Real Estate IRA_2

Post on: 16 Май, 2015 No Comment

Find a Certified Real Estate IRA Agent Select a State

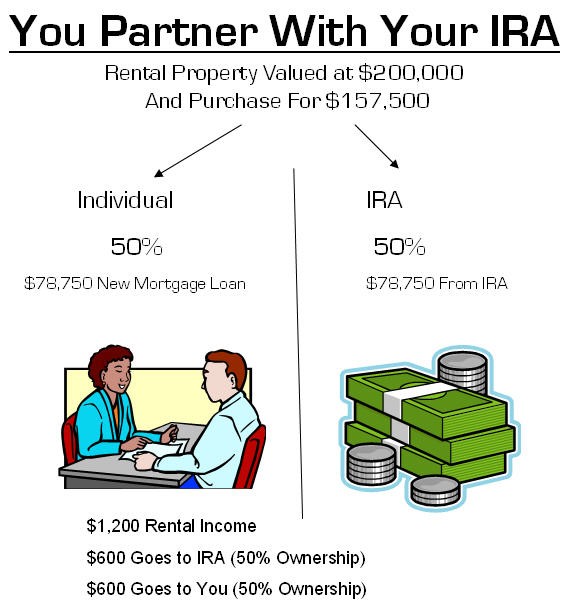

The powerful combination of value appreciation and income has historically been an attraction for investors who understand the risk-return tradeoff of real estate investing. You can own real estate of any kind within your IRA. Been told otherwise? We are not surprised. Since the inception of the IRA in 1974, Americans have been misinformed and kept in the dark about the true choices available within IRAs. But don’t take our word for it. The Internal Revenue Code’s rules and regulations provide the validation you and your trusted advisors often seek.

Types of Property Your Individual Retirement Account Can Own

- Residential Single-family and Multi- family property

- Commercial and Industrial property

- Foreclosures, Short Sales, Distressed and Bank-Owned property

- Improved or Unimproved Land

- International properties of all types

-

This video helps Self-Directed IRA investors learn key considerations of purchasing real estate with their IRA directly from the account or through the use of a Limited Liability Company prior to directing their funds.

- POST Purchase Of Real Estate [ Watch Video ] This video helps Self-Directed IRA investors learn key considerations after purchasing real estate either directly with their IRA account or through the use of a Limited Liability Company.

We Invite You To Call Us or Attend One Of Our FREE Workshops To Learn More

DISCLAIMER: Vantage Self-Directed Retirement Plans does not offer investment, tax, financial, or legal advice nor do we endorse any products, investments, or companies that offer such advice and/or investments. All parties are strongly encouraged to perform their own due diligence and consult with the appropriate professional(s) licensed in that area before entering into any type of investment.