Reasons to be optimistic about the global economy in 2015

Post on: 2 Апрель, 2015 No Comment

Rate Article:

One way in which Middle East investors are increasing their holdings is by placing more capital into alternatives

andresGrowth and opportunity are words used pervasively among players in today’s United States commercial real estate market. As such, investor sentiment is reaching an all-time high. Presented with such lucrative promise, those who come out on top will be the ones who diversify their asset classes, as well as their geographic reach.

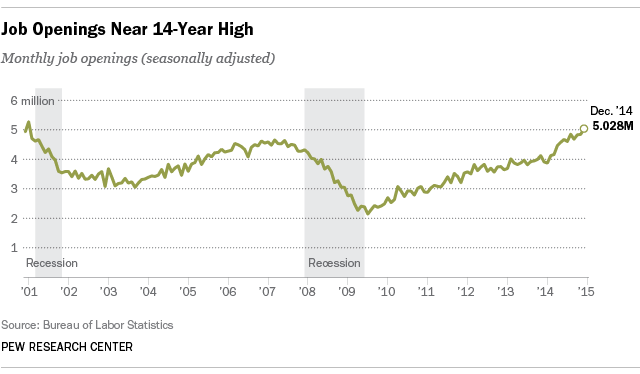

What makes projections of today’s growth even more attractive is how it has spread across all major asset classes. Driving this boom are a few key market dynamics. For one, overall US GDP growth has reached the two to three per cent range annually. Also weighing in is job growth, with an economy that is currently creating approximately 2.5 million jobs per year.

Furthermore, economic recovery in general is happening on a broader scale. Sectors showing the most improvement include financial services, technology, health care, educational services and energy.

Another factor working in favour of market stability is the pace at which this progress is transpiring. Typically, markets burst out of severe recessions with more rapid fervour. Instead, investors are experiencing a steadier pace, which is keeping interest rates low. In turn, the threat of inflation is kept at bay and thus the ability to purchase high-quality real estate in the major US markets avails itself.

Not a bad market to work with; consistent economic growth, coupled with historically low interest rates, together spell a buyer’s market that’s ripe for foreign real estate investors.

Another factor worth mentioning is that, along with the confidence building for the US, there are increased allocations to the real estate market. Equities are at an all-time high as corporate earnings continue their strong upward momentum. As many institutions construct their portfolios based on specific percentage allocations, this denominator effect of growing equity values allows for continued increases in absolute dollar allocations towards non-listed investments.

One way in which Middle East investors are increasing their holdings is by placing more capital into alternatives. Longer duration investments that can outlast those with short-term volatility are attractive for obvious reasons. Investors are shifting allocations away from fixed income and into real estate, to capitalise on long-term yields. Success in real estate markets is also dictated largely by the industry sectors that are prospering. Opportunities abound in hospitality and office. followed closely by retail and multi-family, and an increasing amount of capital flows are heading to secondary markets. While pricing has already returned to record levels in markets such as New York and San Francisco, many key US markets outside of the coastal areas are now getting the attention of investors due to their relative value orientation. Pittsburgh’s market dynamics demonstrate this thinking: while a secondary city, it still boasts a metro population of more than two million and is experiencing tremendous growth in the energy sector due to its location adjacent to the Marcellus shale formation. Minneapolis, known as a prominent centre for medical technology and research, is presently undergoing amazing leasing momentum largely because of its high demand for space catering to the medical sector.

Any real estate crystal ball worth its weight would first warn investors to scrutinise interest rates. Initial increases in index interest rates during any cycle are often just an indicator that central banks, too, sense economic strength all around and frequently these movements lead to compression in real estate lending rates and investment cap rates in the short term.

Also, investors are well advised to look at strategies that are associated with more value creation. Rather than buying stabilised properties with a 150-200 basis point spread over interest rates, where small changes in lending rates can dramatically impact values, consider those that have the opportunity to stabilise at much higher spreads over current interest rates. This approach can help to blunt the impact of increases in the cost of financing.

At this point, the outlook for 2015 is all good news. The US shows strong potential for GDP growth; there has been an unprecedented rise in corporate earnings, resulting in continued hiring and wage growth. Ultimately, consumer expenditures will climb, and that represents two-thirds of the GDP.

History will refer to this time as one that is truly memorable. Three factors are at play that seem to complement one another: real estate availability, strong economic performance, and the effects of supply and demand on the market. The cycle will continue to improve, investors will reach new highs, and the trend will show a preference for more value-added real estate. Those who are broadening their interests and looking at multiple asset classes are all the wiser for it.

Andres Szita is co-founder and chairman of Ethika Investments, a real estate private equity firm.