REIT’s for Dummies An Investors Guide to Real Estate Investment Trusts

Post on: 8 Апрель, 2015 No Comment

REIT’s for Dummies: An Investors Guide to Real Estate Investment Trusts

In the late 1990’s and early 2000’s, broker/dealers and registered representatives throughout the United States were recommending that every investor with a few extra dollars to spare invest the money in private placements. In recent years, many of those investments have proven worthless as evident by the fall of Provident Royalties and Medical Capital, and so many of the broker/dealers and registered representatives that recommended them to their clients.

While private placements have become less desirable investments in recent years, real estate investment trusts (“REITs”) have been the hot investment vehicles for the past 5-10 years. Much like private placements, however, many REITs have been the subject of FINRA arbitrations and FINRA and SEC enforcement actions. For this reason, it is essential that every investor who either has or is thinking about investing in REITs fully understand the ins and outs of this type of investing.

What is a REIT?

REITs are securities in which investors invest in associations, corporations or trusts that then use the investors’ money to invest in real estate. Typically, REITs pool investors’ money to purchase a portfolio of real estate that most individual investors could not acquire on their own. Some REITs own the property in which they invest, and generate revenue to pay their investors through either rental income or the sale of their properties. These REITs are often known as “equity REITs.” Other REITs loan money to property owners, secured by mortgages, or purchase existing mortgages or mortgage-backed securities. These REITs pay investors through interest charged on their loans to pay investors, and are often known as “mortgage REITs.” Finally, some REITs are a combination of equity REITs and mortgage REITs, and combine the investment strategies of both to generate revenue to pay back investors.

No matter what the type, the success of all REIT investments is contingent upon the real estate in which the REITs invest. If successful, however, REITs can be very profitable for their investors as they typically offer high yields and can receive special tax considerations.

Publicly-Traded vs. Non-Traded REITs

All REITs can be broken down into two (2) categories: publicly traded and non-traded. Publicly traded REITs are registered with the Securities and Exchange Commission and are publicly traded on the stock market. Much like other publicly-traded securities, publicly-traded REITS are listed on the stock exchange and the REITs are required to file reports with the SEC. As a result, publicly-traded REITs typically have a secondary market for investors to sell their shares as they choose. Publicly-traded REITS carry the same costs as publicly-traded stocks. Non- traded REITs are much more like private placements as opposed to common stocks. For example, shares of non-traded REITs are not traded on the national stock market, even though they are required to file reports with the SEC. Furthermore, non-traded REITs are usually not automatically liquid and share redemption programs can very greatly depending on the REIT. Often times, investors in non-traded REITs have to wait in order to receive a return on their investment until the REIT decides to liquidate its assets. Finally, the costs associated with investing in non-traded REITs are often much greater than the costs of investing in publicly-traded REITs; typically, non-traded REITs carry commissions of 8-10 percent to the registered representative that sold the investment, in addition to offering costs, land-acquisition and management fees. Although some investors will complain about investing in publicly-traded REITs, the majority of the REIT-related complaints and arbitrations pertain to non-traded REITs.

Specific Types of REITs

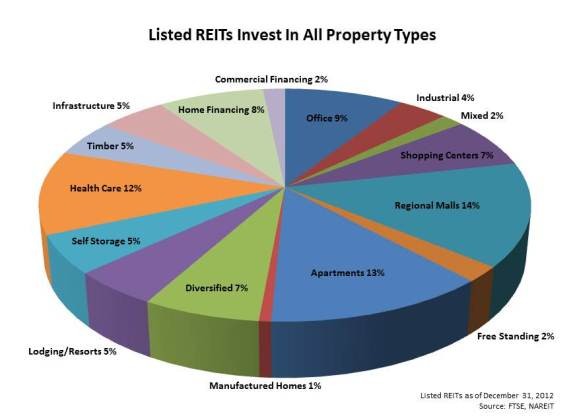

Not only are REITs categorized based upon whether or not they are traded on a public stock exchange, but publicly-traded and non-traded REITs are also categorized by the types of real estate in which they invest. These categories of REITs include apartment REITs, health care REITs, hotel REITs, industrial REITs, office REITs, retail REITs, storage REITs and specialty REITs. For example, health care REITS have typically be considered conservative investments as they have recently suffered minimal losses and managed to maintain their dividends during that period of time. Retail and office REITs likewise remained relatively steady in recent years. Apartment REITs, however, suffered from low rental demands from 2008-2010, but have bounced back recently as a result of declining real estate market and an increased demand for rental units.

The performance of specialty REITs depends on the specific focus of the REIT, with their focus ranging from convenience stores and gas stations to timberland and multi-family housing. Clearly, it is important that investors are fully educated on the specific type of REIT in which they are investing, in addition to the difference between publicly-traded and non-traded REITs.

Typical Risks of Investing in Non-Traded REITs

Although non-traded REITs are not exposed to market volatility, unlike publicly-traded REITs, their investors still fact significant risk when investing. For example, whether to pay distributions and the amount of those distributions are within the discretion of the directors of non-traded REITs – distributions to investors are not guaranteed and returns on investments are subject to the mercy of those operating the REITs. In addition, distributions from non-traded REITs are taxed as ordinary income, rather than qualified dividends. As such, when investments in non-traded REITs are sold or liquidated, the investors could suffer significant tax consequences. Furthermore, given that non-traded REITs are no publicly traded, it is often very difficult to determine a value of shares in non-traded REITs in the event of redemption or liquidation. Even worse, most non-traded REITs impose restrictions upon the ability for investors to redeem their shares prior to liquidation, and in the event early redemption is available, it is often only allowed at a significant cost to the investor. Finally, non-traded REITs are often very expensive, resulting in sales commissions up to ten percent, in addition to other issuer expenses such as offering and organizational costs. Investors in non-traded REITs need to make sure they weigh all the risks and potential rewards before deciding whether to invest their money.

If those risks were not fully disclosed to the investor prior to investing, then there is a likelihood that the REIT investment was not suitable for the investor or recommended under false pretenses, both of which could give rise to a securities fraud claim.