Real Estate VS Stocks Which one is Right For you

Post on: 3 Июль, 2015 No Comment

Real Estate VS Stocks — Which one is Right For you?

Over the years, we have heard the comparisons as to which is the better investment: real estate or stocks. Both have their advantages and disadvantages, and there are several aspects of each that make them unique investments in their own way. To make money with either investment requires that you understand the positives and negatives of both.

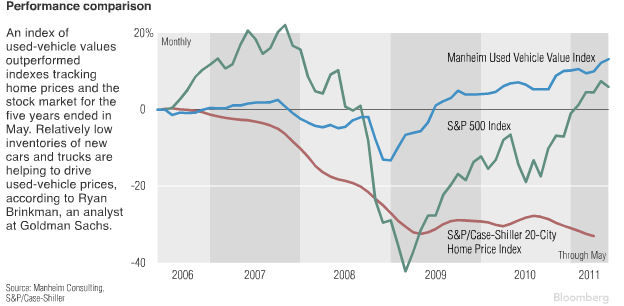

Real estate is something that you can physically touch and feel its tangible goods and, therefore, for many investors, feels more real. Maybe this partially accounts for the high return on the investment, as from 1978-2004, real estate has had an average return of 8.6%. For many decades this investment has generated consistent wealth and long term appreciation for millions of people.

Generally, there are two main types of real estate: Commercial and residential. While other types exist (mobile home parks, strip malls, apartment buildings, office buildings, store fronts and single family homes), they generally fall into those two categories. Making money in real estate isnt as cut-and-dry. Some people take the home flipping route searching for distressed properties, refurbishing them and selling them for a profit at a higher market value. Others look for properties that can be rented in order to generate a consistent income.

Generally, a down payment of up to 20% of the purchase price can be made, and the rest can be financed. This gives you leverage meaning that you can invest in different types of properties with less money down, helping to build your net worth or income that you could make off the properties. While this can be a positive, if this leverage is used incorrectly, you may owe more on the properties than they are actually worth.

There are many positive benefits to investing in real estate, including depreciation (writing off wear and tear of a commercial property), tax deductions and finally, you can sell the property through what is known as a 1031 exchange, and will not have to pay capital gains taxes, as long as you invest the money into a similar kind of property type.

Like all investments, real estate also has its drawbacks. Most importantly, the investment is illiquid. When you invest in a property, you usually cannot sell it right away. In many cases, you may have to hold the property for several years to realize its true profit potential. Also, the closing costs can add up to thousands of Rands, and include taxes, commissions, and fees. Also, real estate prices have a tendency to fluctuate. While long-term prices generally increase, there are times when prices could go down or stay flat. If you have borrowed too much against the property, you may have trouble making the payment with a property that is worth less money than the amount borrowed on it.

Finally, its often hard to get diversified if investing in real estate. However, diversification is possible in real estate, provided that you do not concentrate on the same community and have a variety of different types of property. That being said, there is an additional way that you can be able to diversify in real estate through real estate Investment Companys, under which you can purchase a trust that is invested in a large portfolio of real estate, and will offer you a dividend as a shareholder. However, in general, stocks offer more diversification because you can own many different industries and areas across the entire economy.

From 1978-2006, stocks have delivered an average return of 13.4%. They can be more volatile than real estate but over the long run they have provided a much better return than real estates 8.6% average.

With a stock, you receive ownership in a company. When times are good, you will profit. During times of economic challenges, you may see diminishing funds as the earnings of the company drop. Taking a long-term approach and being balanced in many areas can help build your net worth at a much greater rate, compared with real estate.

As with real estate, financing in stocks allows you to use margin as leverage to increase the overall amount of shares that you own. The downside is that, if the stock position falls, you could have what is known as margin call. This is where the equity, in relation to amount borrowed, has fallen below a certain level and money must be added to your account to bring that amount back up. If you fail to do this, the brokerage firm can sell the stock to recover the amount loaned to you.

Stocks are very liquid, quick and easy to sell. They are also flexible, and can even be reallocated into a retirement account tax-free — until you start to withdraw the money. As well, many stocks can do considerably better than real estate in one year. Due to the volatility of some stocks, it is not unusual to see companies that are averaging 20% or even 50% growth in one year.

Stocks can be very volatile, especially when the economy or the company is facing challenges. Also, stocks are often emotional investments, and your decisions within the market can often be irrational. Finally, bankruptcy is always in the back of the active stock investors mind as it should be, as your investment will be dissolved in this instance.

In general, stocks may have the advantage in more categories than real estate. However, real estate seems to be better when it comes to stability and tax advantages. A good compromise may be to own a Real Estate Investment Company, which combines some of the benefits of stocks with some of the benefits of real estate. While each area has its own benefits and drawbacks, to decide which one would work well for you depends on your overall financial situation and level of comfort. (Courtesy of Chris Seabury )