Real Estate Investment Calculator

Post on: 25 Май, 2015 No Comment

Posted on March 13, 2015 Written by admin Leave a Comment

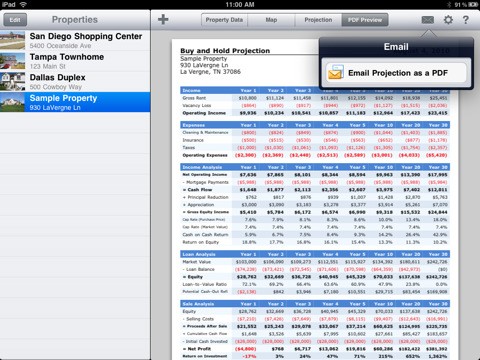

In general, real estate tends to be seen as a great investment as it may be rented out. Nevertheless, without good preparation and caution, you’re quite able to end up buying property, which is a poor investment. In order to determine a property is indeed a good investment, it is always wisest to calculate the ROI or real estate return on investment .

How To Calculate ROI?

It’s time to calculate how much you will earn from the real estate by adding up the money you will bring in from leasing or renting out the property every month.

Please dont deduct any expense yet, and then you should multiply the number by 12 for getting the yearly total. Next, add up your expenses for the real estate . including insurance, taxes, repairs, mortgage payments. and other expenses related to the property. Ensure to convert all of the numbers to yearly numbers. You can have, for instance, expenses of $50 a month (about $600 a year) for insurance, $1,500 a year for taxes, $400 a year for repairs, and $375 a month (about $4,500 a year) for mortgage payments. This will be a total of $7,000 a year for expenses.

When everything is well-done, you need to figure out the amount you have invested. At that time, down payments as well as costs of repairs made before leasing or renting out the property are listed as investments. Repairs made whilst youre leasing or renting out the real estate fall under expenses. In case you put $15,000 down on real estate, and then made $5,000 in initial repairs; for example, then your total investment will be $20,000.

The next step will be to calculate the net operating income . Of course, your NOI, or net operating income. might be found by taking the total amount which you would earn from leasing or renting out the real estate, and then subtracting the total expenses. This number would be your NOI. Take the first example for the more detailed explanation! In case your yearly earnings were $8,400, and your NOI will be $8,400 $7,000 = $1,400. At present, $1,400 will be the NOI.

Finally, use the NOI to get the ROI through dividing the NOI by your total investment amount. Yes, the number youll get must be converted to a percentage via moving the decimal point 2 places to the right. Making use of the instance above, and the ROI will be $1,400:$20,000 = 0.07 that shall be 7 percent for the ROI.

To sum up, all of the above samples and info will be briefly shown off via a very simple formula for all to have a better look and view without causing any confusion anyway.

ROI = (Gain from Investment – Cost of Investment) / Cost of Investment

Please freely contact us for more details of the subject Real Estate Investment Calculator by getting the questions filled in the following box as we love serving you all.