Real Estate Investing Strategies

Post on: 6 Май, 2015 No Comment

Real Estate Investing Strategies

Real Estate Investing Strategies: Which Strategy to Choose?

Rich Dad Education’s elite trainings cover numerous real estate investing strategies. The course material covered in these elite trainings prepare Rich Dad Education students to enter the world of real estate investing from the first day they leave the elite training. Each of the strategies taught in these elite trainings can be used to help students pursue their goal of obtaining financial freedom and escaping the Rat Race. Some real estate investors choose to use multiple strategies in their day-to-day real estate dealings, while other investors focus on one or two strategies that work well within specific real estate markets.

Identifying and understanding the nuances of your targeted real estate market is an important first step in determining which strategies to initially learn and master. Identifying the markets that you may want to invest in can give you a sense of what Rich Dad Education elite trainings may work best for you. Your knowledge of the real estate market goes far beyond simply helping you select which Rich Dad Education elite training is optimal. Understanding the dynamics of your targeted market will give you valuable information and data to help determine revenue projections, estimate rental figures, and calculate expenses. There are far too many advantages to not take the time to understand the specific market you are going to invest in.

Choosing Your Initial Strategy

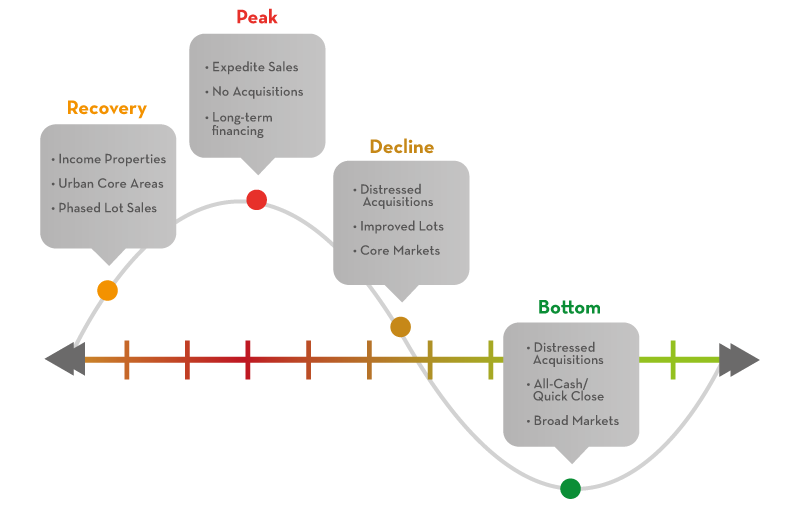

Ideally you want to have numerous real estate investing strategies at your disposal. This will give you tremendous flexibility when approaching potential deals, as you attempt to find solutions that work for all parties involved. It will also allow you to maximize the return on your investment. For example, you might find a distressed property owned by a motivated seller that has fallen behind on their payments. You may be able to work out a short sale with the owner and their bank, use your knowledge of rehabbing to fix up the property, and then use your knowledge of lease options as an exit strategy. The only downside to learning multiple strategies is the time it takes to study and learn them. The upside offered makes this investment of time well worth the effort.

Understanding how multiple investing strategies work should be one of your educational goals. However, if you are new to real estate investing, or are thinking about pursuing a real estate investing career, this might feel like an overwhelming task. If this is the case, then initially focus on a strategy or two that is both appealing to you and one that you feel will work well in the market you have chosen to invest in. If the market you are considering currently has a very high foreclosure rate, then it might behoove you to investigate that particular strategy. If there are a high percentage of renters in that market, and becoming a landlord is appealing to you, then investigating property management might be a good place to start. If rehabbing has always sparked your interest, and there are numerous distressed properties in your targeted market, then it may be wise to start there.

As time goes on you can, and should, add to your real estate investing playbook by increasing your knowledge in various real estate investing strategies and techniques. Even if you find a go to strategy that you enjoy and are successful at, being diversified in your real estate investing approach can help you finalize deals that you might not be able to do otherwise. If you feel overwhelmed as a new real estate investor, then take a moment to realize that all successful real estate investors had a beginning point. If you take the time to investing potential markets and identify strategies that will work in those areas, this simple step can catapult you from your beginning point into a successful real estate investing career.