Rental Property Calculator Real Estate Investment Excel Spreadsheet

Post on: 12 Апрель, 2015 No Comment

With our rental property calculator, youll be able to analyze your real estate investments in minutes.

- Easily create detailed real estate cash flow projections, analytics reports & proformas Simple to use, intuitive and real-time interface Generate beautifully designed PDF and Excel reports #1 Excel based spreadsheet for real estate

We provide the simplest and easiest to use rental property calculator and real estate investment analysis tool on the web. Keep reading below for more information on real estate investing and our real estate investment software .

If youre thinking of investing, here’s a simple statement to follow: cash is king. That should be your real estate investing philosophy and modus operandi.

With that in mind, evaluating the financial prospects of an investment property is one of the single most important steps to take in buying a rental property.

However, preparing a professional and accurate financial analysis for a rental property can be a daunting and time-consuming task. Rather than providing the bottom-line answers an investor needs,

the resources available today are expensive and use clunky, outdated looking software.

Real estate investors are busy.

You don’t have time to go through the process of installing confusing software, learning how to use it, worrying about compatibility and updates, and trying to make sense of it all.

Moreover, in today’s tough mortgage environment, lenders are demanding more due diligence, business planning, financial analysis, and paperwork than ever before from investors to receive financing approval.

Does this sort of hassle sound familiar?

Well, good news. You don’t have to start from a convoluted rental property calculator and spend hours at the computer trying to put it together.

Are you interested in instantly analyzing your rental properties and creating professional investment property marketing plans in minutes? Well if so, this is going to be the most exciting message you will read today

PropertyREIs rental property calculator is the answer to your real estate investment needs. PropertyREI (available here ) was built with the modern day investor in mind by fellow real estate investors and brokers who understand the business challenges involved with the industry.

PropertyREI is the solution to your real estate financial analysis headaches. It is perfect for investors, agents, brokers, and developers.

What PropertyREI does

PropertyREI is a rental property calculator. It provides beautifully designed, simple, and easy to use real estate investment analysis software for putting together a thorough financial analysis on any residential or commercial rental property (single family, multi family, duplex, triplex, apartment, condo, etc.)

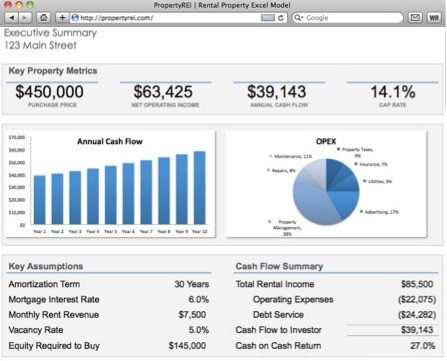

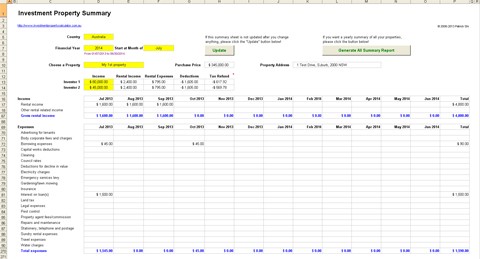

Our Excel-based rental property analysis spreadsheet enables investors to easily model out and evaluate the financial performance of a property to calculate its cash flow and ROI over a 10-year period.The PropertyREI rental property calculator makes it easy to compare the prospects of multiple properties and run a sensitivity analysis on various economic factors. Below is a screenshot of the Executive Summary:

We made it as simple as possible to use. Just enter some details from your prospective property and the model automatically calculates your debt service, investment capital required to buy, generates a 10-year cash flow forecast, prepares a cash flow pro forma statement, calculates important financial metrics, and produces a beautifully designed Executive Summary page. These are the metrics the model calculates for you:

- Cash on Cash Return

- Internal Rate of Return (IRR)

- Net Present Value (NPV)

- Debt Service Coverage Ratio (DSCR)

- Gross Rent Multiplier

- Cash Flow Profit Margin

- Capitalization Rate (Cap Rate)

- Operating Expense Ratio

- Break Even Ratio

- Interest Carry Ratio

- Net Operating Income

- Debt Service (monthly mortgage)

- Annual Interest & Principal

Best of all, PropertyREI is a rental property calculator based in Microsoft Excel (xlsx format). There’s no installation of new software required or learning curve on how to use it. Just download the spreadsheet and you’re in business!

We completely forgot what we knew about outdated, overly expensive real estate software. Instead, we built a modern, state-of-the-art rental property calculator from the ground up. This is a gamechanger that will simplify your real estate investing life. Most importantly, it will save you time in analyzing your investment deals.

So here’s what’s included in PropertyREI:

- Assumption Dashboard – Inputs for property details, rent revenue assumptions, financing strategy, and operating expenses

- Executive Summary – Beautiful interface with graphs, charts, and a perfect high-level presentation view

- 10-year annual cash flow forecast – Pro forma statement of cash flow

- Investment Ratio Analysis Key financial ratios and ROI metrics

- Amortization Schedule – Mortgage amortization payment tables

- Exit Strategy – Calculates property’s future value at the time of sale, valuation, and the net profits from the sale

- Glossary – Key terms and metrics defined

Preparing a rental property analysis

PropertyREIs real estate investment software will guide you along in preparing a rental property analysis to calculate exactly how much cash you, as the property owner and landlord, can expect to take home each month after paying all expenses and debts.

Whether your goal is to buy a house for monthly rental income cash flow, or for long-term capital appreciation, or to use as a tax-shelter to offset your primary income; the fundamentals of real estate analysis stays the same under each of those scenarios and PropertyREI is best equipped to help you in the process.

As an investor, you need to effectively narrow down your real estate investment opportunities to the properties that have the best prospects to produce financially in the long run.

PropertyREI helps you accomplish that task by providing the best real estate investment software solution on the web.

With real estate investing, its not enough to calculate your returns by making a rough estimate of rents minus the mortgage payment and lumping on some float assumption of 10% and calling it a day.

That sort of haphazard thinking is missing critical factors that can ultimately make or break the deal. Factors such as vacancy rates, rent inflation, deferred maintenance costs, property taxes, insurance, property management, inflation, and many others. No need to worry as our rental property calculator has you covered! It calculates all these factors and many more with 100% precision and accuracy.

We take the important numbers a step further and show you the valuation tools and ratios traditionally used by appraisers and lenders to determine the financial viability of a property.

Then, we guide you in your exit strategy (sale of real estate) and help you calculate how much the property could potentially be worth based on the valuation methodology used by most investors and banks.

PropertyREI helps you deal with lenders and banks

Let’s assume for a moment you found what you consider to be the perfect investment property.

This might sound obvious, but the next step in the real estate investment process is to actually buy the place. So unless you are purchasing the property in cash (which we strongly advise against doing with real estate investments), securing financing from the bank is one of the hardest, and yet, often overlooked steps by investors.

When it comes time to look for financing, if you present a lackadaisical plan based off of rough estimates to a lender, theyll usually deny the loan for lack of due diligence on your part.

Because from the lender’s perspective, if you dont take the time and effort to prepare an in-depth, thorough, and detailed cash flow forecast in a professional and well thought out way, then thats indicative of a broader problem with the investor of having a lack of credibility and limited experience with investment property finances and management.

As an investor, the burden is on your shoulders to prove to the bank the financial viability of the property you want to buy. Ultimately, the bank is solely concerned with receiving their money back and interest on debt they lent to you. No loan, no deal, no extra cash flow in your pocket each month.

PropertyREI helps you easily deal with lenders and banks.

Imagine presenting a business plan that looks like this for a property you want to buy (click on the screenshot for a sample PDF report).

Sample PropertyREI Report

PropertyREIs rental property calculator and real estate investment software calculates the most critical metrics the lender is interested in. Metrics such as the debt service coverage ratio (DSCR), the ratio between a property’s net operating income and its annual debt service. This is a metric commonly used by lenders to measure whether the property will generate sufficient cash flow to cover its mortgage payments.

With a financial analysis plan from PropertyREI, the lender will look at you with authority and as a seasoned real estate investor.

Would you like your loan to be pushed to the top of the pile for review and approvals by the bank?

Then PropertyREI is the best real estate analysis solution for you.

Rental Property Calculator for Single-Family

PropertyREIs rental property calculator makes it easy to calculate the free cash flow that a single-family home will generate. Single-family homes make great rental property investments. Typically, they require just one tenant, which is simpler to manage than an entire multi-unit building with numerous tenants. Additionally, a single-family home doesn’t require the same level of management, maintenance, and time commitment that bigger units need.

The single-family rental asset class is now attracting private equity and institutional players to an industry that has always been dominated by “mom-and-pop” individual rental owners. Blackstone Group LP, the largest U.S. private real estate owner, has been buying up billions of dollars worth of single-family homes with the intention of fixing them up and renting them out.

The market for single-family investment properties is in very high demand due to rising rents and home prices. Let PropertyREI do the property analysis work for you! As an investor, you need to successfully target those properties that have the best chances to generate cash flow in the long run. If you don’t have the time or in-depth knowledge to calculate the revenue potential for every investment property deal, you probably won’t be a successful investor. You can get the highest return on your investment by letting PropertyREI crunch the numbers for you.

Rental Property Calculator for Multi Family (Duplexes, Triplexes, Apartments)

If you are looking to invest in multi-family housing, then PropertyREI makes it really simple to calculate and analyze the property’s cash flow. Multi-family units generally provide healthy long-term appreciation potential. They do typically require more intensive management and maintenance, and more expenses, as opposed to single-family houses.

In the real estate world of lending, multi-family buildings are typically divided up into two groups based on the number of units in the property:

Four or less units: These multi-family rental properties are treated as residential and you can obtain more favorable financing terms.

Five or more units: Buildings with five or more units are treated as commercial property and don’t enjoy the favorable financing terms of 1 to 4 units properties.

PropertyREIs real estate investment software makes it really easy to update the financing mortgage strategy of your deal straight from the assumption dashboard in a matter of seconds.

Rental Property Calculator for Student Housing

With a record 21 million college students, college enrollments continue to rise to record levels and are growing by more than 300K students per year according to the Department of Education. As a result, more and more students move off-campus due to a shortage of on-campus beds. The National Center for Education Statistics estimates that dorm capacity stands at 25% of total enrollment, with new private off-campus housing developments matching the increased demand for housing. This pent-up demand has made student housing one of the most attractive (and often overlooked) investment niches in real estate.

There are unique risk factors for management and operations to consider with student housing investments. These are factors such as short leasing cycles, creditworthiness of student tenants, and high turnover costs. When you add 18 to 21-year old student residents away from mom and dad on a large college campus to the mix, the building owner has to face some real operational challenges. However, if properly managed and operated, a student housing property can be a cash cow and generate great wealth for an investor.

The housing market for student housing rental properties is in very high demand due to rising college enrollments and limited supply (on-campus beds). If you’re looking to invest in the very profitable student housing industry, let PropertyREIs real estate investment software do the real estate analysis work for you! As an investor, you need to effectively isolate those properties that have the highest prospects of generating excellent returns. If you don’t prepare an in-depth analysis calculating the cash flow and ROI for every investment property deal, you probably won’t be successful. You can get the best cash on cash return for your money by letting PropertyREIs rental property calculator crunch the numbers for you.

Rental Property Calculator for Condos

PropertyREIs rental property calculator helps you calculate the ROI on a condo investment within a matter of minutes. Condos are usually apartment complex style units that are stacked on top of and/or side-by-side of one another. These units are sold to individual owners. When you purchase a condo you also receive a commensurate stake in the common areas of the building – the pool, gym, laundry, tennis courts, roof decks, and so on. Parking spaces (if available) are either included in the purchase price of the unit or sold separately. As a condo unit owner, you are also required to pay monthly homeowners (HOA) dues to the association responsible for maintaining the common areas.

One major advantage to a condo as an investment property is that most condo associations deal with maintenance issues such as plowing snow, gardening upkeep, cleaning common areas, and so on for the entire condo complex. As an owner, you will still be responsible for maintenance that is needed inside your unit, such as appliance repair and painting.

Although condos may be easier to manage, they typically appreciate in value less than other real estate options.

So whether you are interested in investing in single-family, multi-family, apartments, student housing, or condos, PropertyREI is the real estate investment analysis solution to solving your real estate investment software headaches. It’s fast and easy.

In Conclusion

And this brings us to our last point, which is enormously important. You can continue being on the sidelines while real estate investment opportunities pass you by due to a lack of financial “know-how” on your part. Or, you can get in the game and start analyzing the investment deals available in your area today. You’ll sleep better at night knowing you are one step closer to being real estate cash flow positive. Remember: Cash is King.