REIT ETFs Real Estate Investment Trusts MSCI Index

Post on: 16 Март, 2015 No Comment

N ot long ago retailers were in the abyss. The deep plunge in discretionary spending forced retailers like Circuit City Stores Inc. Fortunoff Holdings, and Linen’n Things to file for bankruptcy and close stores.

Retailer’s fortunes are improving. The Commerce Department recently reported that August retail sales increased 2.7% exceeding analysts’ forecasts. According to analytic software maker Kronos, U. S. discount, grocery, and restaurant chains are turning optimistic and hiring a larger percentage of job applicants than seven months ago.

Shopping center operators are benefiting from improving business conditions in retail-land. Retailers like Aeropostale (ARO), Ross Stores (ROST), and TJX (TJX) are stepping in to fill vacancies. Rising demand for shopping center space is enabling shopping center operators to high-grade their tenant base.

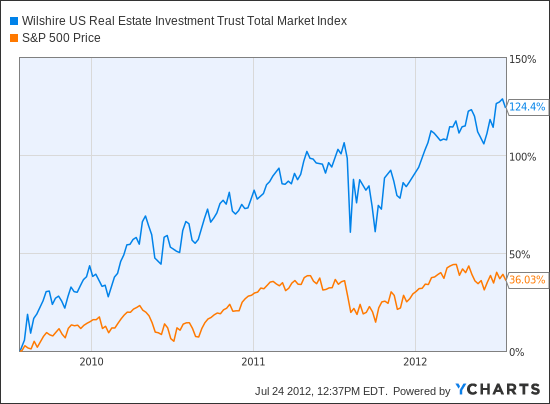

REIT share prices as measured by the MSCI US REIT index are up 17% in just two weeks.

Taking advantage of the improving investor sentiment, many REITs are vying to raise equity capital through initial public offerings (IPO). Earlier last week, CreXus Investment (CXS) raised $200 million through an IPO.

More IPOs are expected to price in the coming weeks. The list includes Apollo Commercial Real Estate Finance (ARI), Colony Financial (CLNY), and Foursquare Capital (FSQR).

Where do REIT ETFs go from here?

News flow from the retail land is likely to remain positive and this can provide a positive backdrop for shopping center REITs. Ken Perkins of Retail Metrics says retail same-store sales comparisons clearly bottomed in July. He is forecasting sequential monthly improvement into the holidays with Christmas 2009 likely being ‘weak but not disastrous’. David Simon is more optimistic. He feels pent-up demand coupled with low inventories could enable retailer sales to surprise to the upside during the upcoming holiday season.

The picture in the commercial property segment is not as sanguine. Commercial real estate typically lags economic growth and is more closely tied to the employment market. As companies continue to reduce headcount, they need less space. With office rents in cities like New York and San Francisco forecasted to decline nearly 20% through 2010, a recovery in commercial real estate could be pushed into 2012.

From a technical perspective. REIT share prices look extended with the MSCI US REIT Index, 13% above its 50-day moving average. With additional REIT IPOs coming on the heels of a cool reception provided to CreXus Investment, REIT share prices are likely to slip into a trading range allowing the 50-day moving average to catch up with price. The bottom of this trading range can be 7% to 10% lower than the current level.

Last week Apollo Commercial Real Estate Finance (ARI) and Colony Financial (CLNY) halved the size of their IPOs on lack of investor demand. This reduction in size however did not prevent ARI and CLNY shares from receiving a haircut on their first day of trading. The MSCI US REIT Index (RMZ) lost 5.8% last week and moved closer to the 50-DMA.

Aggressive investors looking to profit from this pullback can sell short REIT ETFs like iShares Dow Jones US Real Estate (IYR). Vanguard REIT Index ETF (VNQ) or iShares Cohen & Steers Realty Majors (ICF). Investors looking for double or triple the action can consider ProShares UltraShort Real Estate (SRS) and Direxion Daily Real Estate Bear 3x Shares (DRV) .

Over the intermediate and long-term, REIT prices are likely to add to their gains as the economy improves, consumer demand picks up, and hiring resumes. Positioning oneself for the long side of the trade will prove beneficial once the consolidation phase runs its course.