REOtorentals another Fed subsidy for big investors and select bank Reserve looking to

Post on: 5 Октябрь, 2015 No Comment

REO-to-rentals another Fed subsidy for big investors and select banks. Federal Reserve looking to engineer yet another bailout for key banking allies. Fed acknowledges 12,000,000 homes with negative equity.

The Federal Reserve recently came out with an unprecedented analysis directed to the Committee on Financial Services regarding various methods to improving the housing market. The paper is striking because it magnifies how little was learned from this banking and housing debacle. One of the big recommendations centers on creating a “REO to rental” program by facilitating bulk sales to large investors. Ironically the Federal Reserve by bailing out select banks has allowed home values to remain inflated thus causing this backup in inventory to emerge in the first place. Setting that obvious point aside, let us examine the merits of an REO to rental program.

REO bulk sales to select groups – Fed picking winners and losers again

The paper at least acknowledges the reality that there is an enormous amount of REOs on the market. The Fed only discusses visible REO data but the shadow inventory is much larger:

The paper mentions the following:

“Although small investors are currently buying and converting foreclosed properties to rental units on a limited scale, large-scale conversions have not occurred for at least three interrelated reasons.”

The three reasons specified are:

-1. Geographic grouping of properties

-2. Investors want much larger discounts

-3. GSE/banking policy encourages sale of home as soon as possible

Showing that the Fed is somewhat behind the curve, bulk buying is already happening:

“(SF Gate ) Waypoint Real Estate Group which buys, renovates and rents out distressed single-family homes, primarily in hard-hit Contra Costa and Solano counties has just received a capital infusion worth $250 million from GI Partners, a private equity firm headquartered in Menlo Park.

The money will enable Waypoint, which owns about 1,000 homes in the East Bay and Southern California, to buy several thousand more as it expands both locally and nationally, said the companys managing director, Gary Beasley. And there may be more money to come.”

So apparently the market is working in some areas to clear out some excess inventory without the Fed meddling. Why is it working? Primarily because lower prices have pulled money off the sidelines. The article ends with:

“Referring to the white paper, Magnuson remarked, the Fed apparently didnt know that capital like ours is available.

The Fed goes on to discuss Fannie Mae, Freddie Mac, and FHA and how roughly half of REO inventory comes from these entities. Keep in mind this is visible REO data which is only a sliver of the distressed inventory out there. What isn’t a surprise is that most of the inventory is in hard hit states like California, Florida, and Nevada to mention a few.

The Fed does at least recognize the 12,000,000 underwater mortgages in the country:

Yet the Fed is trying to pick winners here again under the guise of helping communities. Interestingly enough they don’t seem too concerned about helping some of the harder hit areas:

“Not all of these REO properties are good candidates for rental properties, even in large geographic markets with sufficient scale. As discussed in more detail later, some properties are badly damaged, in low-demand locations, or otherwise low value.”

In other words, they want to sweeten the pot to their connected allies only when it brings in money for them even on the taxpayer dime. But in truly hard hit communities like Cleveland or Detroit, well who really cares right? Many of these homes are $20,000 or less so there is little potential financial profit here. So to structure the argument as aiding communities is not exactly true. As the earlier article mentioned, in hard hit markets with potential, private investors are starting to move in. Part of the desire to do this is the low yield overall which ironically yet again, is artificially put in place by the Fed.

One of the options presented includes “REO holders to rent” properties out directly. But as we have seen with the massive shadow inventory. banks don’t seem keen on doing this. In fact, it would appear banks would rather wait and see if a nice bailout is coming their way and simply ignore non-payment on homes or taking action on existing inventory. Banks are not in the property management business. Good property managers realize this is a long and time intensive business and profits are there but banks are more into the quick turnaround with larger profits. They have no intention of being property managers when they can’t even get the paperwork straight on many foreclosures.

Another underwhelming option presented in the paper is subsidizing loans to bulk REO buyers. In subsidizing, they mean the taxpayer is going to help fund these deep pocket investors to do something the market will do anyways. The reasons prices are still too high in some markets is because first, the system allowed banks to suspend mark-to-market and allowed these banks to use accounting chicanery. As the paper notes, “small time” investors are already buying homes and fixing them up to rent out. This occurs when prices make sense. Yet banks are basically creating an artificial market where they collude with the Fed to create an artificial ceiling. The market is demanding lower priced homes because household incomes are much lower:

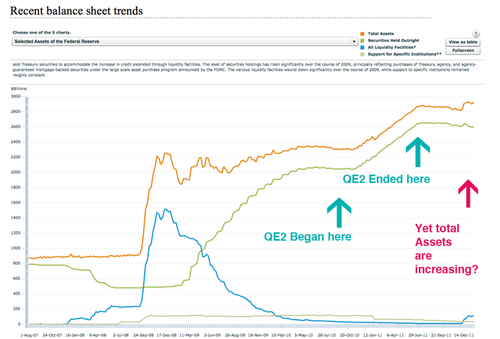

You would think this is obvious but apparently it is not. The Fed in the paper fails to acknowledge the reality that there is no bulk financing for REOs because this is a losing proposition. If there were money to be made here banks would be all over it in two seconds. Almost a century of housing programs in the US and there is a reason that we do not have a REO bulk sale program. Yet here we go again with the Fed subsidizing big players to keep prices inflated. The Fed by pushing mortgage rates lower was a big reason for inflating prices in the first place. As the above chart highlights, the reason home prices remain low is because household incomes are also lower. The paper fails to acknowledge the glaring reality that all gains in the last decade were bubble induced with easy debt.

The Fed has broad enforcement powers yet states the following:

“An REO-to-rental program should also consider the effects that poorly managed or maintained properties have on communities and, in particular, ensure that communities are not damaged by rental practices.”

Instead of using this as an argument to give big gifts to select bulk investors how about cracking down on slumlord banks? The Fed can easily come down on banks and penalize them for their glaring disregard of properties. This would be easier and can be implemented as soon as possible.

The Fed consistently mentions “tight lending standards” and yet fails to make the bigger connection that this is because households are actually on weaker economic terms . In other words, cheaper homes are what they can afford. The premise is wrong and subsidizing here makes winners only out of key investors and banks at the expense of the public. This story is sounding all too familiar. Demand for housing will be there if the economy were stronger. Demand for housing would be there if prices were more in line with household incomes. Instead of focusing on these key topics, the Fed once again looks at subsidizing banks instead of correcting the errors of what led us into this mess.