RecessionProof Your Portfolio And Get A 3 5% Yield With This REIT

Post on: 5 Сентябрь, 2015 No Comment

Share | Subscribe

If you lost a chunk of your portfolio during the GreatRecession or were late to the party as themarket recovered, you might be trying to make up that lost ground with aggressiveinvestments. With the market steadily climbing upward, you would probably be less likely to go for safe, defensive plays intended to protect yourmoney rather than grow it.

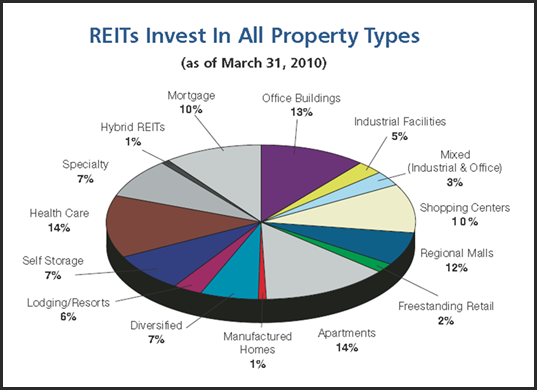

While that’s a good strategy at this point in the economic cycle, it might also pay to consider one particularreal estate investment trust (REIT) that owns, operates and develops retail properties, including a sizable representation of grocery-anchored retail properties in its portfolio. The grocery-anchored retail component provides the safe defensive play, while the REIT also stands to benefit from rising construction activity as theeconomy improves.

Regency Centers Corp. ( REG ) grows by acquiring new properties, developing properties andinvesting inpartnership with others. Typically, the REIT has an anchor tenant lined up to lease the space before starting a development project.

With a portfolio of 345 U.S. retail properties (including the properties it owns in partnerships) totaling 46 million square feet, as of the first quarter, Regency focuses on investing in infill locations that are densely populated and provide barriers to entry that reduce competition. The grocers it counts as anchor tenants include Kroger ( KR ) (accounting for 4.3% of annual base rent at the end of 2012), Publix (4.2%), Safeway ( SWY ) (3.3%), Supervalu ( SVU ) (2.1%), Whole Foods (Nasdaq: WFM)  (1.2%) and Trader Joe’s ( JOES ) (0.7%).

Other tenants — which prefer being close to grocery anchors, considering that these stores attract customers year-round at all stages of the economic cycle (which is what makes for the defensive play) — include restaurants such as Subway and retailers such as Wal-Mart (WMT) and Toys R Us.

As the economy has improved, Regency has seen better performance with itsfunds from operations (FFO). anearnings measure used in the REIT world that accounts for the real-estate-heavy nature of these companies, rising nearly 16% to 64 cents per share for the first quarter from the same period lastyear .

Regency also saw its netoperating income for the first quarter and rents on vacant space rise 5.1% and 5.4%, respectively, from the same period of 2012. For the full year 2012, the REIT’srevenues were at $496.2 million, up 3.5% from 2008. However, the REIT’s expenses were also up during this period, cutting into itsincome .

For the full year 2013, Regency has raised its outlook, looking forFFO in the range of $2.47 to $2.54, up from $2.45 to $2.53. Regency also expects net operating income growth at its properties to be at least 2.5%, from a previous estimate of at least 2%. Regency’s management expects that its rising redevelopment activity this yearwill moderate the REIT’s 2013 income but have a positive impact on future earnings.

Regency’s healthy operating margins, north of 35% last year, and its safe tenant base certainly attracted the attention of investors who saw it as a defensive play during the Great Recession, driving REG’s price as high as $70 during the dark days of September 2008. Thestock is now down to about $53, as investors have started getting more aggressive and leaving the safety of defensive plays, making for a price-to-FFO ratio of as much as 20.

However, Regency’s development portfolio means that the REIT could benefit from economic growth ascommercial real estate activity picks up. As of the first quarter, Regency had four projects in the process of development, with 92% of the space leased. Regency also engages in redevelopment activity at existing properties to add value and increase rents.

Risks to Consider: Regency’s use of prominent grocery-anchored tenants to draw other tenants means that if a prominent anchor vacates a space, other tenants at the property may have the right to terminate their lease, creating a risk. Another risk for investors is nearly half the company’s leasable space is in California, Florida and Texas, exposing Regency to the vagaries of weather in these states, as well as higher insurance costs. Also, rising interest rates could cut into the earnings of this REIT, which finances its activity partly withdebt financing .

Action to Take —> To maintain its status as a REIT, Regency must pay out at least 90% of its earnings to investors. Regency’s first-quarterdividend payout of 46 cents a share makes for an annual dividend of $1.85 and ayield of about 3.5%. This stock may be for you if you have a long-term orientation and value a defensive play with steady dividend payouts that also providesupside. You may want to wait to see if this stock declines any further in the nearterm — as more investors rush out of it in favor of more growth-oriented plays — before you rush in.