REIT Sweet REIT 8 of Today s Most Profitable REITS

Post on: 21 Август, 2015 No Comment

Research these Stocks on Kapitall’s Playground Now

One increasingly preferred method or portfolio diversification is real estate. A house, a hotel, an office building, etc. But not all of us can afford to buy an entire piece of real estate, so the next best thing is REITs.

Real Estate Investment Trusts, are securities that sell like a stock on the major exchanges and invests in real estate directly, either through properties or mortgages. REITs invest in many sectors, from office buildings to homes, hospitals and hotels. Better yet, they receive special tax considerations and typically offer investors high yields, as well as a highly liquid method of investing in real estate.

Business Section: Investing Ideas

Much like buying a house or renting an apartment, choosing a REIT is no easy task, as there are many available on the exchanges.

To provide you with a starting point, we list below the most profitable names in their industry. Profitability is based on their gross, pretax, and operating margins.

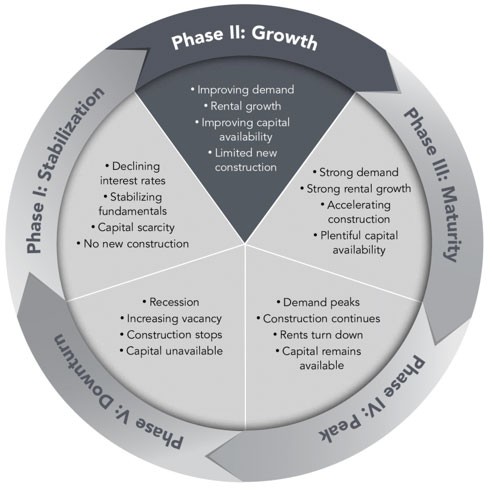

Strong profitability puts the firms in a better position to handle changes. And because the industry is considerably dependent on overall economic conditions (e.g: higher employment means less vacancy and more rent) this characteristic may be important to potential investors.

We found 8 names with significantly better gross, pretax and operating margins than their industry peers. Use this list as a starting point for your own analysis.

List sorted alphabetically

1. Alexanders Inc. (ALX. Earnings. Analysts. Financials ): REIT Retail. Engages in leasing, managing, developing, and redeveloping properties in the greater New York City metropolitan area. Market cap at $2.27B, most recent closing price at $445.0. TTM gross margin at 51.42% vs. industry average at 42.66%. TTM operating margin at 51.42% vs. industry average at 40.34%. TTM pretax margin at 32.48% vs. industry average at 21.59%.

2. Entertainment Properties Trust (EPR. Earnings. Analysts. Financials ): REIT Retail. Develops, owns, leases, and finances entertainment and related properties in the United States and Canada. Market cap at $2.14B, most recent closing price at $45.59. TTM gross margin at 66.12% vs. industry average at 42.81%. TTM operating margin at 66.12% vs. industry average at 40.52%. TTM pretax margin at 43.09% vs. industry average at 22.07%.

3. HCP, Inc. (HCP. Earnings. Analysts. Financials ): REIT Healthcare Facilities. An independent hybrid real estate investment trust. Market cap at $19.54B, most recent closing price at $45.50. TTM gross margin at 62.28% vs. industry average at 42.66%. TTM operating margin at 62.28% vs. industry average at 40.34%. TTM pretax margin at 33.94% vs. industry average at 21.59%.

4. Monmouth Real Estate Investment Corp. (MNR. Earnings. Analysts. Financials ): REIT Industrial. It owns, manages, and leases properties to investment-grade tenants on long-term leases. Market cap at $452.3M, most recent closing price at $11.24. TTM gross margin at 56.46% vs. industry average at 42.66%. TTM operating margin at 56.46% vs. industry average at 40.34%. TTM pretax margin at 32.56% vs. industry average at 21.59%.

5. National Retail Properties, Inc. (NNN. Earnings. Analysts. Financials ): REIT Diversified. The firm acquires, owns, manages, and develops retail properties in the United States. Market cap at $3.16B, most recent closing price at $29.57. TTM gross margin at 54.39% vs. industry average at 42.66%. TTM operating margin at 54.39% vs. industry average at 40.34%. TTM pretax margin at 31.82% vs. industry average at 21.59%.

6. Realty Income Corp. (O. Earnings. Analysts. Financials ): REIT Retail. Engages in the acquisition and ownership of commercial retail real estate properties in the United States. Market cap at $5.45B, most recent closing price at $40.86. TTM gross margin at 60.32% vs. industry average at 42.66%. TTM operating margin at 60.32% vs. industry average at 40.34%. TTM pretax margin at 34.76% vs. industry average at 21.59%.

7. Omega Healthcare Investors Inc. (OHI. Earnings. Analysts. Financials ): REIT Healthcare Facilities. Operates as a real estate investment trust (REIT) in the United States. Market cap at $2.53B, most recent closing price at $23.72. TTM gross margin at 59.06% vs. industry average at 42.66%. TTM operating margin at 59.06% vs. industry average at 40.34%. TTM pretax margin at 30.67% vs. industry average at 21.59%.

8. Resource Capital Corp. (RSO. Earnings. Analysts. Financials ): REIT Retail. Operates as a specialty finance company that focuses primarily on commercial real estate and commercial finance in the United States. Market cap at $478.78M, most recent closing price at $5.65. TTM gross margin at 61.95% vs. industry average at 42.81%. TTM operating margin at 61.95% vs. industry average at 40.52%. TTM pretax margin at 43.21% vs. industry average at 22.07%.

Written by Rebecca Lipman. Profitability data sourced from Fidelity, all other data sourced from Finviz.

Use Kapitalls Tools: Looking for ways to analyze this list?

Use this article snapshot as a launch pad (click here for help ): Simply click on the links, and use Kapitalls tab navigation to browse through the data

Analyze These Ideas: Getting Started

1. New to the site? Click here to register for a free account. and gain access to more tools and data