Realty Income (O) Historically High Valuation with a Correspondingly Low Dividend Yield

Post on: 20 Май, 2015 No Comment

- Page Title:

- Page URL:

This page has been successfully added into your Bookmark.

21 followers

Follow

Realty Income Corp. (O ) is a Real Estate Investment Trust (REIT) that purchases established retail real estate sites and holds long-term contracts with tenants. Rent collected goes mainly toward distributions to shareholders.

-Seven Year FFO/Share Growth Rate: 3.2%

-Seven Year Dividend Growth Rate: 3.9%

-Current Dividend Yield: 4.14%

-Balance Sheet Strength: Stable, Conservative

Realty Income continues to deliver, but the comparatively high valuation has pushed the dividend yield to rather low levels, which reduces the expected long-term rate of return.

Overview

Realty Income Corp. (O ) is a Real Estate Investment Trust (REIT) that maintains a portfolio of over 3,500 properties in 49 states that are leased to over 200 tenants. The business is rather lean, with a nearly $10 billion market capitalization and under 100 employees.

They focus on acquiring and maintaining properties that already have long-term leases contracted for tenants that they believe operate in healthy industries that absolutely require property for their day-to-day operations. (In comparison, that is, to tenants that may be able to shift some of their business towards the internet, or businesses where their property is a smaller focus of their operations.) Most of their contracts are structured so that the tenant, rather than Realty Income, is responsible for paying property taxes, maintaining the interior, exterior, and land of the property, and for insurance. Realty Income also occasionally trims its portfolio by selling properties that no longer align with their goals.

The ten largest tenants for Realty Income are:

Fed-Ex

L.A. Fitness

Family Dollar

AMC Theatres

Diageo

BJ’s Wholesale

Walgreens

Northern Tier Energy

Super America

Regal Cinema

Over three-quarters of the rental income comes from tenants in Retail, while the remaining quarter is split among Distribution, Office, Agriculture, Manufacturing, and Industrial properties. Currently, over 97% of the properties are occupied.

Revenue

(Chart Source: DividendMonk.com)

Revenue growth over this period has been a significant 13.6% per year on average, and Funds from Operations have grown at 10.9% per year on average over the same period.

As will be shown by the next chart, much of this growth is fueled by issuing new shares, which dilutes the numbers on a per-share basis. Over the course of this charting period from 2005 to 2012, the REIT went from 83.7 million shares outstanding to 133.4 million shares outstanding. Because the REIT pays out most of its incoming funds as dividends, there is only a modest amount that can be reinvested to grow the property portfolio. Therefore, most of the property acquisitions are paid for by issuing new shares.

Funds From Operations and Dividends

(Chart Source: DividendMonk.com)

This chart depicts growth on a per-share basis. FFO per share grew by an average of 3.2% per year over this period, while the dividend grew by an average of 3.9%.

The current dividend yield is 4.14%, and Realty Income pays out 85-95% of its FFO as dividends. Realty Income pays out its dividend on a monthly basis.

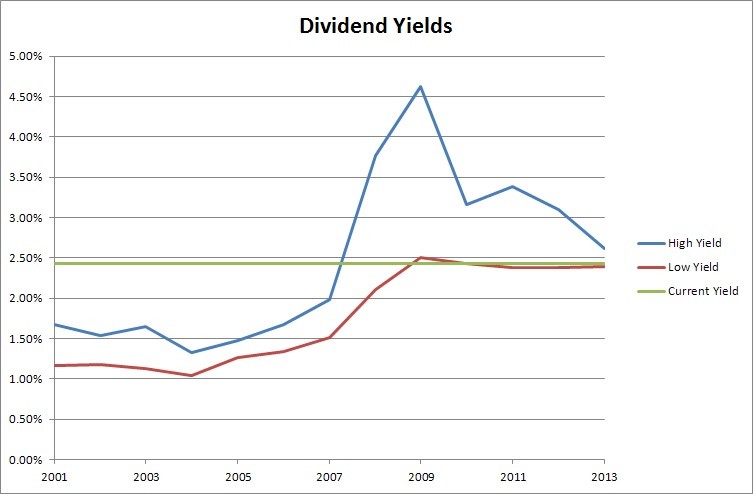

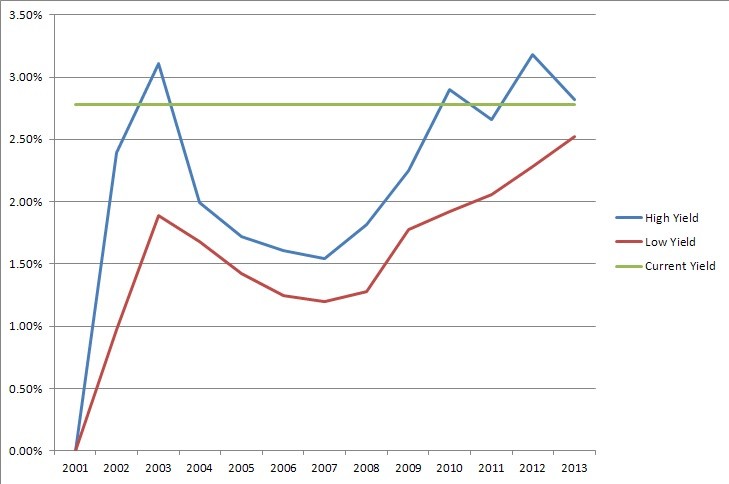

Approximate historical dividend yield at beginning of each year: