Real Estate Investment Property Tax How To Lower It And Add Value

Post on: 30 Май, 2015 No Comment

And How It Can Affect Commercial Investment Property Value

Other than my mortgage payments, I could usually count on the real estate investment property tax line on my annual profit and loss statement to contain the largest value of any other items in the expense column. In other words, when you own real property investments, taxes are typically your largest expense. It goes without saying that you should try and reduce this expense as much as possible.

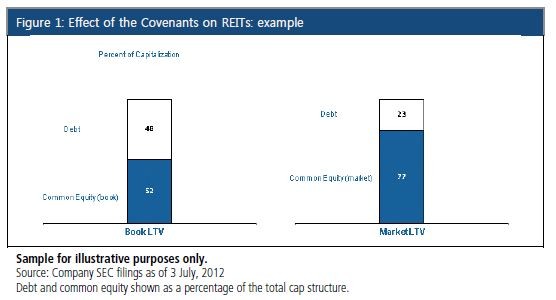

Property tax is one expense that perspective purchasers will take as fact. It is very easy to verify this expense. Therefore, every dollar by which you reduce the taxes, will add significant value to you commercial building. Using a 10% capitalization rate as an example, a one-dollar reduction in real estate investment property tax would translate into $10 in extra value for the property.

So how do you reduce real estate investment property tax? You do it through successfully appealing your property assessment.

Property assessments are usually much lower than the actual value of the property. There has been a movement in many areas to try and bring assessed values closer to actual values but the end result is still the same. What I mean by that is this. You should only be concerned with the assessed value of your investment property as it relates to other comparable properties in your market.

The only way to successfully appeal your property’s assessed value is to show the powers that be that your property has been unfairly valued for property tax purposes compared to other properties in your marketplace .

For example, let’s say you owned a 50 unit apartment building with an actual market value of $3,000,000 (what it could be sold for). Your assessed value was $1,500,000 or 50% of the actual market value. After some sleuthing on your part, you find out that 3 other apartment buildings in you neighborhood have assessed values equal to 45% of their actual market values. Clearly your property has been over assessed. As long as you can back up your claim with solid examples and numbers you should be successful in your appeal.

You can obtain the necessary information you need from several sources.

- commercial brokers

- property managers (if you employ a professional property manager it is likely they manage other properties in your area and have the first hand knowledge you need)

- appraisers

- public records

Of course you will also need a solid understanding of how to value commercial properties in order to make your case.

Another option you might consider would be to hire an attorney that specializes in real estate investment property tax appeals. You can find an attorney in your state and read some more articles on the subject here.

Or, there are also professional consulting firms that will work on your behalf as well.