Real Estate IRA NonRecourse Loans for SelfDirected IRA Investment Financing

Post on: 28 Май, 2015 No Comment

Real Estate // Nate Nead // February 20, 2013 // no comments

Leveraging the funds within your IRA is a great way to fully maximize the returns within the account. Instead of being required to buy real estate in all cash deals, self-directed IRA investors are able to use IRA funds for the investment and borrow the remaining required to finance a real estate transaction. However, there is one caveat: any funds obtained to finance a real estate transaction with your self-directed IRA must be non-recourse. Just like the property cant be tied to you personally, neither can the loan.

Non-Recourse IRA Investment Financing

When it comes to obtaining financing for non-recourse debt within an IRA, the property itself becomes what is assessed for repayment, not the individual. Individuals will not be asked questions about their income, their employment or their credit history. All loan amounts and decisions will be based solely on the basis of the investment property itself because it becomes the entire collateral for the loan. There are two immediate downsides: higher down payment requirements (generally 30% to 50%) and higher interest rates (can range greatly) on the borrowed funds.

Three Variable Assessment Factors for Non-Recourse Loans

- Property Condition. Is the real estate rentable? Is it marketable as a rental property? If the lender later ends up defaulting on the property can the financial institution recoup its loan by selling the property?

- Cash Flow. The cash flow must come be robust enough to make the investment look good in the eyes of a non-recourse lender. That usually means the Debt Service Coverage Ratio (DSCR) is, at minimum, 25% or greater.

- IRA Funds. There must be sufficient IRA funds for the lender to consider you for the loan. Your IRA funds need to have enough to pay the down payment, closing costs and emergency reserves. Remember, IRA rules state that your retirement account needs to pay for the mortgage and any property repairs as they come. The funds will be assessed on the basis of these factors to determine whether the loan is a viable investment option for the bank.

Not Completely Tax Free

While the advantage of a self-directed IRA is the ability to invest and reap returns tax-free, using loan money does not apply. If your property is say 60% financed, then you will be required to pay taxes on 60% of the profits coming from the loan portion of the income. This is known as paying taxes on UDFI (unrelated debt-financed income). Normal tax deductions including depreciation and tax expense will also be taken in the same ratio after such expenses have been incurred. This can at least help to alleviate the UDFI tax liability from borrowing non-recourse money to fund real estate purchases.

Bringing in Co-Investors

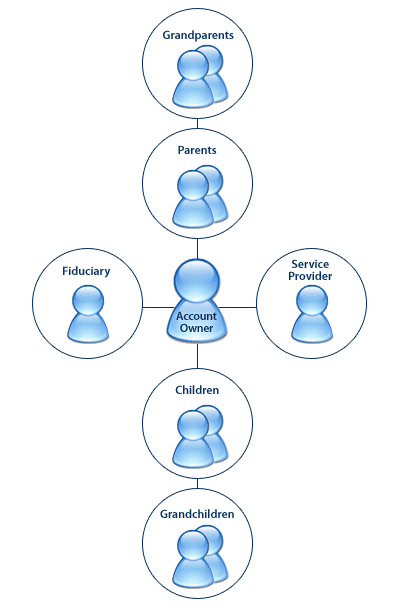

Investors, especially those starting out with self-directed IRAs, will most often be limited by #3 above. If this is the case, there are ways around the issue. You can easily partner with other qualifying co-investors to help defray some of the additional costs associated with down-payments, mortgage costs, repairs and insurance, etc. This can also help to mitigate risk and increase total investment returns by engaging with co-investors. In larger commercial real estate cases, IRA investors can even pool funds with other non-disqualifying persons.

Finding the perfect property for investing your real estate IRA funds will be important, but getting all the financing necessary will make or break your YOY returns for your IRA.