REITs What To Look For In A Real Estate Investment Trust Dividend Ladder

Post on: 23 Май, 2015 No Comment

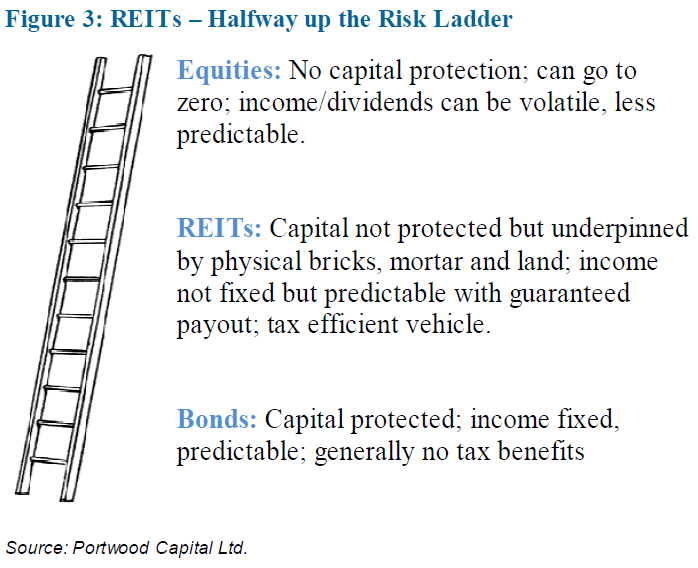

Real Estate Investment Trusts (REITs) can be a great way for investors to gain exposure to the real estate market. These investments tend to attract attention because of their high yields which can often be attributed to the requirement REITs have to pay out 90% of their taxable income to shareholders. Because of this requirement the payout ratio can be safely ignored when evaluating REITs. The SEC has a lot of really good information about what it takes to qualify as a REIT.

Before we get into what to look for in a REIT just a quick note about taxes. Dividends that are paid out from REITs can be treated many different ways. They may be ordinary income, qualified dividends or returned capital. Its important to consult a tax professional before investing in a Real Estate Investment Trust to understand how distributions will be taxed.

Types of REITs

Mortgage REITs are focused on providing financing to real estate owners. This is done by directly lending to real estate owners and operators or by buying mortgage-backed securities. Mortgage REITs can be heavily leveraged and carry exposure to interest rates.

Equity REITs own physical real estate that produces income. They can very focused and only invest or own properties that fall into a specific category. Some of these categories include tech (think data centers), healthcare facilities, apartment buildings or traditional housing.

Hybrid REITs are companies that are a combination of equity REITs and mortgage REITs.

What to look for

There are five major items I use to evaluate a REIT. While historical numbers are important it is equally important to consider the future when evaluating investments.

Yield, its why we are here in the first place. The higher the yield the shorter the payback period and REITs often have very short payback periods (the time it takes to regain your initial investment through yield).

Not all REIT yields are created equally because each type of trust is exposed to different factors. For example a trust that owns property and receives most of its income from rent has very different risks than a trust that lends money for property and is exposed to interest rates.

When it comes to yield and REITs its obvious that more is better, as long as its safe.