REITs and REIT Portfolios

Post on: 30 Март, 2015 No Comment

Non-traded Real Estate Investment Trusts (REITs)

A REIT is a corporation that invests in real estate. REITs provide diversification to portfolios through investments in many types of real estate including apartments, hotels, industrial parks, malls, office buildings, retail stores, storage facilities and other properties. REITs can also invest in equity and debt securities. REITs may provide income and growth depending on the property type or investment strategy defined within the REIT portfolio.

How can a REIT help you?

Because REITs must pay out 90% of all their taxable income to shareholders, they may be a source of reliable and significant income for investors. However, the amount of these distributions is not guaranteed and may change with market conditions.

- REITs also offer an attractive risk/reward trade-off. While non-traded REITs are less liquid than their traded counterparts, they may provide higher total returns. (Source: The REIT Story, 2008. REIT.com)

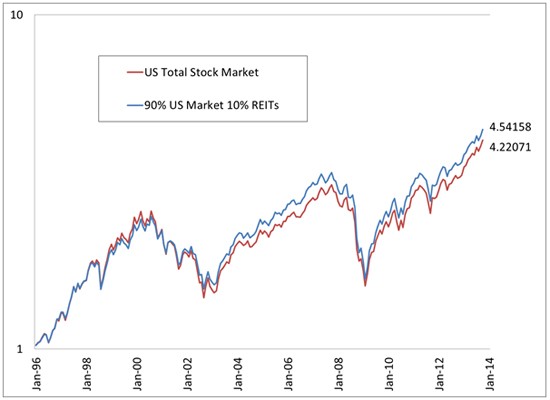

- The correlation of REIT returns with other investments has declined over the last 30 years, which can help add diversification to your portfolio (Source: The REIT Story, 2008. REIT.com).

Real estate investments are narrowly focused investment sectors and may exhibit higher volatility than investments with broader investment objectives. Principal risks associated with REITs include market risk, issuer risk, economic risk, and mortgage rate risk, diversification risk and sector/concentration risk. REITs may use leverage that may accelerate the velocity of potential losses.

REIT products are long-term, illiquid investments and are only suited for clients with long-term investment goals. There can be no assurance that a secondary market for the REITs will exist.

Ameriprise Financial is a distributor of REIT offerings and does not participate in selecting, managing, or selling property or other investments, except as described in the prospectus. REIT products are limited to investors who meet the financial suitability standards as specified in the prospectus, in addition to the Ameriprise Financial minimum suitability requirements.

Investment products are not federally or FDIC-insured, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

Brokerage, investment, and financial advisory services made available through Ameriprise Financial Services, Inc. Member FINRA and SIPC.