Real Estate Investment Trusts (Reits) highrisk investments

Post on: 22 Май, 2015 No Comment

2C100 /%

Asset management entrepreneur Hayden Bamford looks at Real Estate Investment Trusts (Reits), which sound like strange beasts to many investors. He aims to unpack some of the myths that surround investing in Reits. This is his first in a series. The managing director of Alternative Real Estate. Hayden tackles the risks associated with Reits, in particular leverage, diversification and quality of management. JC

By Hayden Bamford*

It’s interesting to see how many people believe that real estate (other than their own home, of course) is a high risk investment through which investors can be wiped out by tenant default and or a decline in property values. The assumption made of course is that if direct real estate investing is risky, then Real Estate Investment Trust (Reit) investing also must be risky.

When taking on Real Estate exposure, one needs to think about the essential determinants of real estate risk which are: leverage, diversification, and quality of management. We hope to show how each of these risk areas of real estate investing are mitigated by rather taking exposure via a Reit than going directly.

Leverage

Leverage in real estate is no different from leverage in any other investment: The more you use, the greater your potential gain or loss.

2C150 /%

Hayden Bamford demystifes Real Estate Investment Trusts – also called Reits, or REITs.

Any asset carried on high margin, whether an office building, a blue chip security, or even an RSA Government Bond, will involve substantial risk, since a small decline in the asset’s value will cause a much larger decline in one’s investment in it.

However, because real estate has historically been bought and financed with a lot of debt, many investors have confused the risk of leverage with that of owning real estate. So what we are saying is that, although real estate investments have often been highly leveraged, it is the leverage rather than the real estate that is the greatest risk.

Low leverage is better in REITdom

Extensive empirical work available from Green Street Advisors shows that even though property prices have risen more than 50% over the last ten years, Reits that have employed-less leverage have delivered far better returns over that time period than Reits with higher leverage.

The same statement has held true over the vast majority of 10 -year periods since the modern Reit era commenced in the early 90s. Not surprisingly, investors are willing to ascribe much higher NAV premiums to Reits with low leverage.

A careful Reit investor needs to look at the mark to market of the Reits debt securities vs total hard asset-value and interest-coverage ratios in order to determine whether a Reit might be overleveraged or underleveraged.

Diversification

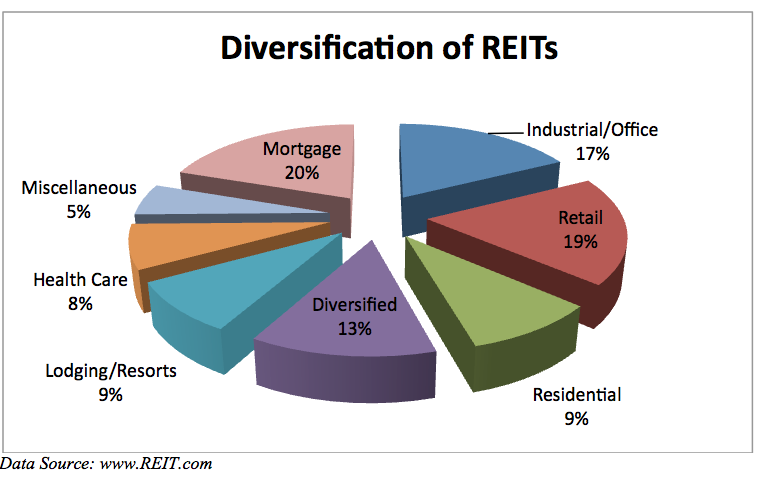

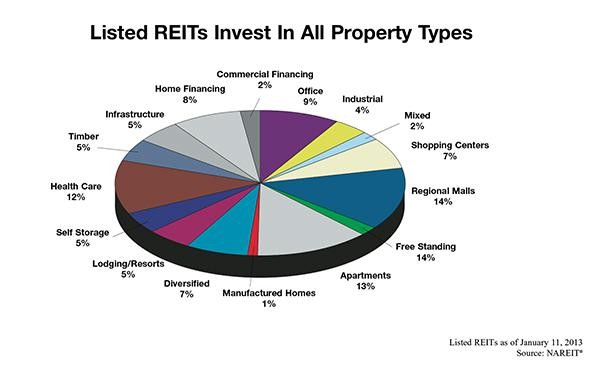

Again, the same rule that applies to other investments applies to Reits: diversification lowers risk. People who would never dream of holding a single security in their portfolio go out and buy, individually or with partners, a single shopping centre or office block.

Things happen – an earthquake, neighbourhood deterioration, excessive building, a recession and all of a sudden the single asset is underperforming and the investor is under pressure.

Whilst Reits provide an exceptional source of portfolio diversification, in our view investors should not purchase Reits that are themselves diversified. Rather invest in Reits that are each doing business in a different sector and location. Investors can themselves attain real estate diversification by geography and sector exposure through a thoughtful allocation to a number of specialist Reits and management teams.

Following on from this, it is important for a Reit to concentrate on a specific geographical area, it is even more important that the Reit specialized in one property type. The reason being that to buy, manage and develop properties well requires a deep familiarity and extensive experience within a specific property sector and the same is true for specific locations.

Quality of management

Good management is what separates mere rent collectors from superior businesses whose stock in trade is real estate. It is important to identify Reit management teams that have been able to invest shareholder capital wisely, who know how to measure risk, and who can raise reasonably priced capital to take advantage of acquisition or development opportunities when they arise.

These are Reits whose management teams have been able to achieve internal growth by upgrading properties and tenant rolls, while maximising rentals and reducing the rate of operating and administration expense growth. They are teams that have navigated a number of significant transactions and guided through the cycle with minimal disruption.

* Hayden Bamford is the founder and Managing Director of Alternative Real Estate. Hayden qualified as a Chartered Accountant (SA). He was previously the Managing Director of Property Index Tracker Managers, having established a niche listed property asset management division for a listed property group.

Also read: