Real Estate v Lazy Man and Money

Post on: 9 Июнь, 2015 No Comment

Six years ago, I wrote an article comparing stocks vs. real estate. using a Money Magazine article as a base. Few of my articles stay in memory too long, but this one did. I remembered it being one of my better articles. Unfortunately, in re-reading it, the writing was, well, terrible. There were parts of the article that I can’t even follow today.

Today, I’d like to revisit the topic. Perhaps being a few years wiser will translate to a better article. (If it doesn’t, then heaven help me.)

Over a month ago, I wrote about expanding our real estate empire. In a comment. Evan from My Journey to Millions. made a great point, I go back and forth on the real estate investment option. On the one hand it seems to be the clearest way to wealth, while on the other it seems almost crazy to take on that headache for a few hundred bucks of current income. Have you given much thought to REITs instead?

For those who aren’t familiar with REITs, they are Real Estate Investment Trusts. You can buy shares of REITs just like stocks or mutual funds and collect a share of the profits. Typically they pay high dividends making them good for those looking to build an income portfolio. Also, because they are usually diversified amongst a number of properties, risk is minimized. I’m a strong proponent of them and believe that putting 10% of your portfolio into an ETF like Vanguard’s REIT index, VNQ is a good diversification strategy.

So if I can invest in real estate without dealing with tenant headaches. I should right? Well, it’s all about the numbers.

A Typical Return on REITs

Zack’s Research notes that During the 40-year period from 1972 to 2012, average annual total returns for REITs were 8.09%. Given that information, I feel comfortable using an 8% estimated return on REITs in general.

For sake of argument we’ll presume that you have $23,000 to invest. Yes, it is an odd number, but you’ll see why I chose it in a couple of minutes. In 15 years, $23,000 invested at 8% turns into $72,960 (don’t we all love compound interest?). Why am I looking at 15 years? Again I ask you to humor me for a few minutes. At that point, $72,960 would give you $2,918 in income using the rule of 4%. That rule of 4% says that you can roughly take out 4% of your invested money safely to live on retirement.

To sum up the last paragraph, a $23,000 investment now in REITs will give me nearly $3,000 per year in income in 15 years.

I realize that there are loads of assumptions here from the expected return on a REIT to the rule of 4% (some say it’s closer to 3%). Unfortunately we have to make some assumptions for this exercise and hopefully these are reasonable assumptions given the information cited.

The Return on My Investment Property

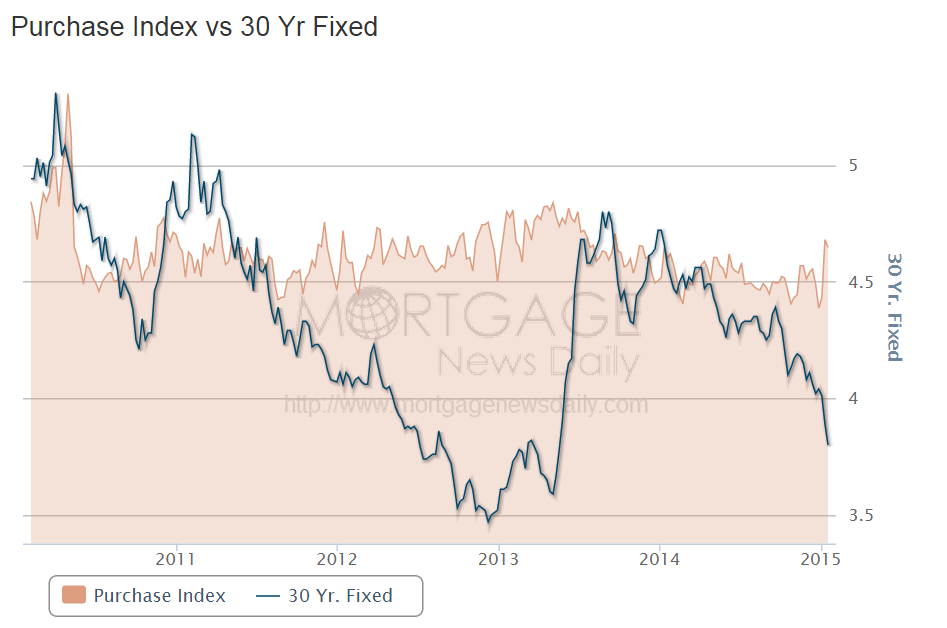

Last week, we closed on the investment property we were looking for (hold the applause). The agreed price was $95,000. With closing costs, we ended up writing about $23,000 in checks (you should be having an a-ha moment). We financed the rest with a 15 year fixed mortgage.

With mortgage, condo fees, property taxes, and insurance it will cost us $1025 a month. We are very confident it will rent at $1250. For sake of argument, let’s presume that the $225/month ($2700 a year) profit will go towards maintenance and real estate listing fees. That’s actually almost scary accurate as estimated maintenance is typically 1% of the purchase price. So that’s $950 in maintenance, plus $1250 (one month’s rent) a year.

So for sake of argument, the $23,000 is going to be invested for 15 years (another a-ha moment?). At that point, we’ll collect $15,000 in rent and owe condo fees, taxes, insurance, maintenance and listing fees. The condo fees are a big hit, but that’s very much part of the maintenance as I explained in this article. By the time all those costs are added up, we should be clearing $10,000 a year.

So to sum up this section, a $23,000 investment now in this property will give me $10,000 per year in income in 15 years.

(In fact, in the extremely unlikelihood that the property doesn’t appreciate at all in 15 years, the $95,000 property will still be worth more than the REIT investment. For what it’s worth, 8 years ago the property was estimated to be worth $185,000.)

Real Estate is Even Better

Hopefully at this point, you see the wisdom in dealing with troublesome tenants. We don’t need the AT&T guy interviewing a bunch of kids to tell us that $10,000 is better than nearly $3,000, right? So how could it possibly get any better?

The nearly $3,000 in income from REITs is money in 2028 dollars, which will probably buy you less than it does today. The $10,000 that I’m using is assuming today’s rent of $1250. In reality, in 2028 it would rent for $2250 assuming 4% inflation. The math then comes to 27,000 where I’ll pay $8K-$9K in the condo fees, taxes, insurance, etc. and come away with $18-19K in 2028 dollars.

In 2028, do I want to have nearly $3,000 or $18-19K a year? I think I’ll go with the later.

Real Estate is not all Rainbows and Puppies

Real estate comes with its headaches, no doubt about that. A REIT has never called me up in the middle of the night with a plumbing problem. Additionally, if there’s a problem and you need access to cash, it’s fairly easy to sell a REIT. Good luck selling a piece real estate in an emergency. You’ll get pennies on the dollar and take around a 6% hit on commissions from real estate agents. In addition, there are few things less diversified than buying a single property. If the economy in that town takes a nose dive, my property value, and the ability to rent it, takes a nose dive with it.

Finally, the condo complex, having been built in 1985 is just starting to show wear and tear today. What it is going to look like in 2045 when it is 60 years old? It’s probably going to look like properties from the 1950’s today. no bueno.

What’s your take? Let me know in the comments.