web analytics company, renamed it Google Analytics, and now offers customers free tools for assessing online ad effectiveness. Google is clearly competing through analytics.

Another order of analysis involves Google’s use of nearly 300 prediction markets consisting of panels of employees. It uses the panels to assess customer demand for new products (“How many Gmail users will there be on January 1, 2009?”); company and product performance (“When will the first Android phone hit the market?”); competitor performance (“How many iPhones will Apple sell in the first year?”); and some just for fun (“Who will win the World Series?”). Prediction markets can be surprisingly accurate decision-support tools. One caveat, however: Senior executives who embrace their use should be prepared to hear the truth rather than the answers that will most gratify them.

Google also employs an idea management system whereby employees can e-mail ideas for new products, processes, and company improvements to a companywide suggestion box. Every employee can then comment on and rate the ideas. This, too, is a form of prediction market, though without the monetary bets (artificial currency, in Google’s case). Google’s founders and senior leadership seem to be saying, “We’re smart, but we’re not smart enough to ignore data. Nor are we smarter than thousands of our bright, motivated employees.”

From a technological and data standpoint, most companies would face few obstacles in adopting the sorts of analytic and democratic approaches to innovation decision making that Google uses. What truly sets Google apart from most businesses in this regard is its culture.

Create a Culture Built to Build

Google has an unusual culture of which only some aspects are shared by other internet-based businesses. It is largely technocratic, in that individuals prosper based on the quality of their ideas and their technological acumen. Google’s use of prediction markets suggests it places a high value on the intellect and opinions of employees. Likewise, giving them budgeted time for innovation shows high regard for their creativity. Google also attempts to provide plenty of intellectual stimulation, which, for a company founded on technology, can be the opportunity to learn from the best and brightest technologists. One employee told the “Google Jobs” website that his favorite perk was the series of regular “Tech Talks” given “by distinguished researchers from around the world….I’ve come to really appreciate the level of commitment Google has to continued learning and education for their engineers.” That same employee, demonstrating that stimulation spans broader interests, told the website that the “most amazing experience” he’d had at Google was a single day during which “the chef Mario Batali came to give away copies of his new book and [the cafeteria served] one of his menus for lunch. Then in the afternoon Thomas Friedman gave a talk about the flattening world, and Robin Williams gave an impromptu comedy sketch to close out the day.”

If a company actually embraced—rather than merely paid lip service to—the idea that its people are its most important asset, it would treat employees in much the way Google does. Google’s founders and executives have thought through many different aspects of the knowledge-work environment, including the design and occupancy of offices (jam-packed for better communication); the frequency of all-hands meetings (every Friday, with beer); and the approach to interviewing and hiring new employees (rigorous, with many interviews). None of these principles is rocket science, but in combination they suggest an unusually high level of recognition for the human dimensions of innovation. Brin, Page, and Schmidt have visited and appropriated ideas from other organizations—such as the software firm SAS Institute—that are celebrated for how they treat their knowledge workers.

In exchange for the privileged treatment, Google expects hard, almost obsessive, work. It therefore devotes considerable effort to identifying the best people, both before and after they are hired. Employees are scored on 25 performance metrics, from how frequently they host Tech Talks to the variability of their interview assessments for potential recruits (an interviewer with variable ratings is considered good, because all recruits are not equally strong). Management also systematically models the attributes of high-performing employees. It continually modifies its hiring approach based on an ongoing analysis of which employees perform best and most embody the qualities of “Googleness.” Few organizations are both so paternalistic and so highly analytical in evaluating performance. Another enterprise might try to create such a culture, but that would require a rare degree of self-confidence on the part of its executives. • • •

As Google grows, will it continue to attract such talented and highly motivated people? Can it retain its sheen? Newer startups like Facebook now compete for the same talent pool and may boast cooler technologies and trendier products. Furthermore, Google may need to find new financial incentives for employees, since its stock options are unlikely to keep growing at the rate that has held since its IPO.

Innovating on internet time requires dynamic capabilities to anticipate market changes and offer new products and functions quickly. Google has made substantive investments in developing the capacity to innovate successfully in this fast-changing business environment. The company is pioneering approaches to organizational culture and innovation processes that continue to attract high-quality employees. At the moment, Google sets the standard for twenty-first-century productivity and growth. If your company employs knowledge workers and needs to innovate, can you afford to wait and see whether Google’s approaches pay off over the long term? We doubt it.

Bala Iyer is a professor and chair of the Technology, Operations, and Information Management Division at Babson College in Wellesley, Massachusetts. Follow him on Twitter @BalaIyer .

Thomas H. Davenport is the Presidents Distinguished Professor of IT and Management at Babson College, a fellow of the MIT Center for Digital Business, a senior adviser to Deloitte Analytics, and a cofounder of the International Institute for Analytics (for which the ideas in this article were generated). He is a coauthor of Keeping Up with the Quants (Harvard Business Review Press, 2013) and the author of Big Data at Work (forthcoming from Harvard Business Review Press).