Recession of 2008

Post on: 7 Апрель, 2015 No Comment

From Conservapedia

The Recession of 2008 (also called the Recession of the late 2000’s or the Great Recession ) was a major worldwide economic downturn that began in 2008 and continued into 2010 and beyond. It was caused by the Financial Crisis of 2008 ; it was by far the worst recession since the Great Depression of the 1930s. The worldwide recession hit bottom in December 2009; however after five years there were few signs that the American economy started moving upward again. Five million of the 8 million jobs lost [1] did not return — despite an increase in population of 10 million over the same span of time covering President Barack Obama ‘s first term. [2]

Greece. Portugal and Ireland remain in serious trouble, while China and Brazil rebounded and are growing rapidly. Concerning the United States economy, some proponents of free market capitalism declare that Federal Reserve Chairman Ben Bernanke and the United States Congress should not have bailed out failing firms and instead should have allowed free market capitalism to recover as it did in the depression of 1920, which recovered without government intervention (free market capitalists assert that government intervention can drag out recessions and depressions). [3] [4] A 2005 study found that government corporate bailouts are often done for mere political considerations and the economic resources allocated exhibit significantly worse economic performance than resources allocated using purely business considerations. [5] Likewise in the U.S. the economy has stabilized but showed little signs of recovery during President Obama’s first term, apart from the stock market going up. Serious weaknesses continued in housing, commercial real estate, banking, automobiles, and retail trade. Unemployment remained above 8% til October of 2012 with conditions especially poor in California, Michigan and South Carolina.

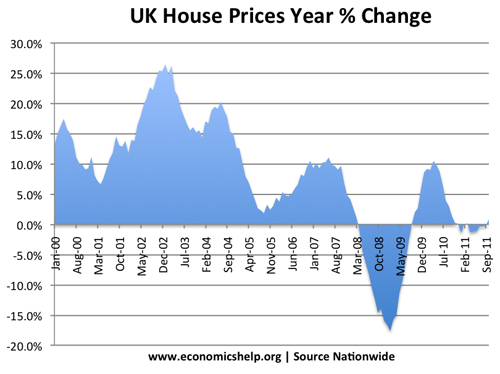

The crisis was worldwide, with major impact in Britain. Europe (that is the European Union or EU), Russia. Japan. the oil countries of the Middle East, and the developing world. The economy of the EU (Europe) shrank by 4% in 2009, with unemployment reaching 10%. Ireland, Iceland and parts of Eastern Europe are hardest hit. Britain was hit hard with its major banks in deep trouble. Recovery in Britain remains slow; its GDP fell 5.2% from 3Q 2008 to 3Q 2009. [6]

Global trade declined sharply—by 13% from August 20008 to August 2009, hurting exporters such as Germany and Japan. China has avoided most of the troubles; it continued to grow at a phenomenal rate (8.9% annual rate in 2008-9). However its exports did shrink because of falling world demand, and its ability to fund global stimulus programs are being dampened by lower growth forecasts and shifting priorities to retain capital earnings for domestic development.

Global governments spent an astonishing $17 trillion to support the world economy in the form of bailouts, guarantees, and equity market purchases. That $17 trillion represents one quarter of global GDP, but only a fraction of that sum will actually be paid out. [7] Global investment declined by 15%. and global GDP by shrank by nearly $4 trillion, or an amazing 6%. Global industrial production in the advanced economies dropped a 15%, causing unemployment to soar around the world, nearly doubling in the United States alone. [8]