RealtyShares Blog How to Calculate Real Estate Returns

Post on: 25 Май, 2015 No Comment

IRR, CAP Rates & Cash On Cash

Three real estate metrics or expressions of ROI investors may encounter today include IRR, cap rate and cash on cash yields.

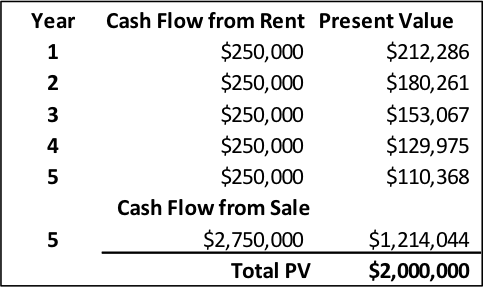

IRR refers to Internal Rate of Return. Simply put IRR refers to the average annual return over a specific number of years. For example; a multifamily property investor would determine the IRR of a specific opportunity by calculating the net cash flow and appreciation growth expected for the period a property will be held.

Cap Rate

The ‘Cap’ or capitalization rate is a calculation frequently used in commercial real estate, and now also on portfolios of single-family home rental properties. Cap rate offers a quick way to compare investment opportunities. Simply stated it is the annual net income divided by the cost or value of the property.

For example a property being purchased for $1M, which produces $100k in net annual income delivers a 10% cap rate. The pitfall here is for investors with properties that have appreciated significantly over time. Using the original purchase price or cash paid of $200k for a property yielding $100k in net income an investor may believe they are receiving a 50% cap rate. However, if the property is now actually worth $1M, the true current cap rate given lost opportunity costs is only 10%.

Cash On Cash Yield

This real estate metric quickly tells an investor what annual return they can expect to receive in cash flow before taxes, based upon their actual cash investment. This is differentiated from cap rate which often considers the value or cost of the entire property (i.e. both the cash investment plus any debt placed on the property).

For example; an investor putting $300,000 into a deal and receiving pay outs of $60,000 a year (before taxes) has a cash on cash yield of 20%. Appreciation is not included in the cash on cash yield calculation and could actually result in a higher overall return on investment. Be sure not to calculate any return of investment in this calculation as it is not profit.

What Types of Returns Should I be Looking for?

The big question most investors have when comparing real estate investments today is whether the real estate metrics and returns being offered are competitive and perhaps why they differ so much? The above real estate metrics and rates of return offered in the market are impacted by a wide range of factors, including:

- Geographical area

- Demand for acquisitions and rents

- Anticipated market direction

- Type of property

- Class of property (i.e. A, B, C etc.)

- Quality of tenants

- Performance history

- Property age

- Availability and attraction of other investments

- Level of risk

In other words a property in a rebounding property sector in a hot primary market with an international brand as an anchor tenant is going to offer a lower return or cap rate than a similar property in a tertiary market with significant vacancies.

A good or acceptable return is really a personal decision and a matter of priorities. If wealth preservation is more important than cash flow or capital gains, then modest yields on a Class A office building in Boston might be sufficient. Those seeking more attractive yields and growth might find more of what they are looking for in a lesser sought after market where property values are lower and thus returns potentially higher.

The Current Real Estate Investment Landscape

Below are some notable real estate metrics that investors should know about before investing in real estate:

- The 3Q 2013 PwC Real Estate Investor Survey reported an average multifamily cap rate of 5.6%, with expectations of this figure holding steady through 1Q2014

- Marcus & Millichap’s 3Q 2013 Net-Leased Retail Market Report reveals retail cap rates averaging 6 to 7%, with fast food on the low end, and auto part retailers at the top

- The below CBRE graph shows how analysts often group cap rates by property sector even though they may vary widely depending on many factors

- At the time of publishing, two San Francisco, CA office buildings were listed for sale – one offering a 4.17% cap rate, the other an 11% cap rate highlighting the diversity that can exist within individual markets as well.

The general consensus in the real estate world today is that all sectors are performing well. Based upon historical cycles and decades of real estate metrics U.S. property markets should enjoy another 7 to 15 years of positive growth ahead. However, it’s obvious from recently reported metrics and surveys of global investors that higher cap rates and faster growth is being seen in secondary and tertiary markets where fewer dollars are chasing inventory. These markets are also being pursued by a broader cross-section of investors as risk appears to be declining and investors are becoming more aggressive in seeking yield and capital gains.

What can make it confusing is the blurring of the lines between these markets. It’s easiest to differentiate by thinking of the largest international cities as primary markets, followed by regional hubs as secondary markets. For example; San Francisco versus San Diego in CA, or Fort Lauderdale or Naples, FL versus Miami or Orlando.

We’d love to hear about the markets that youar emost interested in investing. Please feel free to share by shooting us an email at contact@realtyshares.com or giving us a call at 866-202-2023