Relative Strength ETFs What You Need To Know

Post on: 16 Март, 2015 No Comment

by Stoyan Bojinov on September 14, 2012 | Updated September 20, 2012 | ETFs Mentioned: DWAS PDP PIE PIZ

Countless investors have embraced ETFs in their portfolios thanks to the cost-efficient and easy-to-use nature of these financial instruments. Aside from serving as excellent core building blocks in long-term and retirement-themed portfolios, ETFs have also gained popularity among investors seeking out tactical exposure. One particular breed of products from industry veteran PowerShares has continued to slip under the radar for many, although a closer look under the hood reveals some attractive opportunities [see Free Report: How To Pick The Right ETF Every Time ].

Invesco PowerShares offers a suite of Technical Leaders ETFs which target a number of popular asset classes with a twist; these products employ a proprietary methodology that allows them to sort through thousands of securities and narrow down their basket of holdings to only the ones which satisfy certain criteria. The result is a shallower portfolio that is deemed to hold only the strongest components from each respective universe based on relative performance measures [see also ETFs For Hands Off Investing ].

Relative Strength 101

So whats behind the Technical Leaders methodology? Relative strength. Each of the PowerShares offerings uses relative strength measures as the primary metric to consider securities for inclusion in each underlying portfolio. So what exactly is relative strength?

Simply put, relative strength measures the stockss individual performance in relation to its peers. The index provider behind this lineup of ETFs, Dorsey Wright, states that relative strength improves upon the technical foundation of a basic trend following strategy; this is accomplished by relying on unbiased, unemotional, and objective data rather than biased forecasting and subjective research which is often times at the discretion of the individual portfolio manager [see also ETF Technical Trading FAQ ].

The indexes underlying the Technical Leaders ETFs select the securities from each respective universe that possess the most powerful relative strength characteristics in relation to the performance of the industry and sub-sectors; essentially, these portfolios are quantitatively-enhanced benchmarks. This sort of strategy may appeal to anyone who believes that rules-based technical analysis can serve to enhance bottom line returns over the long-haul [see also Cheapskate Hedge Fund ETFdb Portfolio ].

Performance Check

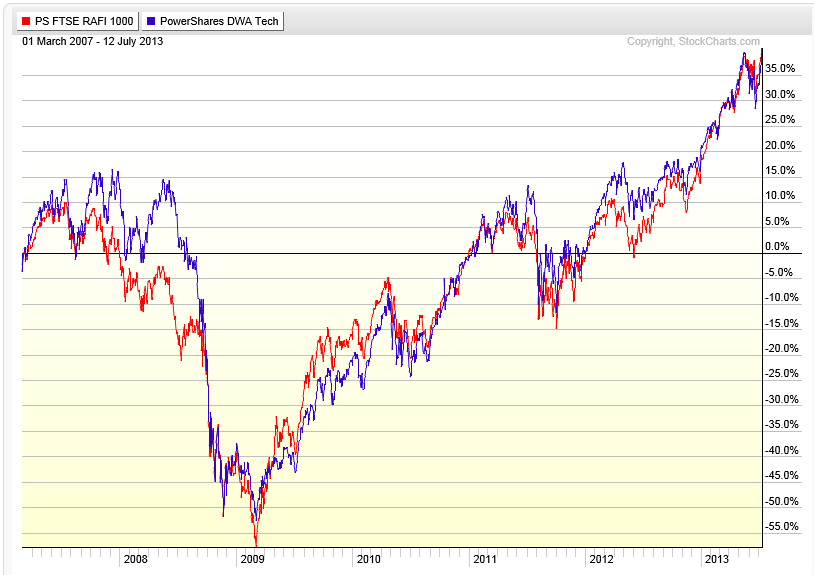

The relative strength-focused lineup of PowerShares offerings has turned in impressive performance results, managing to outperform broad-based ETFs covering similar asset classes (returns as of 9/13/2012):

PowerShares DWA SmallCap Technical Leaders Portfolio (DWAS ): This ETF includes about 200 companies companies that demonstrate relative strength in the U.S. small cap universe. Performance data is limited due to this ETF launching in July of this year.