Record Profits Drive Job Gains Show

Post on: 16 Март, 2015 No Comment

Employees cheer customers as they enter a newly-opened Apple Store in Wangfujing shopping district in Beijing on Oct. 20, 2012. When measuring the. View Enlarged Image

With unemployment remaining high, there seems to be an undercurrent of suspicion that U.S. corporations are making record profits in a way that causes many workers to be unemployed. This myth needs to be dispelled.

The truth is that corporate profit margins are 20% below record levels when properly measured.

In addition, for over six decades under both Republican and Democratic leadership, lower unemployment has correlated with higher corporate profit margins and greater unemployment with lower margins.

This correlation is fairly high, with all nine declines in unemployment since 1951 coinciding with a rise in corporate profit margins, and all nine rises in unemployment coinciding with a decline in profit margins.

The reasons are fairly obvious.

When the labor force and other resources become more fully utilized, companies benefit from economies of scale and firmer pricing as demand starts to approach limits of supply.

This lets companies discount less and raise prices to the point at which higher profits give them incentives to invest, expand capacity and hire and train more workers.

Why don’t people see this relationship?

The biggest reason is that most economists have been using the wrong definition for corporate profit margins, and this definition is becoming increasingly inaccurate with each cycle.

Also, corporate profit margins have tended to lead employment and unemployment data by a year, making the link between them harder to see.

Almost all economists use corporate pretax profit data from government GDP accounts that show National Profits, which include profits from overseas units of U.S. corporations as well as their domestic operations.

But when measuring the profitability of U.S. companies within domestic GDP, it doesn’t make sense to include the faster growing foreign based profits of IBM, Apple, Exxon and other U.S. multinationals in the profit figures.

To more accurately gauge profitability as a share of the U.S. economy, domestic-only profit data make the most sense that is, profits earned in the U.S. Economists at the Bureau of Economic Analysis concur.

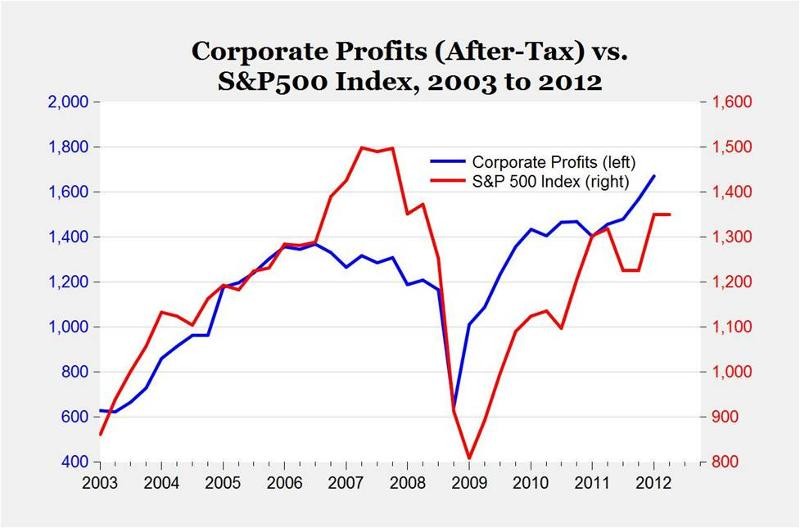

When we use domestic-only profit data divided by GDP, we see that profit margins are not yet at record levels and have room to grow. This is consistent with what we see today an underuse of resources in a lackluster recovery.

How much do domestic-only profit margins differ from domestic plus foreign-sourced profits of U.S. companies?

In the first half of 2012, domestic-only profits were 9.5% of GDP, vs. 12.3% for the more commonly used but less appropriate National Profits data.