REITs v Property (Comparing Apples to Oranges)

Post on: 9 Июнь, 2015 No Comment

by FI Fighter on April 8, 2014

A common question I get asked from readers is: Is investing in a real estate investment trust (REIT) a suitable alternative to buying rental property? On the surface, it would appear that the two types of investments are rather comparable.

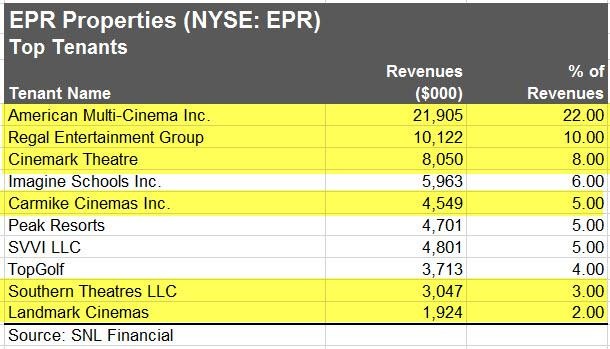

A REIT is a company that invests in real estate (incoming producing assets), whether its directly through rental property (office buildings, apartments, shopping centers, residential houses, etc.), or through mortgages. REITs are securities that sell on the major exchanges just like stocks. You can even think of buying a REIT like buying a real estate index fund you get to earn a share of income produced by the index of rental properties without actually having to go out and buy the properties yourself.

There are many benefits to buying REITs. Chief among them are:

- Liquidity. Like stocks, it is very easy to buy and sell publicly traded REITs. If the price of the REIT you own goes up $2/share tomorrow, you can login to your brokerage account and liquidate your position in an instant.

- Passivity. You get to own a real estate investment without having to be a landlord. There are no maintenance and vacancy issues for you to have to worry about.

- High yield. REITs typically produce high returns, yielding around 4% and above.

A popular REIT in the income investing world is Realty Income Corp (O). As of market closing on March 28, 2014, O was trading at the following valuation:

https://www.google.com/finance?q=NYSE:O

REIT Example

Off the top, you can see that the income (dividends) produced by owning shares of O is currently yielding 5.37% annually.

If you had $81,500 to invest:

Capital to Invest: $81,500

Shares Owned: 2,000

At an annual yield of 5.37%.

Cash Flow (yearly): $4,376.55

Cash Flow (monthly): $364.71

Not bad. $364.71/month in passive income can cover a lot of expenses for most anyone on the journey to early financial independence. The best part would be that the income earned would be more or less 100% passive.